On 23 May 2019, Mestron Holdings Bhd (Mestron) has officially released its IPO Prospectus and has opened application for its IPO shares at RM 0.16 a share. Its IPO Prospectus can be downloaded:

| Mestron IPO | |

| Mestron IPO |

IPO applications will be closed by 3 June 2019 and its shares would be listed on 18 June 2019.

Personally, I’d studied its IPO Prospectus and would like to share my findings on Mestron in this article. Therefore, here are 7 key things to know about Mestron for its IPO.

#1: Business Model

Mestron is involved in two business operations via two fully owned subsidiaries in Malaysia. First, via Meslite, it manufactures steel poles in a facility situated in Puchong, Selangor. Second, via Max Lighting, it trades and distributes a handful of outdoor lighting products under major brands such as GRUPPE, NIKKON, and OSRAM.

For the last 4 years, Mestron has increased its annual production capacity from 3,694 MT in 2015 to 5,670 MT in 2018. As a result, it has recorded growth in its annual production from 3,296 MT in 2015 to 3,912 MT in 2018. Utilisation rates have fallen from 89% in 2015 to 69% in 2018 as Mestron’s growth in production capacity had outweighed its production growth during the period.

| Year |

2015 |

2016 |

2017 |

2018 |

| Max Capacity (MT) |

3,694 |

4,435 |

5,670 |

5,670 |

| Production (MT) |

3,296 |

3,481 |

3,990 |

3,912 |

| Utilisation (%) |

89% |

79% |

70% |

69% |

Source: IPO Prospectus of Mestron

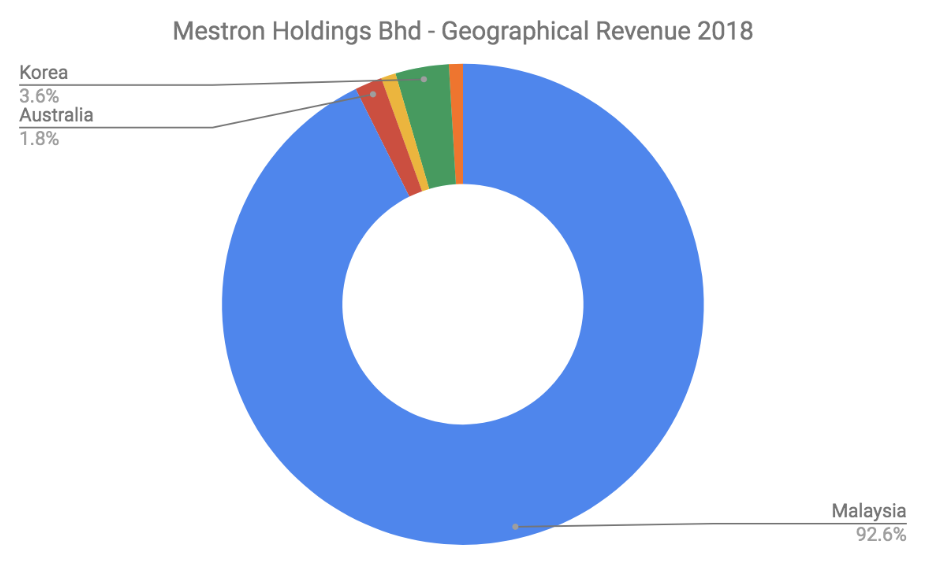

#2: Geographical Markets

Mestron’s principal market is in Malaysia as it had derived 92.7% of its revenue from domestic sales. The remaining 7.3% of its sales are contributed by exports to Australia, Singapore and Korea.

Note: Others refers to sales to Brunei, Myanmar, Sri Lanka and Maldives.

Source: IPO Prospectus of Mestron

#3: Financial Track Record

For the last 4 years, Mestron has achieved growth in revenue, up from RM 40.5 million in 2015 to RM 63.7 million in 2018. This is contributed by rising sales for decorative light poles, specialty poles, and outdoor lighting products during the period. Shareholders’ earnings have grown from RM 2.15 million in 2015 to RM 9.31 million in 2018 due to lower raw material costs during the period. Earnings per share (EPS) had increased from 0.28 sen in 2015 to 1.18 sen in 2018.

Mestron has a 4-Year Return on Equity (ROE) Average of 24.87% per year. Thus, it means that the company has made, on average, RM 24.87 in annual earnings from every RM 100.00 in shareholders’ equity from 2015 to 2018.

Figures in RM ‘000 unless stated otherwise

| Year |

2015 |

2016 |

2017 |

2018 |

| Revenue |

40,540 |

44,374 |

60,747 |

63,680 |

| Earnings |

2,176 |

5,280 |

8,538 |

9,307 |

| EPS (Sen) |

0.28 |

0.67 |

1.08 |

1.18 |

| ROE (%) |

15.99% |

27.09% |

31.02% |

25.38% |

Source: IPO Prospectus of Mestron

#4: Balance Sheet Strength

As of 31 December 2018, Mestron has non-current liabilities of RM 16.0 million and shareholders’ equity of RM 36.8 million. Thus, its gearing ratio is 43.40%. In addition, it has reported current assets of RM 39.3 million and current liabilities of RM 15.3 million. Thus, its current ratio is 2.56. For Mestron has below 50% in gearing ratio and above 1.0 in current ratio, it has maintained a healthy balance sheet presently.

| Year |

2015 |

2016 |

2017 |

2018 |

| Current Ratio |

1.18 |

1.77 |

1.75 |

2.56 |

| Gearing Ratio (%) |

35.40% |

55.76% |

60.87% |

43.40% |

Calculated from Data Sourced from IPO Prospectus of Mestron

#5: IPO Proceeds

Mestron intends to raise RM 25.28 million from this Public Issue. Out of which, it intends to utilise the proceeds by:

- Expand Main Facility: RM 13.00 million

Presently, it owns two pieces of industrial land. On the first land, it has built its facility measuring 120,190 sq. ft. On the second land, it uses it for storage. On 28 March 2019, Mestron applied for the amalgamation of the two land titles.

Then, Mestron intends to expand its current production facility by 75%, from 55,000 sq. ft. to 96,3000 sq. ft. and thus, expanding its production of telecommunication monopoles and high mast poles, which generally have a height of up to 50 meters. It budgeted RM 5 million to construct the expanded facility and RM 8 million to buy plants and machineries. - Working Capital: RM 5.18 million

It is purposed for the purchase of raw materials such as steel plates and steel pipes. It enables Mestron to order materials in bulk quantities and thus, enjoying 3% – 5% in bulk discount.

- Repayment of Bank Borrowings: RM 4.00 million

It intends to make loan repayments obtained in 2016 for its purpose of acquiring its industrial land. The interest rate is 4.87% per year. Thus, it should bring as much as RM 0.19 million in interest savings per annum.

- Listing Expenses: RM 3.10 million

It includes professional fees, underwriting, placement, brokerages, fees to authorities and other incidental costs related to this Public Issue.

#6: Management

After the IPO, Por Teong Eng and Loon Chin Seng remain as key shareholders of Mestron with each person holding onto 35% shareholdings of the company. Por and Loon are founders of Mestron and has expanded their company from being a small-scale pole manufacturer to a supplier of steel poles to a number of high profile construction projects such as:

– Klang Valley Mass Rapid Transit (KVMRT).

– LRT Ampang Line extension project.

– East Klang Valley Expressway.

– Coastal Highway Southern Link Project.

– Bukit Jalil National Sport Complex refurbishment project.

Por and Loon are appointed as Managing Director and Executive Director of the company.

#7: Valuation

The IPO share is offered at RM 0.16 a share. Based on 790.0 million shares after its IPO, Mestron’s market capitalisation would be lifted up to RM 126.4 million.

In 2018, Mestron has recorded 1.18 sen in EPS and would record a net assets of 7.0 sen per share after its IPO. Thus, at RM 0.16 per share, the offer is valued at P/E Ratio of 13.56 and P/B Ratio of 2.29.

Mestron does not have a clear dividend policy at the moment.

Conclusion:

Mestron has achieved growth in both sales and profits for the past 4 years and maintained a healthy balance sheet. It plans to strengthen its balance sheet by raising equity and use a portion of its IPO proceeds make loan repayments.

The management has set aside two years to expand its operations and has revealed its expectation of growing its production capacity from the current 5,670 MT to as much as 11,400 MT by 2021.

FREE Download – “7 Top Stocks Flashing On Our Watchlist”

Psst… We’ve found 7 exciting companies that are poised to skyrocket >100% in the years to come. Simply click here to uncover these ideas in our FREE Special Report!