On 2 June 2021, Pekat Group Bhd (Pekat) had launched its IPO Shares where its shares are offered at 32 sen a share.

Pekat’s market capitalisation will stand at a total of RM 206.4 million after the IPO listing. Pekat IPO shall end in 8 days on 10 June 2021 and its listing date is tentatively set on 23 June 2021.

To read more about its prospects, you may download Pekat’s IPO Prospectus (Part 1 & Part 2).

Alternatively, you may spend 5-10 minutes where I had summarized 7 things to know before investing into it:

#1 Business Model

Pekat derives income from three business divisions:

- Solar

- Earthing and Lightning Protection (ELP) systems

- Trading

Solar:

Pekat designs, supplies, and installs solar PV facilities for industrial, commercial, and residential building owners either under a fixed contract or a fixed+variable periodic payment contract.

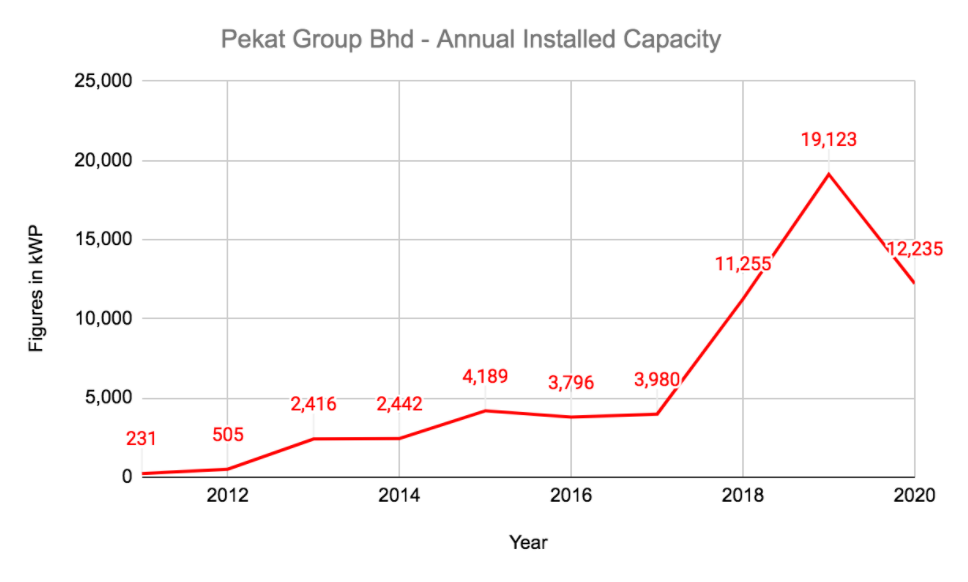

Over the last 10 years, Pekat has achieved growth in its annual installed capacity, up from 231 kWP in 2011 to as high as 19,123 kWP in 2019 before dropping to 12,235 kWP in 2020.

The growth in annual installed capacity was due to higher contracts for solar PV facilities demand for industrial and commercial buildings from 2011 to 2019. As such, they have been an important growth driver for Pekat in that period.

In 2020, Pekat had recorded lower annual installed capacity, due to a slowdown in its installation activity for solar PV facilities in commercial buildings, resulting from the COVID-19 pandemic.

ELP systems:

Pekat supplies and installs ELP systems on buildings, structures, and facilities to channel unintended electricity safely to earth in order to prevent damages onto equipment, property, and life under fixed contracts.

Trading:

In addition, Pekat distributes solar PV, ELP and surge protection devices under a variety of brands such as Pekat, PWeld, Noark, Solar-Log, and Sungrow.

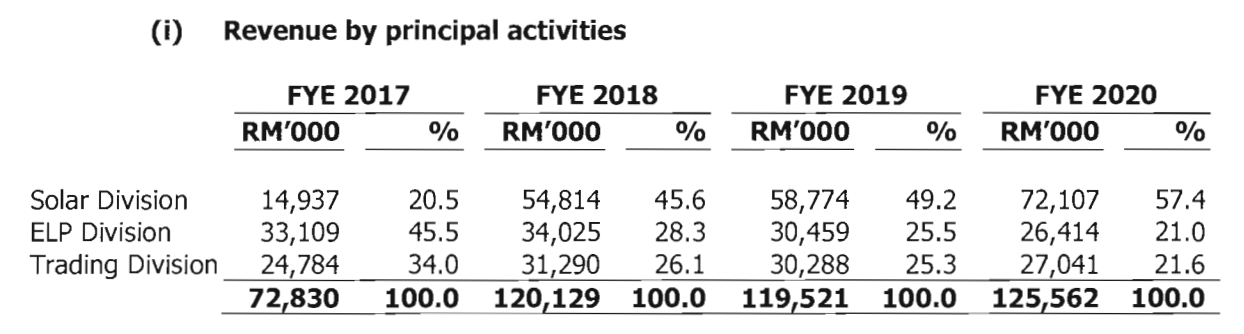

Their contributions to Pekat’s group revenues in 2017-2020 are as follow:

#2 Financial Results

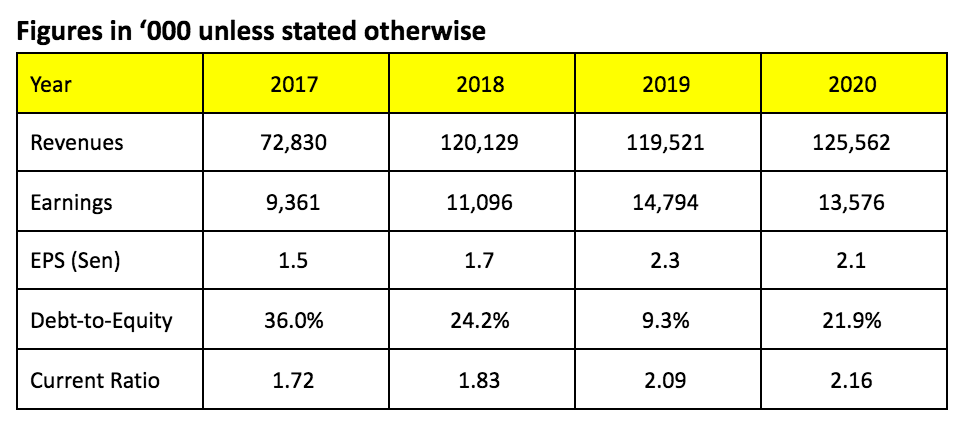

Overall, for the past 3 years, Pekat has maintained its group revenues at around RM 115-125 million and of which, made its shareholders’ earnings at RM 10-15 million or earnings per share (EPS) at 1.5-2.5 sen per annum in 2018-2020.

Also in relation to its balance sheet strength, Pekat had kept its Debt-to-Equity Ratio below 50% and its Current Ratio above 1.0 in the 4-year period.

#3 Order Book

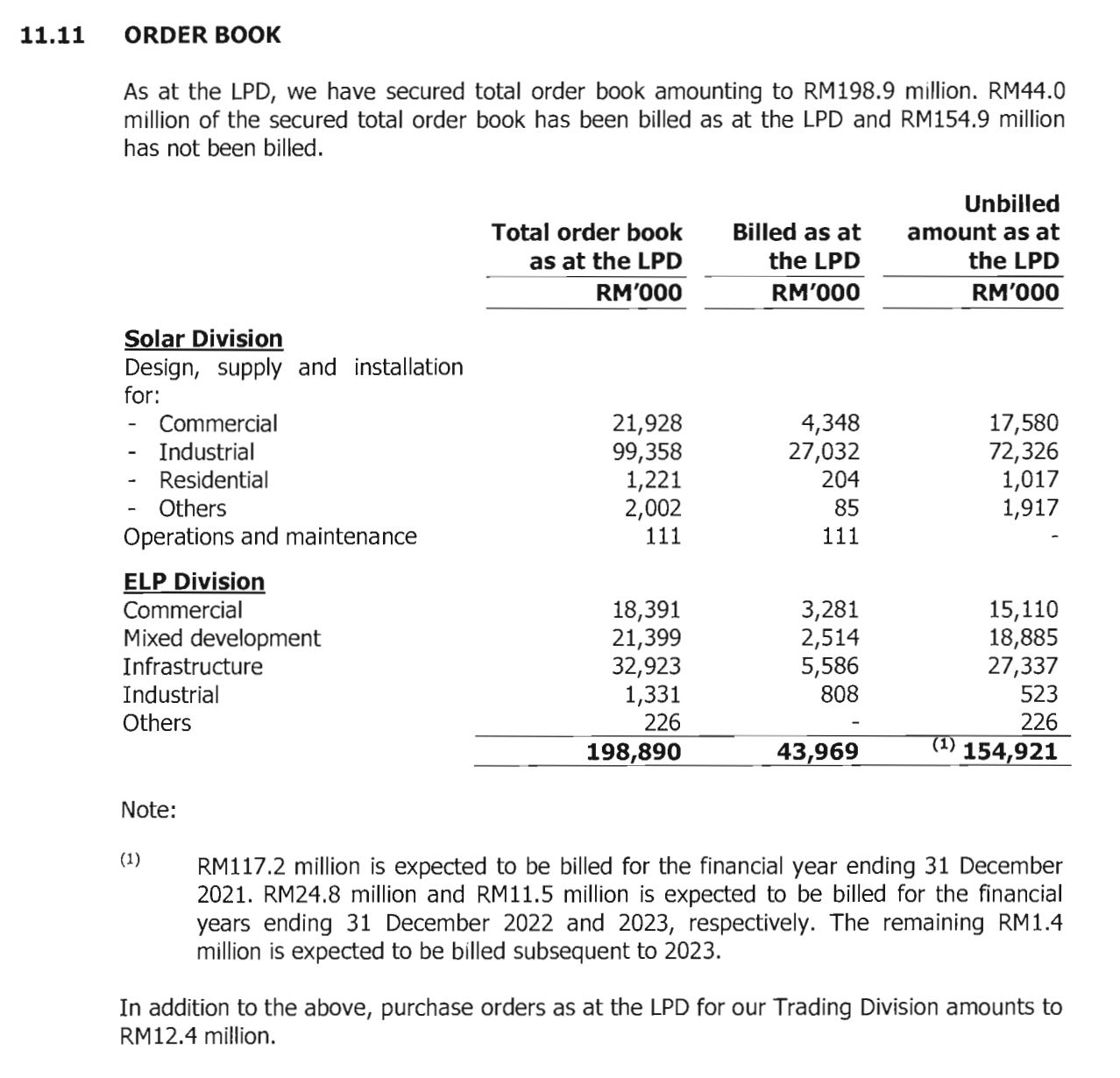

As of 3 May 2021, Pekat has secured a total order book amounting to RM 198.9 million.

Of which, RM 44.0 million had been billed. Pekat revealed that it would expect to bill:

a. RM 117.2 million in 2021.

b. RM 24.8 million in 2022.

c. RM 11.5 million in 2023.

d. RM 1.4 million in 2024.

In addition to the above order book amount stated, Pekat’s trading division had secured RM 12.4 million in purchase orders.

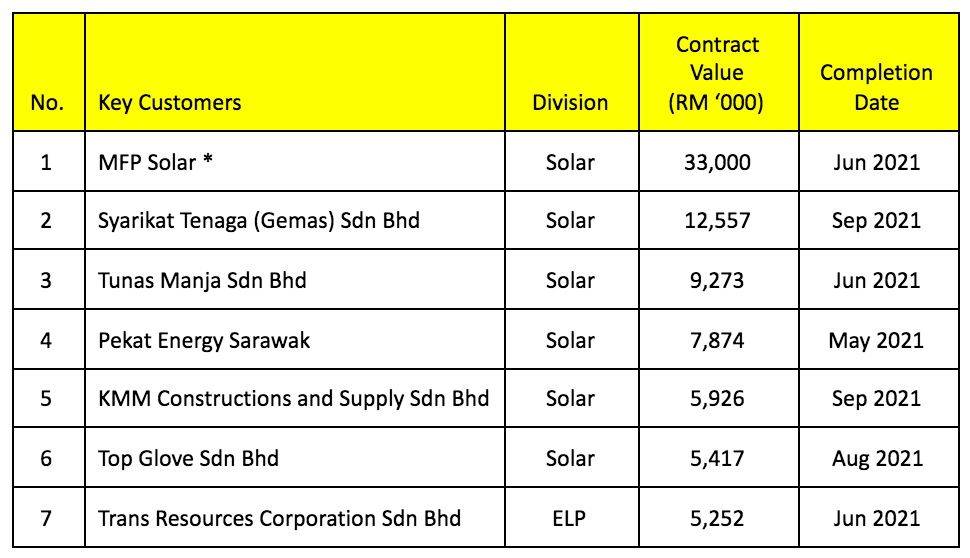

Here is a list of some key ongoing contracts (worth above RM 5 million) and its completion date:

MFP Solar is a 45%-owned associate of Pekat, which is set up to be an owner or investor of solar PV facility.

On 19 August 2020, Pekat entered into a Power Purchase Agreement (PPA) with Proton. Pekat subsequently novated this PPA to MFP Solar.

Of which, MFP Solar engages Pekat to install a solar PV power plant to Proton’s manufacturing plant, located at Tanjung Malim. MFP will then supply power to Proton for 15 years.

#4 Utilisation of IPO Proceeds

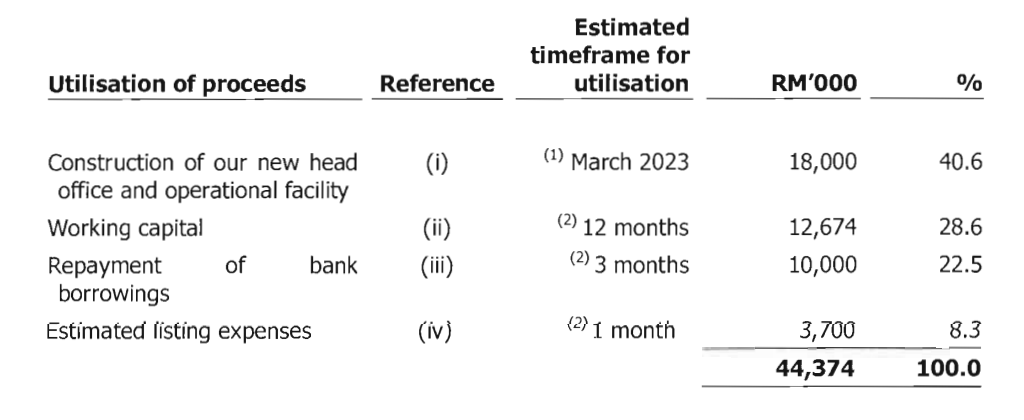

Pekat intends to raise RM 44.4 million in gross proceeds from its IPO listing. The proceeds shall be utilised in the following manner:

The largest item stated is its construction of its new head office and operational facility. Here are its details:

On 8 July 2020, Pekat had acquired 137,928 sq. ft. of Elmina Land to build itself a new head office, showcase, central monitoring station, training centre, and as well as a workshop and warehouse on this land.

The cost of construction of this building is budgeted to be RM 18 million and if there is any overrun in cost, the management shall be funded with its internal-generated funds or from working capital raised from this IPO listing.

#5 Major Shareholders

After its IPO listing, Pekat’s substantial shareholders are as followed:

#6 Dividend Policy

At present, Pekat does not have any formal dividend policy.

#7 Valuation

The offer of 32.0 sen per share is valued at P/E Ratio of 15.24, based on 2.1 sen in 2020.

Conclusion

Pekat has achieved profitability and maintained a solid balance sheet in the last 4 years (2017-2020).

Moving on, its profitability and growth shall be dependent on its ability to secure itself new contracts for its project-based sales accounted for 78.4% of its total revenues in 2020.

The duration for its solar PV contracts is 3-18 months while for the ELP contracts, they range 12-36 months. Most of the major contracts are scheduled for completion mostly in 2021.

Thus, the onus is upon the investor to determine the management’s ability to secure new deals / contracts to upkeep its financial results in the near-term before investing in it.