In response to our survey, a few readers have requested for us to write on Evergreen Fiberboard (KLSE: EVERGRN). You can access the survey here!

A quick look at this company shows that this stock has been undergoing a downtrend since 19 May 2017. As of 2 June 2017, it has experienced a 9.7% drop in its price! With such drop in a short span of 2 weeks, what does this stock has in store for us?

Evergreen Fiberboard’s Profile

Let’s start off by looking into the company’s businesses.

Evergreen Fibreboard engages in the manufacture of medium-density fibreboard and Particleboard with an annual production exceeding 1.3 million cubic meters.

Medium-density fibreboard is an engineered wood composite board that is an alternative to solid wood and plywood. It is mainly used to produce furniture, speaker boxes and doors.

The company’s businesses run in Malaysia, Thailand, Indonesia and Singapore.

Why the Drop in Stock Price?

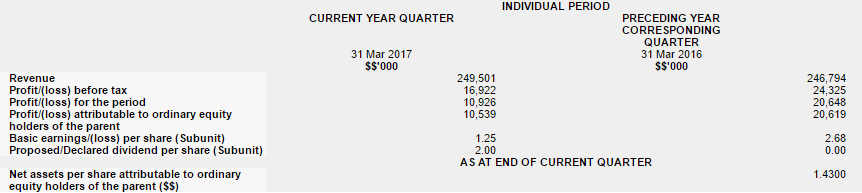

Based on its latest financial results, its net profits suffered a 30% drop from RM24.3 million in 1Q2016 to RM16.9 in 1Q2017. This is mainly attributed to an increase in costs.

As a result, earnings per share for the period has also fallen drastically from 2.68 to 1.25. That translates to a year-on-year decrease of 53.4%!

To add on to the negative outlook, its cash and cash equivalents pool has depleted by 14.6% since Dec 2016. This is attributed to a huge drop in working capital this quarter.

Despite the drop, its cash pool currently stands at RM137 million, sufficient to cover its short-term debts of RM107 million.

Growth Prospects

Notwithstanding its latest underperformance, the company has been working hard to expand its particleboard manufacturing capacity to target demand for raw material used in lower-end furniture.

It also aims to materialize a second automated production line for its ready-to-assemble furniture products in 2017 to diversify its businesses. You can read more from the article here.

All these expansion projects will kick-in during the second half of 2017, which will provide the company with additional income streams.

Furthermore, the company is expecting a significant drop in its capital expenditure this year. This is because most of the investment costs are already accounted for in the previous 2 years.

All in all, the company cites a “slight improvement” in its financial results compared with the previous year. Evergreen Fibreboard has a P/E ratio of ~11, which is relatively on par with its competitors. It offers an estimated dividend yield of 4.8%.

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!