Since the start of 2020, Covid-19 has been affecting many lives, world economies and companies. It has changed how people work and has heightened the need for hygiene.

From the upstream of medicine, medical instruments to the downstream of hospitals and general practitioner clinics, demand for its goods and services has increased exponentially.

In that aspect, gloves are an integral part of any hospitals, clinics and handling of sensitive medical instruments or medicine. The demand for gloves have thus skyrocketed and astute investors have benefited from the almost insane growth of their share prices recently…

The question beckons, are these stocks overvalued or do they still offer further upside at the current prices?

Let us take a quick look at the 3 glove makers below:

Glove Stock#1 Top Glove

Top Glove is the world’s largest glove manufacturer. It is dual listed on SGX and KLSE with presence across the whole world including America, Asia, Europe, etc. It has factories in Malaysia, Thailand and Vietnam.

As of the latest quarterly report, Top Glove’s revenue increased by 14.2% to MYR 4.13 billion. Its net profit increased substantially by 96.9% to MYR 577.8 million. Free cash flow came in at a strong level of MYR 1.2 billion. As a result, cash balance of the company almost doubled to MYR 347.8 million.

Top Glove has a 5 years average P/B of 4.37 and currently has a P/B of approximately 13.22.

It also has a 5 years average P/E of 25.7 and a current P/E ratio of about 91.43.

Average dividend yield for the past 5 years was 1.80%, while current dividend yield is roughly 0.62%.

Compared to its historical ratios, Top Glove has a rich valuation currently. Even though demand for gloves have increased, there is a limit to the supplies as the production capacity of the company is near its max. This certainly limits the growth of the company.

Top Glove last closed at $7.50, which values it at a P/E ratio of 91.43x and dividend yield of 0.62%.

Glove Stock#2 UG Healthcare

UG Healthcare is a disposable gloves manufacturer with its own established global downstream distribution. It markets and sells disposable glove products under its proprietary “Unigloves” brand. It has presence in USA, Nigeria, Shanghai, Europe, Brazil and China. Its manufacturing facilities are in Malaysia.

As of the latest quarterly report, UG’s revenue increased by 28.5% to $53.2 million. Its net profit decreased by 71.4% to $306,000. Free cash flow was at a negative value of $ 3.91 million. Cash balance of the company is at a healthy level of $3.9 million.

UG has a 5 years average P/B of 1.26 and currently has a P/B of approximately 7.57.

It also has a 5 years average P/E of 14.8 and a current P/E ratio of about 176.

Average dividend yield for the past 5 years was 1.1%, while current dividend yield is roughly 0.2%.

Compared to its historical ratios, UG has an extremely high valuation. Moreover, the company has negative free cash flow, which could mean that it must take on more debt or secondary offering of shares to plug its cash. Also, since it still a relatively small glove manufacturer, it might not be able to fully capture the upswing of the demand for gloves.

UG last closed at $1.64, which values it at a P/E ratio of 176x and dividend yield of 0.2%.

Glove Stock#3 Hartalega Holdings Bhd

Hartalega Holdings Berhad is principally involved in the manufacturing and sale of latex and nitrile gloves for manufacturing, healthcare and laboratory sectors. The Group is currently the largest nitrile glove producer in the world. It has 8 manufacturing facilities and workforce of roughly 7800 people.

As of the latest annual report, Hartalega’s revenue increased by 4.4% to MYR 2.92 billion. Its net profit dipped slightly by 4.2% to MYR 435 million. Free cash flow was at an impressive level of MYR 655 million. As a result, cash balance of the company almost doubled to MYR 304 million.

Hartalega has a 5 years average P/B of 11.5 and currently has a P/B of approximately 22.72.

It also has a 5 years average P/E of 60.7 and a current P/E ratio of about 133.

Average dividend yield for the past 5 years was 0.965%, while current dividend yield is roughly 0.44%.

Compared to its historical ratios, Hartalega has a higher than average and rich valuation. Even though it is the biggest nitrile gloves manufacturer in the world, the same supply constraints persist for Hartalega. Moreover, its net income dropped slightly which implies that costs control wise it may not be as astute as Top Glove.

Hartalega last closed at MYR 17.1, which values it at a P/E ratio of 133x and dividend yield of 0.44%.

Conclusion – More Potential Upside for Glove Stocks

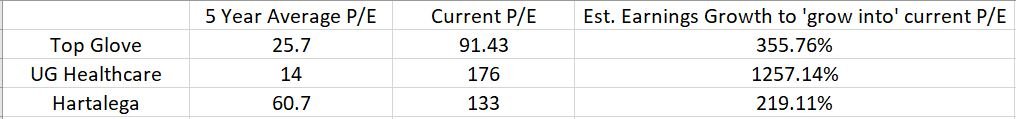

Based on the picture above, UG Healthcare has to grow its earnings 12x to justify the premium that it is getting right now.

Analyst report from Philips Securities has shared that ex-factory spot prices for nitrile gloves have skyrocketed from US$25 to US$120 per 1,000 pieces. Translating into a 480% just based on average selling prices itself.

And UG Healthcare would need another ~260% increase in sales volume to ‘grow into’ its current P/E. For the other 2 glove makers, it does seem that they have more room for growth if the glove prices are already converting into a 4.8x increase in EPS from the usual norm.

That said, investors would have to assess if this is a sustainable thing over the long run and make necessary assumptions as well.

“Want to stay in the loop for top ideas and exclusive content, subscribe to our FREE newsletter here.”