As Warren Buffet said, when the market is selling, it’s time to get buying.

One good way to hunt for potential bargains is to look at stocks trading near their 52 week low and examine whether they have solid fundamentals to help their share price rebound in the long run.

Without further ado, here are 4 little-known stocks trading at their 52-week low that we have dug out of:

#1 Fraser and Neave

Known affectionately as F&N to many of us for their soft drinks, Fraser and Neave (F&N) is currently trading at a share price of around SGD1.09 compared to its 52-week low of SGD1.06.

F&N sells mainly beverage and food products such as soft drinks, beer, dairy, juices, and ice cream. Notable brands include 100 plus, Magnolia, F&N Seasons, Sunkist, and Oyoshi.

Revenue growth has been pretty stable in the past 2 years, growing by 8.2% and 3.6% in 2021 and 2022 respectively despite Covid. However, it is the profits that have been rather disappointing, as its 1QFY2023 declined by 28.8% YoY to S$28.6 million from S$40.2 million in the corresponding period a year earlier due to higher input costs.

F&N has a BUY call currently and could be worth looking at for the following reasons:

- Resilient to recessions as a consumer stock. F&N did not make a loss during the pandemic.

- Quite diversified in the consumer industry with multiple product offerings.

- Established market presence in Singapore and Malaysia.

The group had cash of S$345.1 milllion as at Dec 31, 2022, while borrowings stood at S$1.09 billion. F&N had total equity of S$3.4 billion, with gearing at 21.6 per cent, and the group noted it has “generous debt headroom for acquisitions”.

To wrap up, F&N is currently trading at a price-to-earnings ratio of 12.5x ttm, lower than the historical average of 18.0 times. Dividend yield is at 3.2% currently, higher as compared to to the consumer staples industry at 1.6%.

#2 Ho Bee Land Ltd

Ho Bee Land Ltd is trading at a share price of SGD2.23, near the 52-week low of SGD2.21. It is a far cry from its 52-week high of SGD3.08, dating all the way back to March 2022.

Ho Bee Land is a real estate company, where its portfolio consists of residential, commercial, and industrial properties. It primarily operates in Singapore, Australia, China, the U.K, and Europe.

Ho Bee Land’s financial performance has actually been quite impressive in the past couple of years. Revenue actually doubled from SGD212.4 million in 2019 (before the pandemic) to SGD 435.6 million in 2022. Meanwhile, profits unfortunately did not follow this track record, as it declined from SGD331.3 million to SGD167.1 million over the same period.

The latest analyst report shows a BUY call from analyst with an average target price of SGD3.80. This implies a whopping upside of over 60% from the current share price.

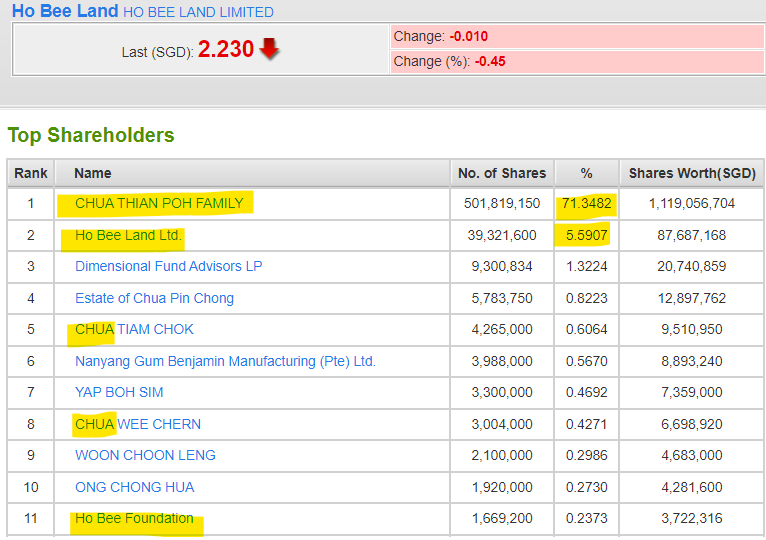

In addition, Ho Bee remains a “palatable candidate” for privatisation, given the Chua family’s 76% substantial stake and attractive valuation at 0.38x FY2022 P/B and dividend yield of ~3.0%.

#3 China Everbright Water Limited

China Everbright Water Limited (CEWL)’s share price currently stands at SGD0.22, which is not far from as its 52-week low. It has breached its previous low of SGD0.23 a couple of weeks ago, and is now trading at close to its pandemic low at SGD0.20.

CEWL is based in China, and is mainly involved in the water environment management business. It engages in sponge city construction, river-basin ecological restoration, waster water treatment, and water environment technologies.

Similar to F&N and HBBE, CEWL’s financial performance has also been quite steady during the pandemic. Its revenue grew by 24.7% from SGD960.8 million in 2019 to SGD1.2 billion in 2021.

However, lockdown restrictions in 2022 hasn’t been kind for CEWL as its revenue declined by 3.2%. The same can be said about its profits too, where it declined by 17.3% to SGD183.9 million in 2022.

In the long-term, China Everbright Water Limited could be a worthy investment opportunity:

- The recent drought in September and October 2022 has increased the demand for water supply restoration projects in China.

- High dividend yield of 8.8% in FY2021 which could be repeated again because the dividends paid in FY2022 is reduced due to China’s lockdowns.

- Low P/B of 0.32x.

CEWL seems to be neglected as there is a social stigma with Chinese stocks and how the operations work. Hence, a rebound can likely occur if the financials start to show promise again.

#4 Japfa Ltd

Japfa Ltd (Japfa) is trading at SGD0.24, pretty close to the 52-week low of SGD0.215. This has even breached the lowest level since 2015 where it traded at SGD0.25.

Japfa is involved in the agri-food industry where it produces poultry, beef, swine, aquaculture, dairy, and packaged foods. Its main operations are in Indonesia (67% of revenue), Vietnam (15%) , and China (12%).

In terms of financial performance, Japfa’s has been mixed. Revenue only declined by about 3.0% in 2020 during the pandemic, but its profits saw a big jump of 96.4% due to the one-off gains.

In 2022, as prices of fertiliser and animal feeds increased amid the Russia-Ukraine conflict, Japfa suffered an erosion in its profit margins, as it declined from 4.6% in 2021 to as low as 1.4% in 2022.

Hence, Japfa currently only has a NEUTRAL investment call, with an average target price of SGD0.29, implying an upside of about 32.2%.

Nevertheless, there are some investment merits in the stock Japfa.

Firstly, prices of fertilizers and animals feeds have declined from their peaks in 2022, potentially leading to higher profit margins. As countries over the world want to secure their own food supply, this bodes well for Japfa in the long run.

Renaldo Santosa, Japfa’s executive director, has acquired 500,000 shares at an average price of S$0.24 per share. This increased his total interest in the pure play animal protein producer from 60.70 per cent to 60.72 per cent.

He is the son of Handojo Santosa, the company’s executive chairman, who passed away last September, and grandson of the family patriarch, Ferry Teguh Santosa.

Analysts have recently downgraded Japfa following weaker than expected earnings. While revenue grew, costs went up by a bigger magnitude. Coupled with prospects of a prolonged industry downturn, investors ought to brace for lower chances of a quick recovery.

Japfa’s share price has declined by a steep 36.2% since the beginning of the year, possibly due to its low profit margins for 2022. It is currently trading at a price-to-book ratio of 0.44 times compared to the consumer staples industry average of 1.5 times.

Conclusion

The recent volatility in the global markets including Singapore, has created numerous opportunities for investors to invest in companies that have solid long-term fundamentals.

Futhermore, these little known stocks can benefit from the re-initiating of the analyst coverage once their business activities pick up and share price also increase in line too.