Many investors have been opening up to impact investing in recent years as the world faces imminent threats from climate change.

Impact investing is an investment strategy that seeks to generate financial returns while also creating a positive social or environmental impact. This particular focus provides the necessary capital to address the world’s most pressing challenges in sectors such as sustainable agriculture, renewable energy, conservation and more.

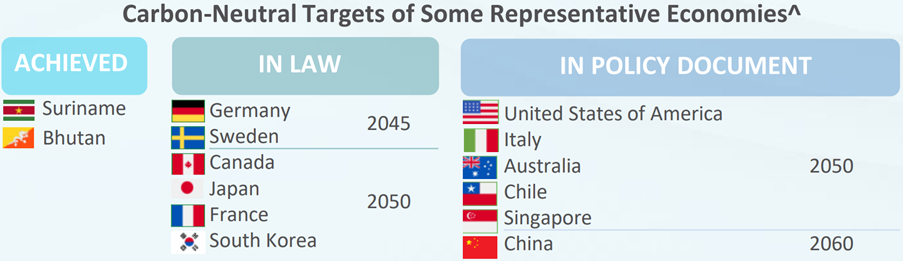

In fact, according to Energy & Climate Intelligence Unit, more than 130 economies have declared their intentions and targets for carbon neutrality (net-zero emissions) as shown below.

Why ESG investing is on a slow start

While many investors would want to make a social impact and earn positive returns at the same time, they are usually sitting on the sidelines probably due to the reasons below:

- ESG adoption usually means higher costs involved (think solar panels installation) and hence, lower returns

- Fear of “Greenwashing” – where companies appear ‘socially responsible’ but is actually breaking their promise to environmentally conscious consumers

- Lack of knowledge for ESG Investment products

To be honest, I myself have not really explored ESG investing but that being said, one ETF caught my attention due to its focus on environmental, social, and governance (ESG) criteria, as well as its potential to provide long-term capital appreciation.

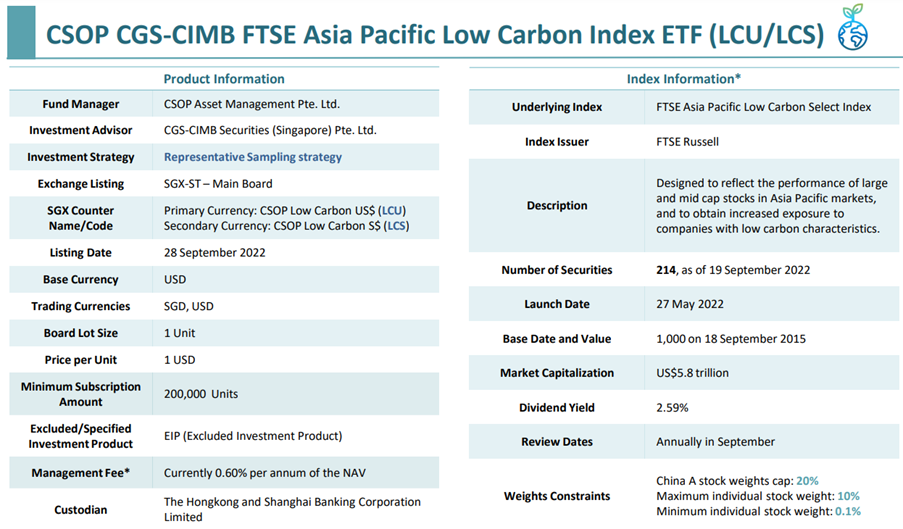

Introducing CSOP CGS-CIMB APAC Low Carbon Index ETF (LCU/LCS)

CSOP CGS-CIMB FTSE Asia Pacific Low Carbon Index ETF is an ESG-focused ETF that tracks the FTSE Asia Pacific Low Carbon Index.

According to the prospectus, it is composed of large and mid-cap stocks from the Asia Pacific region that have been screened for their ESG characteristics and meet certain carbon emission criteria.

On top of that, the Index is pretty diversified given that it owns more than 200 as of 31st August 2022*.

*The above is for illustration purpose, not to be taken as a recommendation to buy/sell in the above-mentioned securities*

The top 10 constituents in the ETF are also familiar household names such as Samsung, Toyota, Alibaba and AIA Group. Taiwan Semiconductor Manufacturing (TSM.NY), the stock with the highest weightage of 4.23%, also recently came into the limelight when Warren Buffett took a sizable stake in it.

With that, lets talk about 5 things I like about this ETF.

#1 Doing my part for the World

Although it sounds cliché, as a parent with kids, I am always all in for investments that will help to make the world a better place especially for the next generation.

Hence, the ETF serves as a good opportunity to invest in companies that are taking steps to reduce their carbon emissions via a nice systematic methodology.

Out of the whole FTSE Asia Pacific Index, they do an exclusion of companies involved with controversial product activities including controversial weapons; tobacco, thermal coal and UN Global Compact (UNGC) controversies.

Source: FTSE Russell; ^FTSE Russell. As of 2022/9/19, the first day after annual rebalancing took effect. * Z-Score formula for the index: 𝑍𝐹,𝑖 = 𝐹𝑖−𝜇𝐹 𝜎𝐹 where F ∈ ሼ𝑂𝐸, 𝐿𝑜𝑔(𝑅)}

Next comes the weightage exercise based on the the Carbon Emissions and Fossil Fuel Reserve Intensity; companies that perform better are given higher weightage.

Source: ^FTSE Russell. As of 2022/9/19, the first day after annual rebalancing took effect Note: *Emission/Reserve Intensity are calculated at regular index reviews

According to their 7-year average historical data, the FTSE Asia Pacific Low Carbon Select Index lowered the carbon intensity and reserve intensity much more than the parent index of 62.4% and 93.6% respectively.

#2 Exposure to APAC’s huge growth

The APAC region accounts for and is forecast to grow at a much faster pace compared to Europe and U.S. in the next 2 decades.

In fact, de-globalization has led to many APAC countries forming regional free-trade agreements such as Regional Comprehensive Economic Partnership (RCEP) and localized value chains which will benefit them more in future.

On top of that, everyone knows that the developed nations from U.S. and Europe are already getting the ball rolling when it comes to impact investing and sustainable development.

That being said, the APAC region is in dire need of transiting to a low carbon future because according to IMF, parts of Asia will experience extreme weather by 2050.

These scenarios like what we always see on movies may be coming sooner than we think: deadly heat waves, extreme rainfall, severe hurricanes, droughts and water shortages.

Source: *IMF F&D “Asia’s Climate Emergency”, September 2021. ^McKinsey Global Institute “Climate risk and response in Asia”, November 2020

All these are expected to damage grain yields, infrastructure, workability, supply chains and production. McKinsey expects Asia will contribute to >66% of the annual global GDP loss from climate impact too.

The strong APAC growth and climate change will literally ‘force’ governments to drive more policies towards carbon neutrality by 2050.

3. Do Well, Do Good

The other aspect I like about it is how I can do good for the environment but not sacrifice my investment returns in doing so.

Source: ^Bloomberg. As of 2022/8/26. #FTSE Russell, As of 2022/8/31

As per the backtested results, the index was up around 50% if we take 18 September 2015 as the base. If I punch the 50% returns across 7 years, we would be looking at around 6% compounded annual growth rate (CAGR).

This is not too shabby given 2 things – 1) we just tumbled across the Covid pandemic where everyone rushed towards the SaaS stocks and 2) the ESG sentiment was not as strong back then and will definitely stick out more in future.

4. Diversification with Dividends

Last but not least, the ETF offers investors exposure to companies with lower carbon emissions while also providing broad geographic and sector diversification.

Although Japan and HK constitutes to a big part of the ETF, I am convinced that the developed financial markets there can benefit the ETF instead.

The ETF also comprises of various sectors, mainly in the financials, technology and consumer discretionary. This makes sense given that these industries typically don’t ‘pollute the earth’ as much as other industrial/construction areas.

I also like this ETF includes dividend-paying stocks as well and buying it would net the investor a decent 2.59% dividend yield.

“Getting paid to save the earth” – not bad at all!

Conclusion

The CSOP CGS-CIMB FTSE Asia Pacific Low Carbon Index ETF pops out at an opportune time where there are only a handful such sustainable-focused ETFs in Asia as compared to U.S. and Europe.

Through this ETF, investors can benefit from the potential upside of investing in companies that are better positioned to benefit from the transition to a low-carbon economy.

To conclude, I would like to say that the philosophy of this ETF “Low Carbon, Long APAC” deeply resonates with me personally. Having watched the video where a dinosaur ‘invades’ the UN and tells us to stop making excuses to save the earth, I am optimistic that more sustainable financial products will come to fruition.

All in all, by investing in companies that are more mindful of their environmental impact, we are collectively agreeing to support a better future for our next generations to come.

Disclaimer

The investment product(s), as mentioned in this document, is/are registered under section 286 of the Securities and Futures Act (Cap. 289) of Singapore (the “SFA”). This material and the information contained in this material shall not be regarded as an offer or solicitation of business in any jurisdiction to any person to whom it is unlawful to offer or solicit business in such jurisdictions.

CSOP Asset Management Pte. Ltd. (“CSOP”) which prepared this document believes that information in this document is based upon sources that are believed to be accurate, complete, and reliable. However, CSOP does not warrant the accuracy and completeness of the information and shall not be liable to the recipient or controlling shareholders of the recipient resulting from its use. CSOP is under no obligation to keep the information up to date. The provision of this document shall not be deemed as constituting any offer, acceptance, or promise of any further contract or amendment to any contract. The information herein shall not be disclosed, used or disseminated, in whole or part, and shall not be reproduced, copied or made available to others without the written consent of CSOP.

Advice should be sought from a financial adviser regarding the suitability of the investment and/or investment product before making an investment. Investment involves risk. The value of investments, and the income from them, can go down as well as up and an investor may get back less than the amount invested. Past performance is not necessarily indicative of future performance. Investor should read the prospectus and product highlights sheet, which can be obtained on CSOP website or authorized participating dealers, before deciding whether to invest. This document has not been reviewed by the Monetary Authority of Singapore.

Index Provider Disclaimer

The CSOP CGS-CIMB FTSE Asia Pacific Low Carbon ETF (the “ETF”) has been developed solely by CSOP Asset Management Pte. Ltd. The ETF is not in any way connected to or sponsored, endorsed, sold or promoted by the London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). FTSE Russell is a trading name of certain of the LSE Group companies.

All rights in the FTSE Asia Pacific Low Carbon Select Index (the “Index”) vest in the relevant LSE Group company which owns the Index. FTSE® is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license.

The Index is calculated by or on behalf of FTSE International Limited or its affiliate, agent or partner. The LSE Group does not accept any liability whatsoever to any person arising out of (a) the use of reliance on or any error in the Index or (b) investment in or operation of the ETF. The LSE Group makes no claim, prediction, warranty, or representation either as to the results to be obtained from the ETF or the suitability of the Index for the purpose to which it is being put by CSOP Asset Management Pte. Ltd.

Source: ^United Nations, 2019

Source: *FTSE Russell