With the concerns of a 2nd wave of virus outbreak, the Asia indices staged a major selldown on 11 June 2020. Singapore’s STI Index plummeted 3.5% in a single day and Hong Kong’s Hang Seng Index also gapped down 2.0% on the same day.

In times like this, some investors are thinking of shorting the market to make money on the way down. This is also equivalent to hedging and protecting their portfolios during this huge market swings.

There are predominantly 3 ways to take advantage of a market downturn (through shorting) in Singapore:

- Naked Short Selling (you borrow to short sell)

- Contracts For Differences (CFDs)

- Daily Leverage Certificates (DLCs)

Naked short selling is cumbersome when traders have to disclose their short sell orders to the exchange. Furthermore, there will be huge penalties if you are unable to cover the short selling on a T+2 settlement date.

As for CFDs, they are not traded on the exchange and have different margin structures which mean you can potentially lose more than your invested capital.

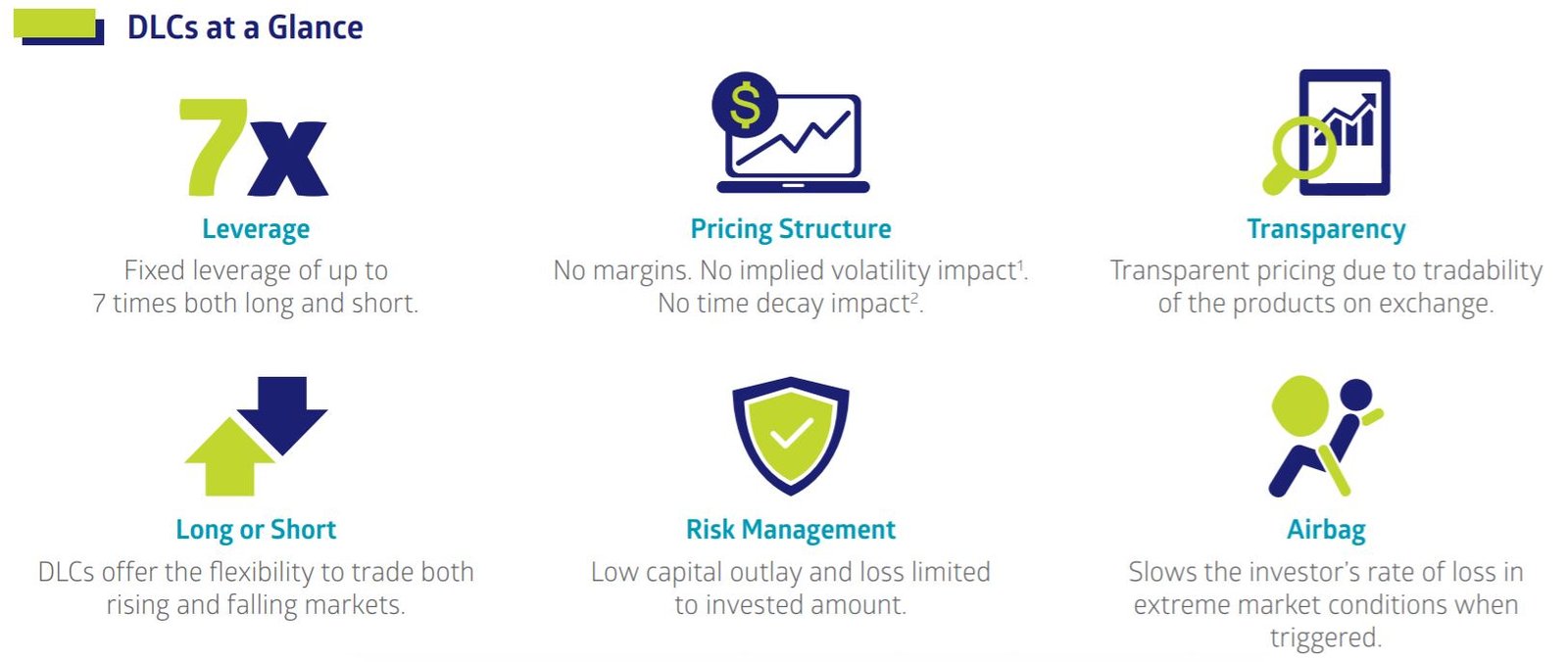

This brings us to DLCs – a new instrument brought over to Asia by SGX around 2018. There are several characteristics which allow for much easier short selling as shown below:

Source: SGX’s DLC Factsheet

Moving on, we will highlight how DLCs work and various other things to take note of DLCs.

Table of Contents

- Introduction to DLCs

- How DLCs work in 4 different scenarios

- How to Utilize DLCs

- Conclusion – Are DLCs Right For You?

Introduction to DLCs

Daily Leverage Certificates (DLC) are exchange-traded financial products that enable investors to take a leveraged exposure to an Underlying Asset, such as an equity index or a single stock (Full list of DLCs).

Daily Leverage Certificates replicate the daily performance of an underlying asset versus its previous day closing level, with a fixed leverage factor of 3, 5, 7x.

The basic principle is simple – if the underlying asset moves by 1% from its closing price of the previous trading day, the value of a 3x DLC will move by 3%, and that of a 7x DLC will move by 7%.

The underlying assets are usually either equity indices or single stocks. You can find the entire list of DLCs from Socgen here and check out 2 such examples below:

Source: Socgen Handbook

The one on the left is a Hang Seng Index Long DLC with 7x leverage factor, expiry date on 23 July 2021.

The one on the right refers to a DBS Long DLC with 5x leverage factor. Investors should note that there is no expiry date for DBS in this example. However, every single stock DLC has an expiry date; you would need to refer to the actual website to check it out.

How DLCs work in different scenarios

Given the leveraged nature and compounding effect (more on this below) embedded, DLCs are designed to be traded over short periods of time. Investors should note that the exposure of a DLC is reset every day at day end.

While this may sound easy to understand, there are 4 different scenarios investors need to take note of as shown below:

#1 Daily Long or Short

DLCs offer the flexibility to trade both rising and falling markets – buy a long DLC to benefit from rising prices, buy a short DLC to benefit from falling ones.

Here’s a simple example assuming you bought a 5X Long DLC on Tencent:

If Tencent goes up by 1% today, your 5X Long DLC would go up by 5%*.

To put into dollar terms, say you buy a 5X Long DLC with $5,000 today when Tencent’s price is at HK$400. Tomorrow, Tencent’s price goes up to 404 (up by 1%), your DLC investment value will increase to $5,250 and you will have generated a gain of $250* in this case.

On the flip side, if Tencent price drops by 1% to HK$396, your DLC investment value will drop to $4,750 before costs and fees (down by 5%*). You will have generated a loss of $250* in this case.

*The above illustration is before the incurred costs and fees.

#2 Variance of Compounding Effects

If you intend to hold the DLCs over a few days, it is important to note that the performance of the DLC may vary from the leverage factor of the DLC. This is because the performance of the underlying asset and the DLC is reset at the end of each trading day.

Below, we will showcase how DLCs’ returns perform under a trending up market and a volatile market using a 5X Daily Long.

Source: Socgen website

This example explains how consecutive days of positive returns will lead to 5x Daily Long returning more than 5 times the overall performance of the Underlying Asset.

The Underlying Asset has increased a total of 6.12% over the 3-day period but 5x Daily Long would have increased 33.20%, which is 5.42 times the performance of the index (33.2% divided by 6.12%). This is because each day the return is applied to a progressively larger amount.

If daily compounding was not applied, 5x Daily Long would have only increased by 30.60% (6.12% x 5) as the Underlying Asset is assumed to have an initial constant increase of 6.12%.

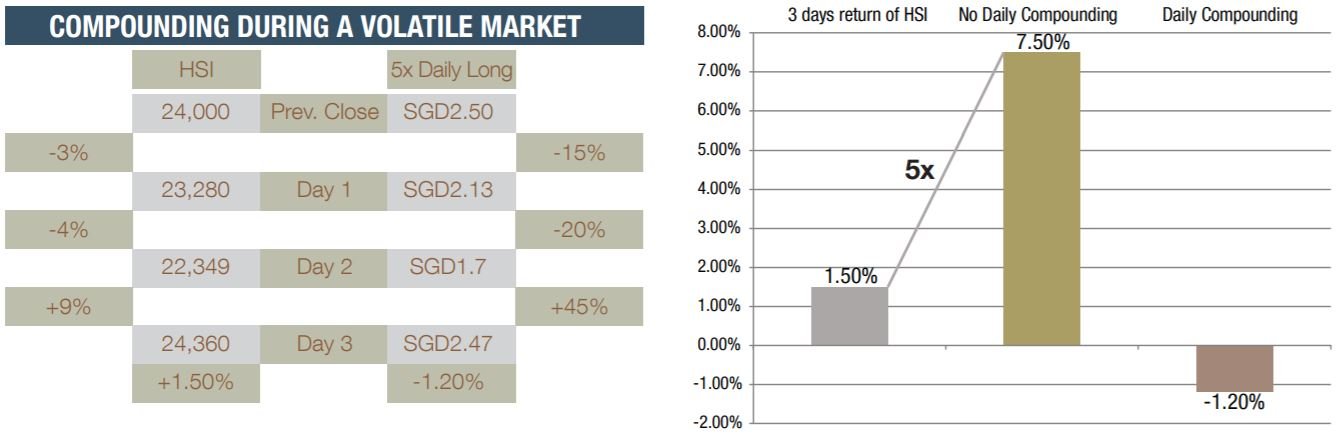

Source: Socgen website

On the other hand, the downside of compounded returns comes from volatile markets where prices are changing on an erratic basis from one day to another.

In the above example, we see that the 5x Daily Long DLC falls 15% on day 1 and 20% on day 2, before rising by 45% on day 3. The important point to note here is that the 45% rise on day 3 only takes 5x Daily Long back to a value of S$2.47. This is because 5x Daily Long was only valued at SGD1.70 when it rebounded on Day 3.

As such, the 45% gain only amounted to S$0.765 (S$1.70 x 45%). The overall loss over the 3 days is actually 1.2% rather than a gain of 7.50% (1.5% x 5) without compounding effects.

#3 Airbag Mechanism

The Air Bag Mechanism is a mechanism that is built into the Daily Leverage Certificates. It is designed to reduce the actual exposure of the Daily Leverage Certificates to changes in the Underlying Asset in case of significant adverse movement in the Underlying Asset during the day.

Here’s a simple illustration on how it is supposed to protect investors:

Assume an investor bought a 5x Long DLC on DBS for S$2.00. If DBS drops 15%, it would translate into a 75% loss on the DLC, leaving it at a price of S$0.50.

At this point, the airbag mechanism is triggered and the DLC issuer will request SGX to suspend trading in the relevant DLC for at least 30 minutes.

Reference price of the stock will be updated from the previous closing price to a price that is lowest level of the stock (for Long DLCs) during the first 15 minutes of observation period after the airbag is triggered. Assume that lowest level is down 16% from previous close.

Assuming DBS falls another 5% from its previous close after trading resumes, DLC price will go down by another 23.8% from its price determined at the lowest level. In this case, DLC price will go down from S$0.4 to 0.304.

Without the airbag mechanism, an additional 5% fall in DBS would have left the DLC worthless. This is because the total fall of 20% in the DBS would result in a (5 * 20% =ed 100%) 100% loss on the 5x Long DLC.

But if the underlying stock rebounds after the airbag, recovery in DLC value will also be reduced. If the underying goes back up to 90, DLC value will become S$ 0.543. If there is no airbag, the product would be at S$ 1 (down 50% because the stock is down 10%).

#4 Holding DLC to Expiry

An expiry date of a DLC is usually 3 years from its launch date. Last Trading Date usually falls on the date which is 5 business days before Expiry Date. Investors will not be able to trade the DLCs after Last Trading Date.

DLCs will be delisted after Expiry Date. If investors hold certain DLC until expiry, the DLC will be cash settled at its fair intrinsic value determined on Valuation Date, which is usually one Business Day before Expiry Date.

The cash settlement will be made no later than 5 Business Days after Expiry Date.

Prior to expiry of a DLC, issuers usually already have issued DLCs with a longer expiry for investors to continue expressing the same view.

How to Utilize DLCs

If you are still reading this post, you would probably be keen in understanding how you can utilize DLCs. As previously highlighted, the compounding effect of a DLC may not provide favourable returns when the price of the underlying asset moves in a sideways pattern.

Hence, DLCs are more suitable for intra-day trading and to capitalize (punt) on major daily swings like a 3.5% plunge of the Straits Times Index on 11 June 2020. With that, here’s a strategy we like to use when we trade DLCs:

- Have a watchlist of the few DLCs that we want to focus on instead of going for the whole list here.

- Set up the technical chart analysis for the underlying assets to achieve the best probability odds.

- Monitor market-changing events such as Federal Open Market Committee meetings, oil price news and even things like coronavirus vaccine updates etc. They are the catalysts which will spur the DLC’s price.

- Come up with an exit plan. Intra-day trading happens too fast so it’s prudent to follow a trading plan strictly.

To sum up, DLC traders should have sufficient trading experience and a deep understanding of DLCs to properly evaluate and assess the associated risks, valuation, costs and expected returns.

Conclusion

To conclude, Daily Leverage Certificates (DLCs) are a good addition to the investment space because of its simple characteristics as compared to other financial derivatives.

On top of transparent pricing and no margins with a fixed leverage ratio, traders can get access to them just like any other stock provided if they are specified investment products (SIP) qualified.

If you are wondering how to get started on the above, please approach your stock broker if you have any questions. You can also refer to this one pager on the SIP requirements.

This article is sponsored by Societe Generale.

Read also: https://www.smallcapasia.com/5-things-you-should-know-about-daily-leverage-certificates-dlcs/