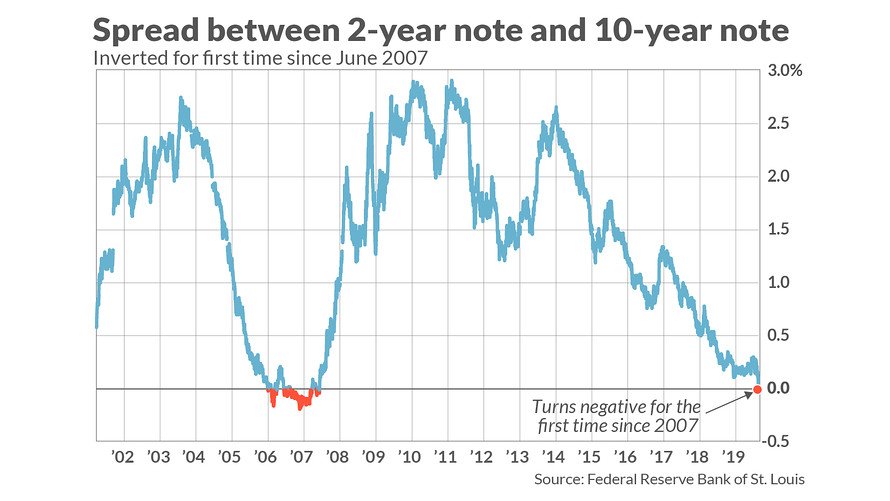

Inversion of yield curve has been the talk of the market in recent months. Technically, inversion of yield curve occurs when near-term USA treasury has a higher yield than further-term treasury.

On 14th August 2019, 2-years treasury yield went higher than 10-years treasury yield for the first time since June 2007.

Meaning of Inverted Yield Curve

During normal times, further dated treasury bonds have higher yields due to the longer time needed for it to mature. (think about how you lock in your money for 10 years versus 2 years. you will want to be compensated for higher yields when your money is locked for 10 years!)

However, when investors have bearish views for near-term markets/economy, these investors start buying up further dated bonds.

Since price and yields are inversely proportional, the higher the prices are drummed up, the lower the yields.

Thus, the inversion occurred when the 10 years treasury yield dropped lower than 2 years treasury yield.

Why Inverted Yield Curve signals a Recession

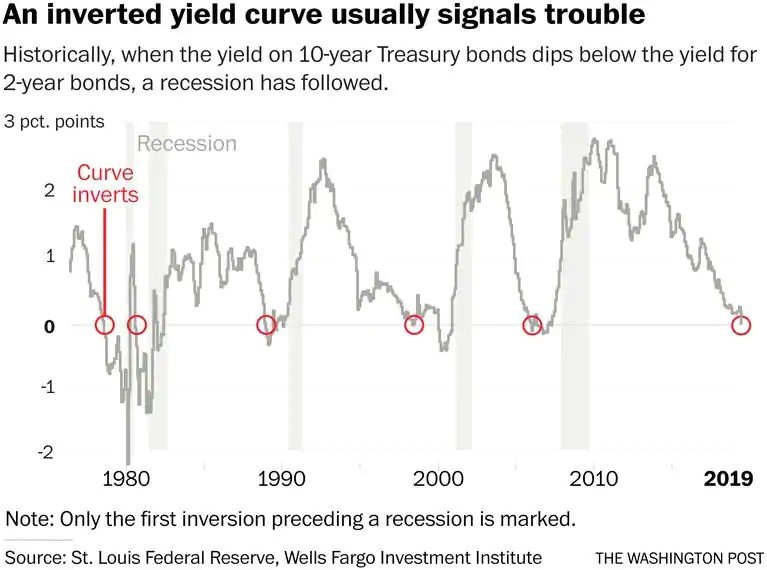

According to data compiled from Washington Post, the treasury yield curve has inverted prior to the past few recessions.

CNN business has this to say as well:

“Yield curve inversions have often preceded recessions and are a sign of just how nervous investors are about the immediate outlook for the economy. They are demanding higher rates for short-term loans, which is not normal.”

Moreover, another expert from The Sevens Report, an investment research firm included this line in its research report:

“Historically speaking, the inversion of that benchmark yield curve measure means that we now must expect a recession anywhere from 6-to-18 months from today”.

In local context, it is evident that Singapore has been affected by the possible downturn. In 2Q2019, Singapore grew marginally by 0.1% YoY, moderating from the 1.1% YoY in the previous quarter.

Our manufacturing sector, a major sector which contributes 20-25% of Singapore’s GDP, contracted by 3.1% YoY during Q2.

It was a much sharper drop than the 0.3% YoY in Q1. Due to the above factors, Ministry of Trade downgraded the GDP growth forecast for Singapore from 1.0 – 1.5% to 0.0 -1.0%.

Being a trade reliant country, downward movements in global economy will be keenly felt by Singapore.

Due to the above results, there are some expectations that Singapore might go into a technical recession – two straight quarters of quarter-on-quarter contraction.

What to do during a Recession

*Important Disclaimer* We do not have a crystal ball and cannot explicitly imply that a recession is coming. No one else can predict the unfolding of the events over a long period of time and you should be wary if someone told you so.

It is of no secret that one can be fully insulated from the depression since we live in such an interconnected world.

Planning of your portfolio in the form of investments/rainy day funds/expenses are extremely important during this turbulent time.

One such article that we have written may be of help in your financial planning: https://www.smallcapasia.com/what-to-do-during-a-market-correction/

It is also noteworthy that during such confusing times, certain stocks shine more than others due to the nature of its business.

These stocks are labelled as defensive stocks as the products/services provided by the companies are needed even in times of recessions.

Here is an article to check out some of the stocks we have highlighted: https://www.smallcapasia.com/3-defensive-stocks-to-buy-during-a-recession/

With the ongoing trade war having no end in sight, MNCs are laying off staffs and investments are dropping in view of the possible downturn. Retail investors like us need to have preparations in place to tide through this roller coaster ride.

Do you know that Master Investors like Warren Buffett has his own Unique Investing System which you can emulate yourself?

We have distilled it into a simple 10-Step Checklist for you to decide how or when to buy/sell your stocks.

Simply click to receive your copy today!