High returns on equity? Are these companies generating their profits efficiently?

2023 has been a volatile year for global equity markets. From concerns about the sustainability of China’s reopening to a global recession, investors are retreating from high-risk, high-growth stocks and looking for companies that can generate efficient profits.

Screening for large-cap stocks with high returns on equity is one of the ways that could help investors determine that. Returns on equity are defined as net profit divided by the shareholder’s equity.

Furthermore, these companies must also have market capitalization considering their ability to withstand uncertainties.

Hence, here are 4 Malaysian large-cap companies with high returns on equity!

#1 Press Metal Aluminum (Bursa: 8869)

Press Metal Aluminum (PM) is currently generating a return on equity of 26.8%, compared to its 5-year average of 21.2%.4 Malaysian Stocks that Have High Returns on Equity

PM mainly produces aluminum products for the local market and exports them to other regions such as Southeast Asia, China, Australia, Europe, and the Americas.

Smelting and extrusion remain the main segment for PM, encompassing 89% of total revenue followed by trading at 8%.

Smelting is the process in which PM produces the basic aluminum ingot and other value-added products such as alloy ingots, aluminum billets, and wire rods.

Meanwhile, extrusion is the process by which aluminum alloy materials are heated and pushed through a shaped die opening.

PM’s financial performance has been stellar, with revenue doubling from RM7.5 billion in 2020 to RM15.7 billion in 2022.

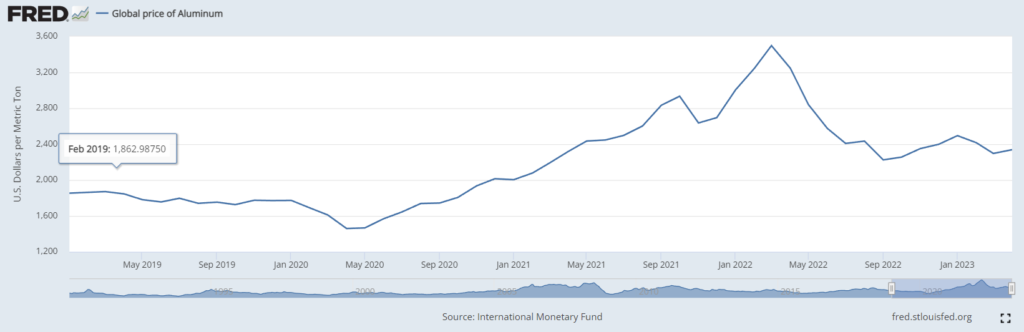

This was driven by higher global aluminum prices, as it rose by 50% to an average of US$2,596 in 2021 and 2022 from US$1,730.

On another note, profit margins have also almost doubled to 9.0% in 2022 from 5.4% in 2019 (pre-pandemic) and this might be the main reason for its high returns on equity.

PM can best be characterized as a manufacturing company that gets more efficient the more revenue it generates – PM is scalable past a certain level.

PM would always need to incur a fixed amount of capital and operational expenditures (repairs, maintenance, salaries, rent, renovations, additions) on its assets (factories and equipment mainly) every year no matter what. Any level of revenue that covers these costs and exceeds it would generate more efficient profits.

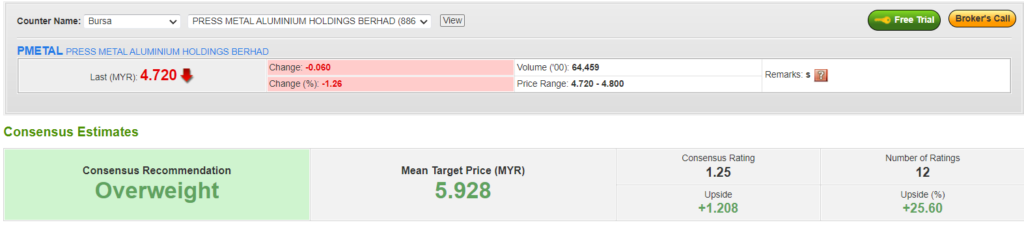

Market analysts have an OVERWEIGHT investment call with an average target price of RM5.93.

This implies a total upside of 26.9% with a capital gains upside of 25.6% and a current dividend yield of 1.3%.

#2 Mr D.I.Y Group (Bursa: 5296)

The return on equity for Mr D.I.Y (MR D.I.Y) stands at 36.2%, with a market capitalization of RM15 billion.

MR D.I.Y is a home improvement retailer which mainly sells household and furnishings, stationery, sports equipment, hardware, electrical and other products (toys, car accessories, cosmetics, food & beverage).

It operates under 3 separate brands which include its flagship

- Mr D.I.Y

- Mr Toy &

- Mr Dollar

Most of its revenue is derived from Malaysia at 99.6%, with a small operation in Brunei (0.4%).

Being a recession-proof company, MR D.I.Y’s revenue continued to grow for 3 consecutive years from RM2.2 billion in 2019 to RM4.0 billion in 2022. Profits have also grown by 49% from RM318 million to RM473 million over the same period.

Its strong performance can partly be attributed to increased consumer spending on home improvement products during the pandemic. While returns on equity have been steadily declining, it remains quite high due to its ability to keep its cost structure relatively low.

MR D.I.Y’s main costs involve the rental of brick-and-mortar stores, salaries of employees, and raw material costs. MR D.I.Y normally negotiates for longer-term rental tenures considering its plans to expand aggressively in the next few years.

Meanwhile, employee salaries and benefits proportion to revenue remains low at 12% in 2022, as most of MR D.I.Y’s employees are involved in lower-cost jobs such as administration, storekeeping, and others at stores.

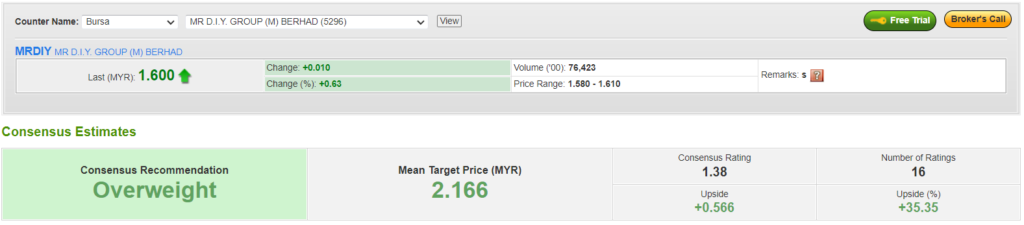

Market analysts have MR D.I.Y at an OVERWEIGHT call, with an average target price of RM2.17. This implies a total upside of 36.9% with a capital gains upside of 35.4% and a current dividend yield of 1.5%.

#3 Westports Holdings (Bursa: WPRTS)

Westports Holdings (WH) registered a return on equity of 23.7%, with a market capitalization of RM12.8 billion.

WH develops and manages port operations in Malaysia, with its main seaport located in Port Klang, Selangor. WH’s main business is still concentrated on handling the movement of the gateway and transshipment container boxes, encompassing 86% of its revenue.

In terms of financial performance, WH’s revenue grew by 10.8% during 2020 amid the pandemic even when Malaysian exports growth declined by 1.1%. Subsequently, as export activities improved to a growth of 26.1% and 25.0% respectively in 2021 and 2022, WH’s revenue also grew by an average of 2.4%.

Furthermore, high container freight rates in 2021 and 2022 also supported the higher revenue of WH.

In terms of efficiency, WH’s profit margins are high at an average of 35.6% in the last 3 years.

Similar to Press Metal, WH is a scalable business with higher capacity utilization (more export activities) translating into more efficient profits.

In the market, most analysts have WH at an OVERWEIGHT investment call and an average target price of RM3.89.

This implies a total upside of 5.6%, with an upside of capital gains of 1.7% and a current dividend yield of 3.9%.

#4 7-Eleven Malaysia (Bursa: 5250)

7-Eleven Malaysia (7E) recorded a high return on equity of 61.0%, with a market capitalization of RM2.2 billion. 7E mainly manages and operates convenience stores in Malaysia, with more than 2,400 stores nationwide.

Furthermore, 7E’s business segments can be broadly divided into two main ones – convenience stores (66% of revenue) and pharmaceuticals (34% of revenue).

Both the revenue and profits of 7E have grown at a strong rate of 48.3% and 138.6% respectively during the pandemic from 2020 to 2022.

The high return on equity of 7E can be explained by the high use of debt instead to fuel its growth. From 2019 to 2022, long-term borrowings more than doubled from RM556 million to RM1.2 billion. Hence, the long-term debt-to-equity ratio stood at a high 4.8 times in 2022.

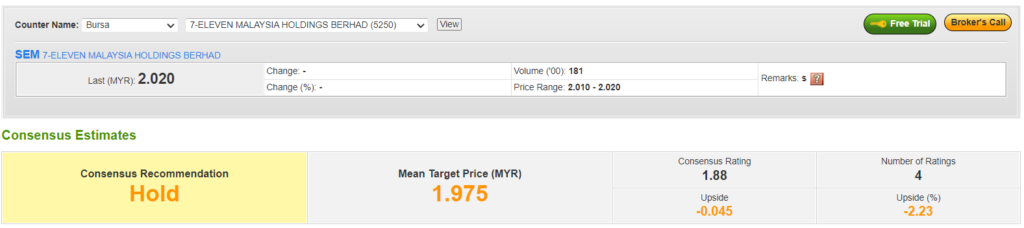

From the market perspective, 7E currently has a NEUTRAL investment call, with an average target price of RM1.98. The dividend yield stood at 2.6%.

Conclusion

In this time of uncertainty, it’s time to look for large cap stocks that have high efficiency in generating their profits.

These 4 Malaysian companies could be a starting point for you if you are looking to be more defensive during this period.

[…] Source link […]