Yes, this is the million dollar question – Is it time to buy stocks amid the COVID-19 recovery? Especially when all the governements are pumping money in to shore up the markets?

Let’s check out what the gurus are saying:

Bill Miller’s Take

According to his 1st quarter 2020 letter on 20 April, he mentioned that the corona virus has provided investors with one of the “great stock market buying opportunities” of his lifetime.

Bill Miller, renowned for beating the S&P 500 for 15 consecutive years while at Legg Mason, offered his thoughts on a tumultuous time for the stock market and economy in the wake of a pandemic.

In the letter, Miller said that there are only 4 other times have stocks have been as attractive:

- In 1973-1974 when the Vietnam War was going on and Richard Nixon had resigned as president

- In 1982 after Mexico defaulted on its debt

- In 1987 following Black Monday

- In 2008-09 during the last financial crisis

“If you missed the other four great buying opportunities, the fifth one is now front and center,” wrote Miller, who is now the chief investment officer and founder of Miller Value Partners in Baltimore.

Justin Thomson’s Take

Justin Thomson is a chief investment officer for T. Rowe Price Group Inc. When enquired about whether is it time to buy stocks, Thomson acknowledged that the current situation is a “deeply worrying time” because of the health challenges and quick descent of the economy.

However, like Miller, he sees a buying opportunity. He then identified 5 rules for investors to follow as the crisis continues to unfold:

- Be patient: Thomson said investors should not “try to solve for the whole world at once” and be willing to invest in “air pockets.”

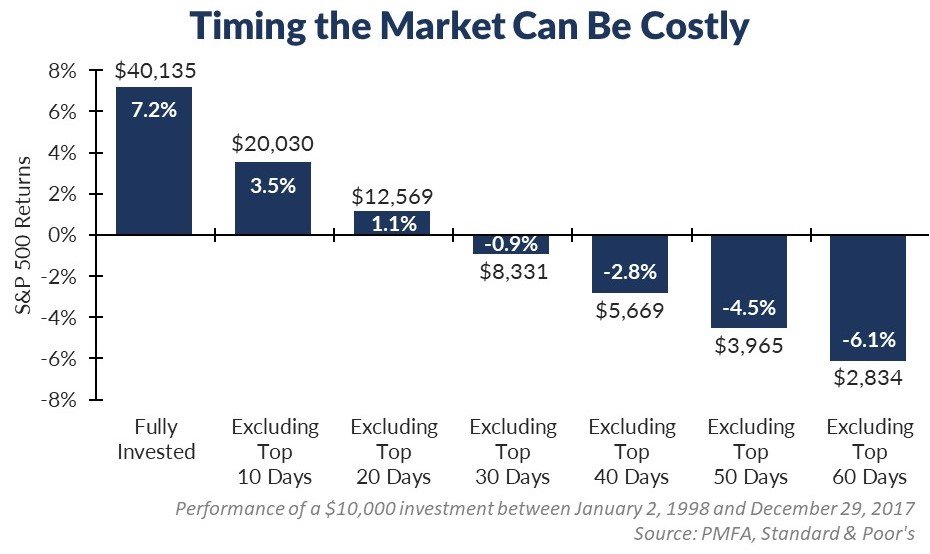

- Avoid predictions: A point made by Miller as well, Thomson said it is almost impossible to “pick the bottom” of the stock market’s fall. “It is easy to start the day with optimism and get stuck in the market only to look foolish by mid-afternoon,” he said. “Nobody, no matter what they claim, has the power of precognition — so avoid becoming obsessed with it.”

- Stay invested: Also a point made by Miller, Thomson encouraged investors to keep their money in the stock market because a recovery could happen quickly. “When the reversal comes (and I am not calling the bottom here), we believe it will be powerful, and the majority of the upside potential will come in a limited number of sessions, so you will unlikely be able to get invested in time,” he said.

- Monitor quality: Thomson told investors to “not get anchored to the points that prices have fallen from.” He said he believes quality stocks now offer enough potential upside that investors do not need to take risks on companies with “leveraged balance sheets.”

- Be alert for fallen angels: Thomson also encouraged investors to look for companies that are “economically quite large and/or highly rated” but have seen their market caps or ratings decline substantially. Following the Great Recession, he said many of those companies recovered fairly quickly.

Howard Marks’ Take

According to his latest memo, Howard Marks gave a quick overview of what he is seeing in the U.S.

- one of the greatest pandemics to reach us since the Spanish Flu of 102 years ago,

- the greatest economic contraction since the Great Depression, which ended 80 years ago,

- the greatest oil-price decline in the OPEC era (and, probably, ever), and

- the greatest central bank/government intervention of all time.

And he explicitly bold-ed this sentence – “In short, it’s my view that if you’re experiencing something that has never been seen before, you simply can’t say you know how it’ll turn out.”

Howard Marks further reiterated his stand on CBNC that “the recent stock-market rally is “inappropriately positive” based on the below:

- “We’re (S&P500 index) only down 15% from the all-time high of February 19”

- “It seems to me the world is more than 15% screwed up”

- “It took 7 years to get back to the 2000 highs in 2007” and “It took five-and-a-half years to get back to the 2007 highs in late 2012”

- “Is it really appropriate that, given all the bad news in the world today, we should get back to the highs in only three months?

My Personal Take – “Is it time to buy stocks?”

As for me, i am more slanted towards the “we have not seen the worst” given that the 1st quarter 2020 results will turn out to be horrendous.

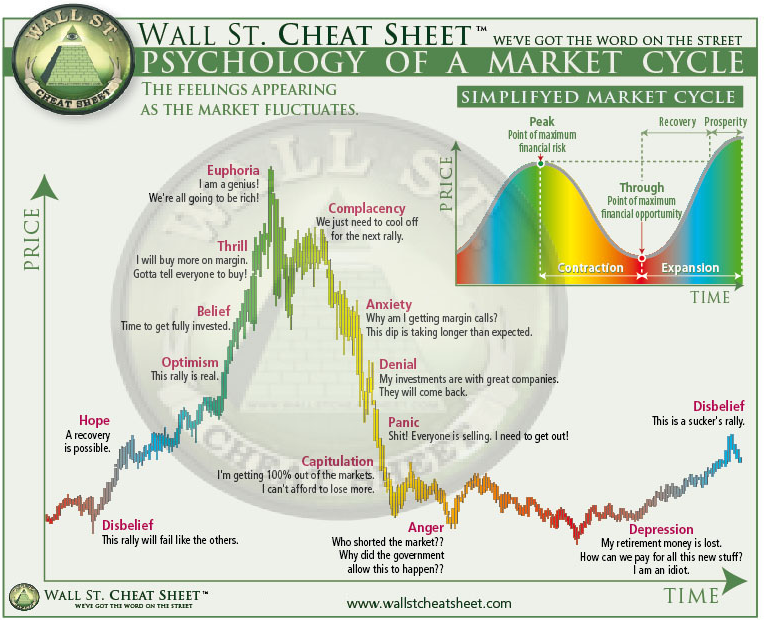

Moreover, when i compare the psychology of many investors out there, it is giving me the feeling that we are at the ‘complacency – just cool off for next rally’ stage.

Of course, i may be totally wrong about that and markets continue its V-shape recovery to soar up higher. OR we may all be wrong – where the markets will go stagnant for the next 5 years (supported by the government yet not being able to push up higher).

Hence, the best bet i would say is to …. *drumroll please*…. dollar-cost-average. By averaging out your purchases across the months or years, it negates any major impact and allows you to build out your portfolio slowly.

The key thing is to know what to buy. My own strategy is to zoom into specific stocks that can potentially more than double/triple in the next 3-5 years. Using the simple rule of 72, you only need a 14.4% annualized return to double your money in 5 years (not that hard right?).

Thats why i am always on the look-out for quality bargains whether be it deep value opportunities or value compounded growth stocks.

If you are keen to be in the know when i share about them, subscribe to our FREE newsletter here for exclusive top ideas.