Unless you have been living under a rock, you would have known that the Coronavirus outbreak is wreaking havoc all across China now. Started as a flu-like illness in Wuhan, it has spread beyond China with more than 42,000 cases and 1,000 deaths.

The impact of the virus has left many major Chinese cities in lockdown, resulting in people staying at home. Businesses in the retail, food and beverage, and tourism sectors are affected with shortened operating hours and closure of outlets.

Yum China Holdings (YUMC) is one such company. It announced closure of 30% of its restaurants in the recent Q4 earnings announcement. Correspondingly, its share price has dropped by around 16% to US$42 since a month ago.

Can YUMC survive this pandemic and continue its growth story in the future? Let’s find out.

Overview

YUMC is the largest restaurant operator in China with vast network of 8,484 restaurants covering 1,200 cities as of end 2018. Its brands of well known quick service and casual dining restaurants include KFC, Pizza Hut, Taco Bell and others.

Among these brands, KFC is the largest fast food restaurant in China, even larger than McDonald’s, with over 5,900 outlets. As for Pizza Hut, it commands leading position in the casual dining sector, boasting 2,200 outlets across 500 cities.

KFC and Pizza Hut restaurants in China are highly differentiated from its international counterparts. Menu is customised to suit local consumers’ taste. For example, other than the original recipe chicken, China KFC has an extensive menu featuring pork, seafood, rice dishes, vegetables, soups and many others. I was delighted to have a unique dining experience there, with a fusion of western fast food and delicious congee giving me a complete, satisfying meal.

Revenue and Earnings

YUMC has shown solid growth across three Financial Years from 2017 to 2019, with its overall revenue increased from $7.76b to $8.78b. The main contributing factor is the number of new stores opened in a year that saw a steady increase from 691 to 1006 stores in 2019. This has brought the total store count to a record 9,200 as of end-2019.

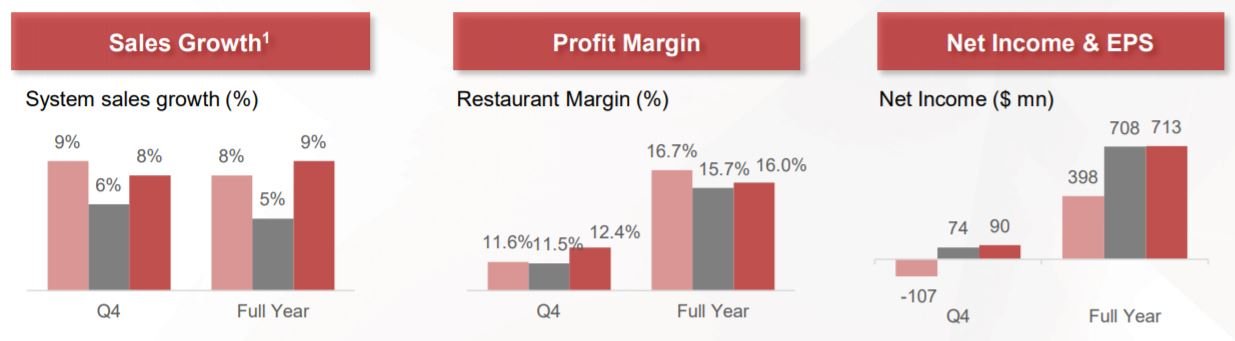

While pursuing growth, the company has not neglected its bottom line. Its System Sales Growth that reflects overall health of all restaurants, and Profit Margin, have increased in 2019. Personally, I find a restaurant margin of 16% remarkable. This shows that YUMC is able to keep its expenses in check and maintain efficient operation across its vast restaurant network.

Full year net income has expanded to $713 million too, a slight uptick from 2018.

Balance Sheet Strength

For a growth company, ideally I would like to see that it has not taken on excessive debts to fund its expansion.

For Financial Year 2019, YUMC has a total liabilities of $3.77 billion, versus total assets of $6.95 billion. Thus, its Debt/Asset ratio is 0.54.

Drilling deeper into its balance sheet, I found out that YUMC has total current liabilities of $1.73 billion and total current assets of $2.25 billion. This gives rise to a current ratio of 1.3.

Based on the company’s scale and growth thus far, I am not worried about its balance sheet.

Cash Flow

What about its cash flow? Does YUMC have a healthy cash flow that grows in tandem with its revenue?

Looking at its 2018 annual report, the company’s Net Cash Provided by Ops Activity had been steadily growing from $777 million in 2014 to $1.33 billion in 2018. Similar figure for 2019 stood at a healthy $1.18 billion.

This indicates that YUMC is efficient in converting its revenue into actual cash inflow, definitely a healthy sign.

Management Profile and Ownership

YUMC’s CEO, Ms Joey Wat, has been in this post since Mar 2018. Before becoming the CEO, she served as the COO of YUMC and CEO of KFC China from 2015.

Prior to joining YUMC, she was the Managing Director of Watson UK, a unit of Li Ka Shing’s Hutchison Group. She also spent seven years in management consulting with McKinsey & Co Hong Kong.

Dr Fred Hu is the Board of Director’s Chairman. He boasts an impressive list of credentials, including Chairman of Greater China for Goldman Sachs, board member of Hong Kong Exchange and Clearing Limited, and economist at the International Monetary Fund.

BlackRock Inc, the world’s largest asset manager, is the largest shareholder of YUMC, with a 8.7% ownership in the company’s outstanding shares.

Prospects

China’s vast market underpinned by a growing middle class with increasing consumption power provides a long growth runway for YUMC.

In the 2018 annual report, management stated that the company aims to expand its network in under-served market across China to 10,000 stores by 2021.

YUMC seems poised to achieve this target as management guided for 800-850 new stores in its 2020 outlook on top of the 9,200 stores in operation.

YUMC is also leveraging its extensive digital and delivery strategy to drive sales growth, lower operating expenses and improve outlet’s productivity in serving more diners.

As of end-2019, YUMC owns one of the world’s leading restaurant membership programme with more than 240 million members.

Digital and delivery orders constituted 61% and 23% of Q4 2019 total sales, an increase of 17% and 3% from previous year respectively.

Moving forward, i foresee YUMC’s digital and delivery efforts as its key weapon in penetrating the lower-tier inland cities.

Management is optimistic about its growth path, and cited the potential to grow to 20,000 stores over the long term.

Risks

No doubt, the biggest risk right now is the epidermic outbreak in China.

In fact, in its 2018 annual report, YUMC explicitly stated that ‘Health concerns arising from outbreaks of viruses or other diseases may have an adverse effect on our business’.

The Coronavirus has impacted its operations since start of the year, and as a result, YUMC may experience operating losses for Q1 2020. As protection measures, the company has closed more than 30% of its restaurants.

For outlets that remain open, same store sales during the Chinese New Year period has dropped by 40% to 50% compared to 2018. At this point in time, management is unable to forecast when the closed outlets will reopen, and traffic will resume.

Conclusion

I am attracted by YUMC’s leadership position in a vast market with a clear growth potential. Key thing to do now is to forge ahead with its expansion strategy to further fend off its competitors.

Based on its steady growth in past few years, management seems to have the capability to pull it off.

Of course, the biggest question now is how big an impact Coronavirus will have on YUMC’s business? Could there be further loss down the road, beyond a first quarter operating loss?

Judging from past epidermic outbreak, call me an optimist, I am confident that the latest public health scare will eventually boil over. Of course I do not know when.

But should we stretch our investment horizon long enough to beyond 3 years, I believe this episode would most likely be a minor blip, rather than a major event that will fundamentally cripple YUMC.

Based on 2019 Earnings per Share of $1.89 and 11 Feb closing share price of $43.81, YUMC has a PE ratio of 23.2. It does not seem too expensive compared to peers: McDonald’s 26.9, Chipotle 70.6, Starbucks 27.5, Haidilao 79.9.

I may just start collecting more of YUMC shares soon.

Like this case study above? Want to know more about such companies?Simply click here to uncover these ideas in our FREE Special Report!