On 19 August 2019, MTAG Group Bhd (MTAG) has extended an invitation to the public to subscribe its IPO shares at RM 0.53 a share.

You may download a copy of its IPO documents with the links below:

|

MTAG IPO |

Part 1 |

| MTAG IPO |

The application for MTAG’s IPO shares will be closed on 6 September 2019 with its shares to be listed on 25 September 2019.

So, should we invest in MTAG at a price of RM 0.53 a share today? Here, I’ll summarise my findings as follows:

#1: Business Model

MTAG has two business divisions.

- First, it prints labels and stickers and provides printing services such as lamination, adhesive-kill printing, double-side printing, and varnish coating.

- Second, MTAG distributes industrial tapes, adhesives and a wide range of printing materials. The two divisions mainly serve customers who are in industries such as electrical & electronic, precision tooling, mechanical & engineering, automotive, and construction in Malaysia.

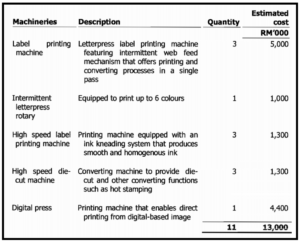

It operates from a facility on a piece of land measuring 107,637 sq. ft. at Tebrau in Johor, Malaysia. The facility is equipped with:

Source: Page 112 – 113 of MTAG’s IPO Document

#2: Financial Results

MTAG’s financial results are as follows:

Revenue

MTAG has increased its revenues significantly in 2017 for it had received higher orders for its mesh products from Dyson to manufacture its vacuum cleaners.

It had also received higher orders for its tapes and adhesives from Dyson for they are used to produce new hair dryers and bladeless fan models.

Shareholders’ Earnings

This led to growing earnings from RM 15.9 million in 2016 to RM 34.5 million in 2018. It has achieved a 3-Year Return on Equity (ROE) of 42.0% per annum.

This means, it has made, on average, RM 42 in earnings per year from RM 100 it has in shareholders’ equity from 2016 to 2018.

| Year |

2016 |

2017 |

2018 |

| Revenue (RM ‘000) |

126,987 |

186,607 |

187,465 |

| Earnings (RM ‘000) |

15,890 |

22,631 |

34,454 |

| EPS (Sen) |

2.33 |

3.32 |

5.05 |

| ROE (%) |

41.7% |

39.2% |

45.1% |

Source: Page 145 – 148 of MTAG’s IPO Document

#3: Balance Sheet Strength

MTAG has reduced its debt-to-equity ratio from 52.1% in 2016 to 12.1% in 2018 and raised its current ratio from 1.78 in 2016 to 3.17 in 2018.

| Year |

2016 |

2017 |

2018 |

| Cash & Cash Equivalent (RM ‘000) |

3,025 |

8,022 |

22,311 |

| Current Ratio |

1.78 |

1.75 |

3.17 |

| Gearing Ratio (%) |

52.1% |

32.6% |

12.1% |

Source: Page 148 – 150 of MTAG’s IPO Document

#4: IPO Proceeds

MTAG intends to raise RM 72.2 million in gross proceeds from this IPO.

From it, MTAG plans to utilise it with the following below:

Source: Page 9 of MTAG’s IPO Document

1. Land Acquisition & Construction of Manufacturing Plant (RM 33.0 million)

MTAG intends to buy 10 acres of land (435,600 sq. m) in Senai or Tebrau area to construct a new manufacturing plant to house its new corporate office, grow its production lines and warehouse spaces. It plans to build it in two phases. Phase 1 covers 200,000 sq. m. and Phase 2 covers the remainder of the land.

As I write, MTAG is still in the midst of identifying its suitable land.

2. Capital Expenditures (RM 13.0 million)

MTAG will buy more machineries from China, Taiwan and Japan to substantially increase its production capacity. They are as follows:

Source: Page 26 of MTAG’s IPO Document

3. Repayment of Bank Borrowings (RM 10.0 million)

MTAG has an outstanding amount of RM 6.1 million and RM 4.8 million in term loans from Public Bank and bankers’ acceptances from Public Bank and CIMB.

It incurs an average of 5.0% interest rates per annum from these facilities. Thus, it intends to save RM 0.5 million per annum in interest costs after it repays RM 10 million in bank borrowings.

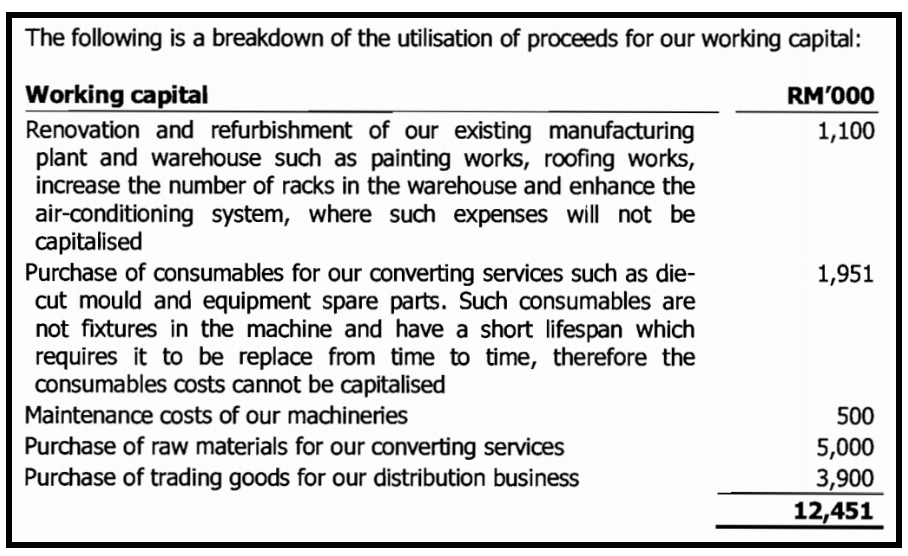

4. Working Capital (RM 12.5 million)

They are as follows:

Source: Page 27 of MTAG’s IPO Document

5. Estimated Listing Expenses (RM 3.8 million)

#5: Management

Upon the IPO, the major shareholders of MTAG are Chaw Kam Shiang and Lau Cher Liang with 50.5% and 16.7% shareholdings respectively.

Chaw retains his position as its Managing Director. Lau is the Executive Director of the company.

#6: Major Risks

MTAG is subjected to the risk of customer concentration as it is now deriving as much as 71.1% of its total revenues from five main customers.

Out of them, the company has derived 52.7% of its total revenues from its main customer, which is Jacob Filter System Sdn Bhd. The list of the five key customers are as follows:

Source: Page 131 of MTAG’s IPO Document

Except for Technocom Systems Sdn Bhd (2.2%), the top five customers of MTAG are suppliers of Dyson. Therefore, Dyson is influential to the financial results of MTAG in the future.

#7: Valuation

At RM 0.53 a share, its IPO shares are offered at P/E Ratio of 10.50. It has a net assets of RM 0.23 per share. Thus, the offer is at P/B Ratio of 2.30.

The board is adopting a dividend policy to pay out at least 20% of its profit after taxes which are attributable to shareholders to its investors in dividends.

Thus, if MTAG has the ability to maintain its EPS 2018 at 5.05 sen, it would pay out a total of 1.01 sen in dividends per share (DPS), which translates to 1.91% in dividend yields a year.

Conclusion

MTAG has delivered growth in revenues and earnings for the last three years. It has reduced its gearing ratio and boosted its current ratio in that 3-year period.

MTAG has an ambitious growth plan as stated in its IPO document. The thing to consider is Dyson as it remained influential to MTAG’s future performance. So, will you invest in MTAG’s IPO shares at RM 0.53 a share? I’ll leave you to decide.

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve found 7 exciting companies that are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!