If you want to participate in an alternate investment opportunity that differs from your traditional investment instruments (such as stocks and bonds), you ought to check out the world of crowdfunding.

But before we dive right into the details on how to achieve such returns, let us first touch briefly on the history of crowdfunding and what it is all about.

What is crowdfunding?

As the name suggests, crowdfunding is the practice of funding a project or venture by crowdsourcing small amounts of money from a large number of people. The modern concept of crowdfunding dates all the way back to year 1997, where the British Rock and Roll group ‘Marillion’ raised funds for their tour through the donations of fans.

Fast forward to today, crowdfunding has developed its reputation to be a viable investment option for many investors lately due to its rapid rise in popularity. With that in mind, here’s 3 types of crowdfunding approaches we should know.

3 popular types of crowdfunding

#1 Invoice Financing

Invoice Financing is a form of short term borrowing which allows firms to draw down cash against outstanding invoices due from customers through a middle agent (usually a bank or financial institution). The companies usually receive up to 85% of the invoice amount upfront and also pay a percentage of the invoice amount to the lender as borrowing fee.

The concept behind invoice financing is that businesses can improve their cash flow immediately instead of waiting for the credit terms like 30 to 90 days. There are several advantages as well such as helping to pay for new supplies or to keep the business going when cash runs dry, keep the credit score low for securing another bigger business loan and also invest on the company’s profitability and future expansion.

#2 Equity Financing

While investors are usually more familiar with buying shares of public-listed companies, they can also opt for pre-IPO or early stage companies in what we call “Equity Financing”.

Designed for start-ups, equity financing involves raising money through investors who want to be shareholders of a potentially high growth start-up. More often than not, this type of financing is usually set aside for those Private Equity firms where they invest and support start-ups like Grab, Shopback, Carousell and more.

That said, we also have 2 equity crowdfunding platforms in Singapore catered more towards the retail investors – FundedHere and Fundnel.

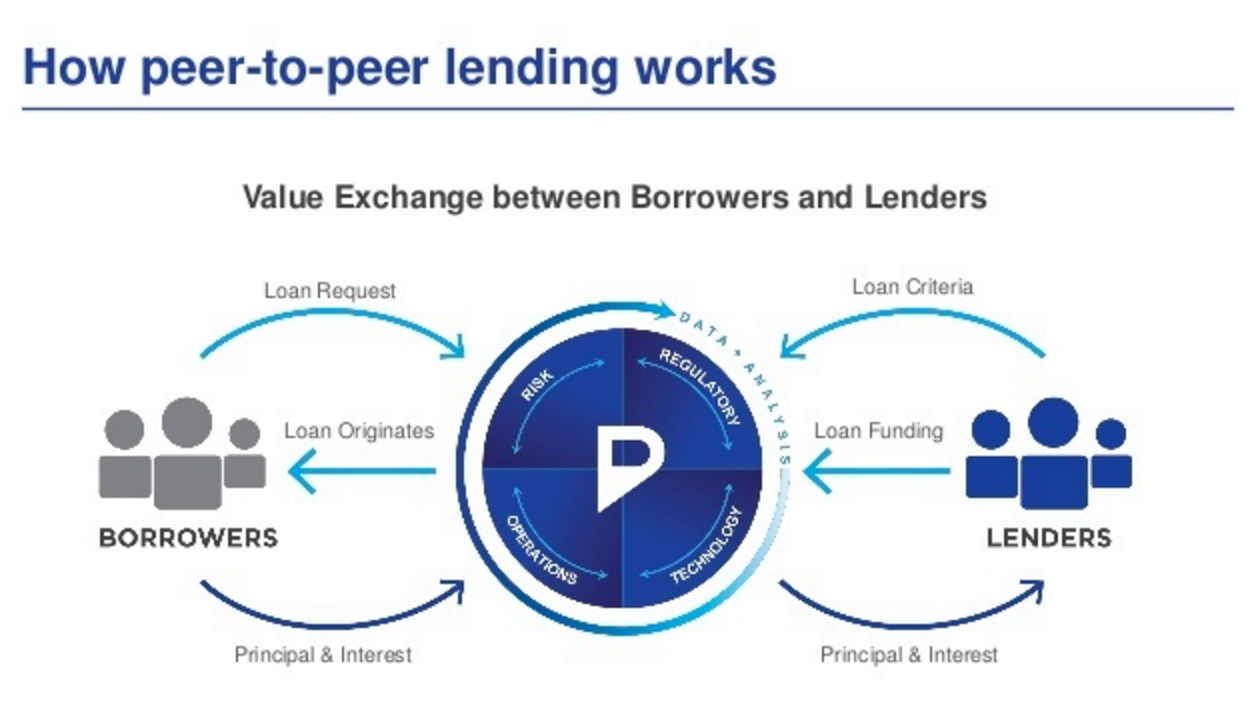

#3 Debt financing (also known as P2P Lending)

Last but not least, we have Debt financing or P2P lending which is the most commonly heard of among retail investors.

Here’s how P2P Lending works in 3 easy steps:

- Imagine yourself being a bank (one with lots of money to lend to corporations).

- You extend a loan to some companies (except that you only need to put up a low amount due to the power of crowdsourcing – everyone chips in a bit but the amount balloons up due to network effect)

- The companies pay you the interest regularly and principal at a predetermined rate (together with the interest payments or end of the loan period).

P2P lending has blossomed in the recent few years as many companies opt for this kind of funding due to quick turnaround and lower financial costs. Thus, we listed out 4 popular debt-based crowdfunding platforms in the chart below:

| CoAssets | Funding Societies | MoolahSense | Minterest | |

| Type of Crowdfunding | Business Term | Business Term Loans, Secured Loan

& Invoice Financing |

Business Term Loans

& Invoice Financing |

Business Term Loans

& Invoice Financing |

| Weighted Returns in Year 2018* | 9.91% | 11.73% | 9.9% | 12.95% |

| Minimal Investment | $5,000 | $20 (initial deposit $500) | $100 (initial deposit $1,000) | $500 (initial deposit $1,000) |

| Use of Escrow Agents | Yes | Yes | No | Yes |

| Fees Involved | 0%

(on investors) |

18%

(on interest earned) |

1%

(on all repayments) |

15%

(on interest earned) |

*Figures are sourced from each website’s statistics page

While P2P lending has always revolved around providing loans to start-ups, something interesting caught our attention as we browsed through these platforms – funding a movie and its distribution. With that, let us zoom into this special kind of ‘movie funding’ unique to CoAssets.

First of its kind – Movie Funding by CoAssets

If you are a die-hard movie fan, have you ever wondered if you can channel that interest into sponsoring a movie project before?

Well… now you can do it via movie crowdfunding – an unique proposition conceptualized by CoAssets. They have already successfully completed some past projects as seen below:

Take for example the Japanese romantic movie called “The 8 Year Engagement”. It was already released on 16 December 2017 in Japan but only released (and probably subbed) in Singapore from September 2018 onwards.

The timing of the movie falls nicely around the period where the movie secured funding of S$530,000 which had a tenure of a short 4 months.

By and large, the movie production companies probably wanted to raise this sum of money to market their movies, knowing that they can repay the loan in a short period of time if the movie is a box office hit. All these is only made possible by CoAssets.

How CoAssets stands out

Founded in Singapore in July 2013, CoAssets Pte Ltd is a MAS licensed company which provides the mass market carefully-curated and robustly- structured investment opportunities through its online funding platform. It is wholly owned by CoAssets Ltd, which is a listed company on the Australian Securities Exchange (ASX).

CoAssets Ltd’s listing provides a bigger platform for transparency and credibility amongst Singaporean retail investors. Now present in Australia, Hong Kong and China, CoAssets Ltd has more than 574,000 registered clients and users and has facilitated over S$100M for a variety of projects.

Here are 6 more reasons why CoAssets Pte Ltd stands out among the P2P sphere:

- Wholly owned by a listed company which brings a great deal of credibility to the company because they are subjected to external audits.

- Figures such as rate of returns and default rates have to be true and transparent under the scrutiny of the Monetary Authority of Singapore.

- CoAssets has sported a 2018 according to MAS calculations, while keeping the non-performing loans to 0% for the same period.

- The stipulated rate of returns come with zero costs like service fees or surcharges which other P2P lenders impose on.

- No balance is required to hold an account with CoAssets.

- Each qualified member is assigned a dedicated alternative wealth manager who offers personalized services, addresses concerns and gives salient updates.

You can also get more information about the platform at coassets.com.

Final Thoughts

All in all, the concept behind movie crowdfunding sounds exciting. Movies require a very short lead time to raise funds and achieve the rave marketing in its movie promotion campaigns. Assuming the marketing has accomplished its purpose, the box office can become a hit and achieve significant returns as compared to its investment.

To end off, all forms of investments has its own risks and P2P lending is no different. It is vital that investors should do your own due diligence and get familiar with this innovative concept before investing.

Read more..

Investing in movies may sound exciting, but how much do you know about the industry? The CoAssets research team took a deep dive into film investing by studying industry trends, types of film financing available, and some risk mitigation tools to consider.

This paper includes the insights on:

- Film investments’ low correlation with equity markets

- Trends in the film & online video industry: A closer look into China

- Value chain of the film industry

- Types of film financing

- Risk mitigation and considerations

As the paper is accessible to qualified CoAssets members only, be sure to complete the onboarding process (free-of-charge) to get the password from a CoAssets alternative wealth manager.

Happy reading!