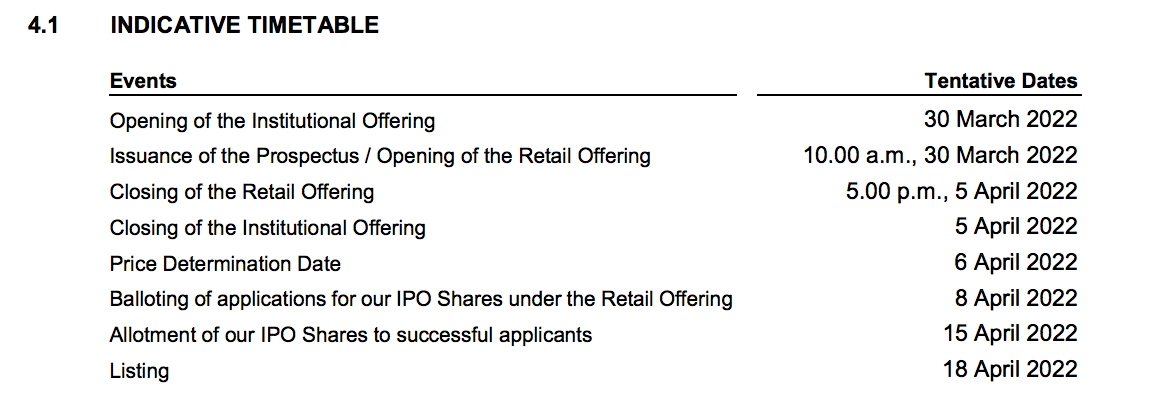

On 30 March 2022, Cengild Medical Berhad (Cengild) has just launched its IPO at 33 sen a share.

Upon its listing, Cengild’s market capitalisation shall be lifted to RM 207.2 million. The application to its IPO shares will be closed on 5 April 2022.

There are 9 things investors should know about Cengild Medical IPO as shown below:

#1 About Cengild Medical

Cengild Medical runs a medical centre which specialises in the diagnosis and treatments of gastrointestinal and liver diseases and obesity in Kuala Lumpur.

It had started its operation in October 2017 at Nexus @ Bangsar South with a built-up area of approximately 36,588 sq. ft. that houses 6 clinics, 10 inpatient beds, and as well as 1 operating theatre.

Since then, Cengild has expanded its medical operations to 10 clinics, 28 inpatient beds, and 2 operating theatres as of 1 March 2022.

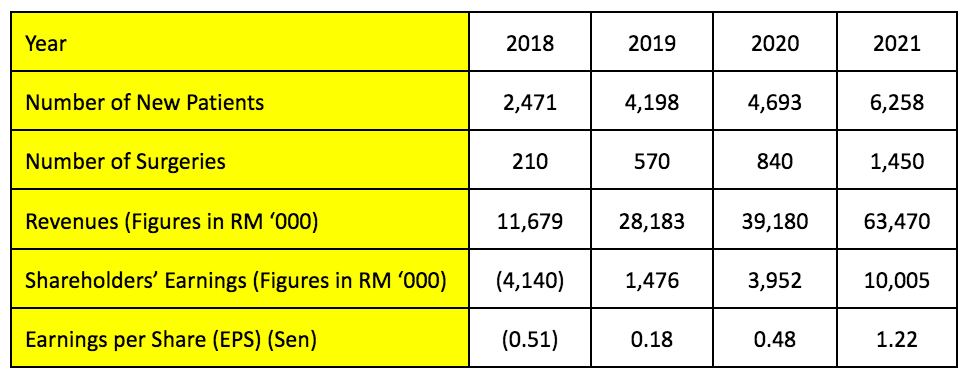

#2 Financial Results

Since commencement, Cengild had increased its number of brand new patients and surgeries performed significantly. For example, the number of surgeries jumped 7x from 210 to 1,450 in FY2021.

This has been accentuated in 2020-2021 due to Dr. Mustafa joining Cengild as its sixth consultant.

As a result, Cengild’s revenue leapfrogged from RM 11.7 million in 2018 to RM 63.5 million in 2021. It started to be profitable in 2019 and recorded an incredible RM 10.0 million in earnings.

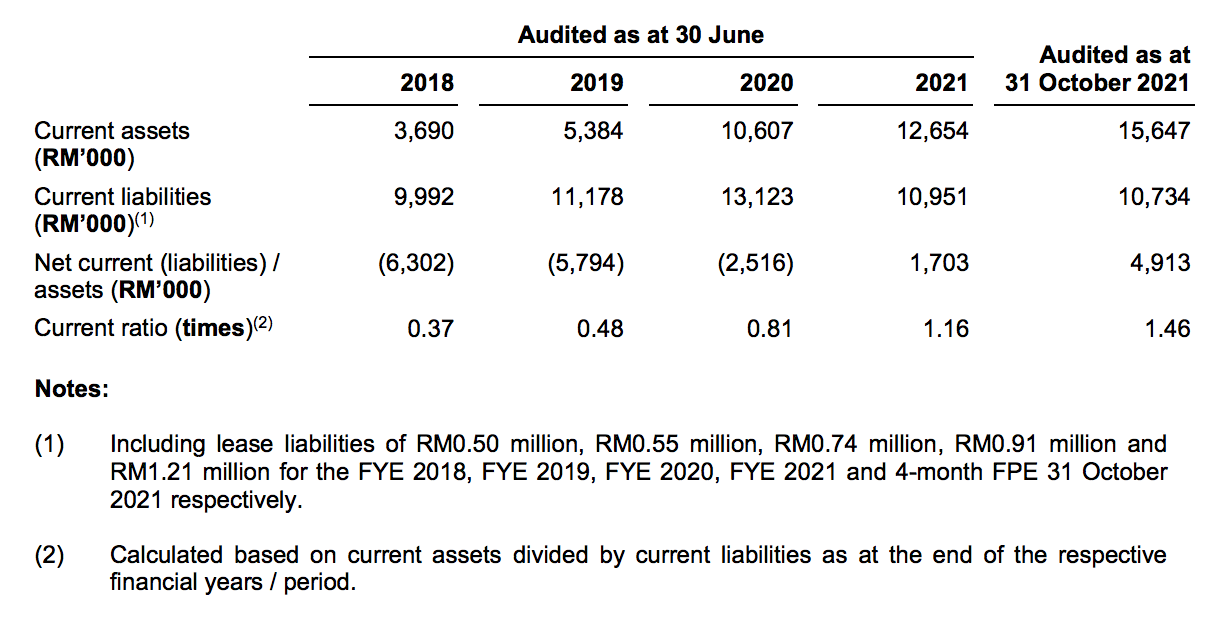

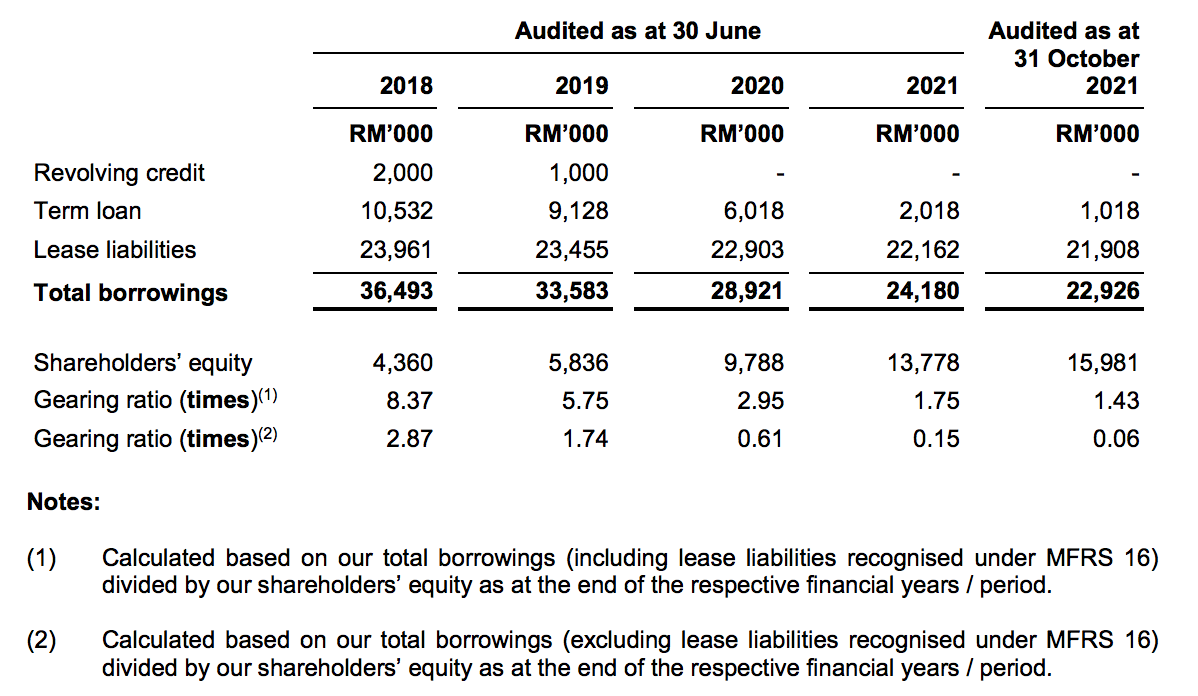

#3 Financial Strength

Source: Cengild’s IPO Prospectus Page 223 and 228

Cengild has lifted its current ratio to 1.46 as of 31 October 2021 which means it has enough current assets to meet its short-term obligations.

Its gearing also reduced significantly as Cengrid repaid its term loans gradually in the past 3 years.

Overall, Cengrid’s net gearing (excluding lease liabilities) from 2.87x in FY2018 to a mere 0.15x in FY2021 shows that the management has been going in the right direction.

#4 Cengild Medical Associates

UNCKL Sdn Bhd (UNCKL) is a 30%-owned subsidiary of Cengild that is formed to offer urology services to Cengild.

Presently, UNCKL is dormant for the execution of its shareholders agreement and things are still pending between KL Urology (UNCKL’s other shareholder who owns its balance 70% shareholdings) and Cengild.

#5 Joint Venture

Cengild and Dr. Hendrick Chia had formed a joint venture (JV) company namely, Cardiac Care Centre Sdn Bhd (CCC), where Cengild owns 30% shareholdings and Dr. Hendrick holds the other 70% shareholdings of the JV company.

Presently, it provides cardiology assessments to patients at Cengild’s medical centre.

#6 Major Shareholders

Source: Cengild’s IPO Prospectus Page 45

Except for Anne Marie, the major shareholders listed above hold onto positions as follows:

This mean that the 5 insiders within the management team will still hold on to 49.1% stake in the company post-IPO.

Its a positive sign that all the ‘Doctors’ in the company have their interests well-aligned with the shareholders.

#7 Utilisation of IPO Proceeds

Source: Cengild’s IPO Prospectus Page 33

Cengild intends to raise RM 72.2 million in gross proceeds and has allocated the proceeds to be utilised as follows:

1. Expansion of Medical Centre at Nexus @ Bangsar South (RM 13.0 million)

This refers to its leasing of additional 12,000-15,000 sq. ft. of spaces at Nexus to cater for current & future demand of its medical services, especially endoscopic procedures.

The RM 13 million would be used to pay for rental, renovation, and purchases of beds, medical devices, and computing equipment.

2. Establishment of New Medical Centres (RM 37.1 million)

Cengild intends to establish two new medical centres in other cities in Malaysia namely, Johor Bahru, Penang, or Ipoh.

The set-up cost of each medical centre is estimated to be around RM 18.55 million.

3. Working Capital (RM 17.4 million)

This refers to the recruitment of 10 new employee consultants, surgeons and as well as nursing staff, clinical support, and administrative staff which support the company’s plans of expansions as listed above.

#8 Dividend Policy

Cengild intends to pay out at least 25% of its consolidated net profits attributed to shareholders in the form of dividends.

Based on its EPS 2021 of 1.22 sen, the minimum amount of dividends per share (DPS) 2021 works out to be 0.305 sen.

This would be an initial dividend yield of 0.92% per annum, based on its offer of 33 sen for its IPO shares.

#9 Valuation

The IPO offer of 33 sen is valued at P/E Ratio of 27x, based on 1.22 sen in EPS 2021.

Conclusion

Since inception, Cengild has expanded its medical practices and attained tremendous financials’ growth in the past 4 years.

On top of that, it has consistently made debt repayments to reduce its net gearing and 49% stake would still be retained by the management team post-IPO.

1 major risk worth nothing is how Cengild is heavily dependent on its six consultants for sales and thus, it is vital for Cengild to retain them.

The company plans to spread this out by hiring more consultants in the future.

All in all, with an indicative P/E Ratio of 27x and 0.92% dividend yield, the IPO is not coming cheap as compared with other SG-listed healthcare operators such as IHH, Singmedical Group, Talkmed and Raffles Medical.

Hence, it depends on whether Cengild can sustain its growth momentum to justify its slightly lofty valuation from the onset.