The Singapore stock market has always been a haven for dividend investors. There is a number of stocks listed on the exchange that pay out quarterly dividends allowing investors to enjoy a constant stream of steady passive income.

Such companies make for great long-term investments as you will be able to receive income every quarter. Here are 4 Singapore stocks paying out quarterly dividends that you may wish to include in your buy watchlist.

DBS Group Holdings

DBS is a leading financial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia.

DBS is the only listed bank that pays out quarterly dividend. In fact, The bank declared a whopping 54 cents dividend for the quarter ended 31 Dec 2023 and proposed a 1-for-10 bonus issue. The management added that annualised ordinary dividend going forward will be $2.16 per share over the enlarged share base.

DBS CEO added that while interest rates are expected to soften and geopolitical tensions persist, DBS franchise strengths will put them in good stead to sustain performance in the coming year.

Hence, DBS is one of the 4 Singapore stocks paying out quarterly dividends. You can view the bank website here.

Singapore Technologies Engineering

ST Engineering is a global technology, defence and engineering group with offices across Asia, Europe, the Middle East and the U.S., serving customers in more than 100 countries.

The Group uses technology and innovation to solve real-world problems and improve lives through its diverse portfolio of businesses across the aerospace, smart city, defence and public security segments.

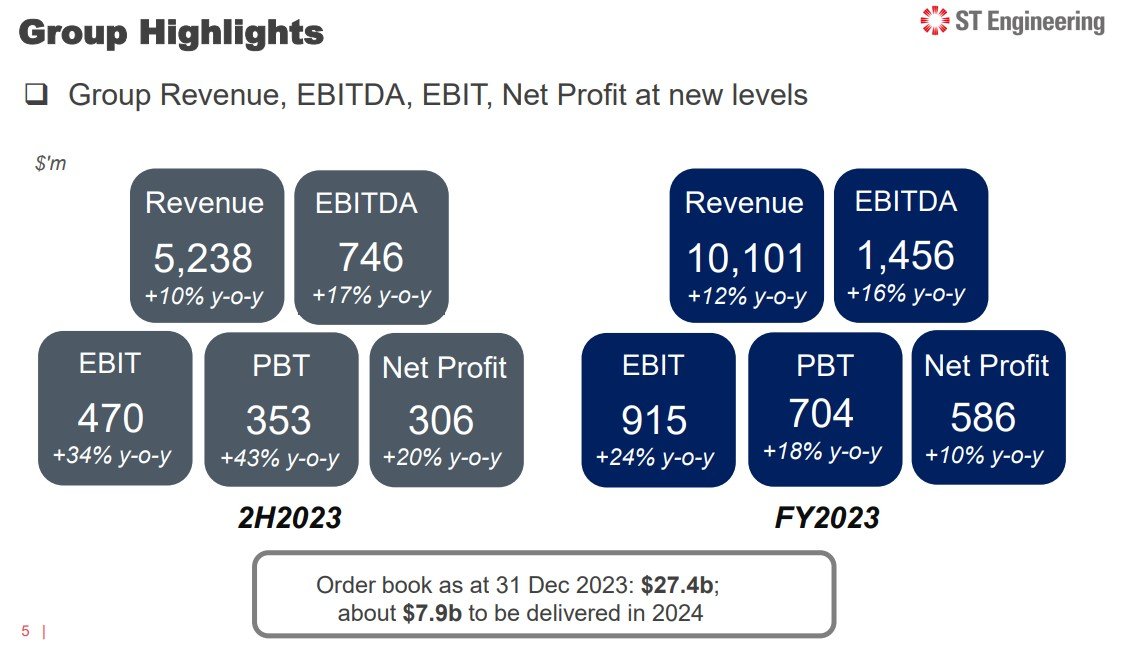

In its full year results ended 31 Dec 2023, revenue is up 12% to S$10.1 billion while net profit is up 10% to S$586 million. The company declared a final dividend of 4 cents per share for the quarter bringing total dividends of 16 cents per share for FY2023.

With is strong order book of S$27.4 billion and recovery in air travel, ST Engineering is poised to continue giving out quarterly dividends to shareholders. You can view the company website here.

Singapore Exchange

Singapore Exchange (SGX) is Asia’s most international, multi-asset exchange, providing listing, trading, clearing, settlement, depository, data and index services, with about 40% of listed companies and over 80% of listed bonds originating outside of Singapore.

In its half year results ended 31 December 2023, SGX reported revenue increased by 3.6% to S$592.2 million. Adjusted net profit increase by 6.2% to S$251.4 million. The company declared an interim quarterly dividend of 8.5 cents per share.

Mr Loh Boon Chye, CEO of SGX commented that “the year ahead could see muted global economic growth and geopolitical concerns that may affect market sentiment and risk appetite.

Nonetheless, the resilience of SGX multi-asset strategy as well as healthy financial position and discipline will enable SGX to capitalise on conditions across cycles.

SGX being a monopoly exchange in Singapore should be able to continue giving quarterly dividend going forward. You can view the company website here.

UMS Holdings

UMS is another one of the 4 Singapore stocks that pays quarterly dividends. UMS is a precision engineering group which specializes in manufacturing high precision front-end semiconductor components and perform complex electromechanical assembly and final testing services.

Included in its core business is the production of modular and integration systems for original semiconductor equipment manufacturers

For FY2023, UMS reported revenue decreased by 19% to S$299.9 million while net profit decline by 40% to S$61.1 million. The company declared final dividend of 2.2 cents bringing total dividends of 5.6 cents for FY2023. UMS has been giving quarterly dividend since 2016!

On the company’s growth prospects ahead, the management is optimistic with the completion of new production facilities in Penang, UMS is well poised to capture new growth opportunities on the horizon.

Future growth will continue to be powered by UMS twin growth engines – Semiconductors – which will benefit from new tech innovations and the AI boom – and Aerospace as global air travel trends extend their strong rebound. You can view the company website here.

Conclusion

The abovementioned are the 4 Singapore stocks paying out quarterly dividends. Investors need to do due diligence before investing in these stocks.