Since the start of 2024, the market sentiment has not been kind to REITs. As at 19 Feb 2024, the FTSE REIT has fallen from 727.04 points to 676.39 points representing a decline of 6.96%.

I will not mention the US office REITs in this article as these REITs have been beaten up badly this year and will continue to remain badly bruised for a long time to come.

A beaten up REIT that may represent potential bargain is when it still shows steady DPU and tailwinds in the macro outlook.

Many of the US REITs has deep discount to NAV. However, as I have always mentioned in my articles on REITs, NAV or PB should never be used as a factor to buy a REIT or else investors could suffer losses by using NAV as a metric to buy REITs.

We now focus on 3 beaten up REITs that has declined more than the FTSE Index and could represent bargains to add to your watchlist.

Mapletree Logistics Trust

Mapletree Logistics Trust (MLT) share price has declined by more than 11% year to date faring worse than the FTSE REIT index. Many investors will be scratching their heads wondering despite having the brand name Mapletree, it is among the worst performer in share price.

MLT has been very active in acquisition and divestments of properties recently. This may not benefit shareholders especially their acquisition of 12 logistics assets in China in 2022.

The China assets is now facing a challenging leasing environment and thus affecting MLT share price.

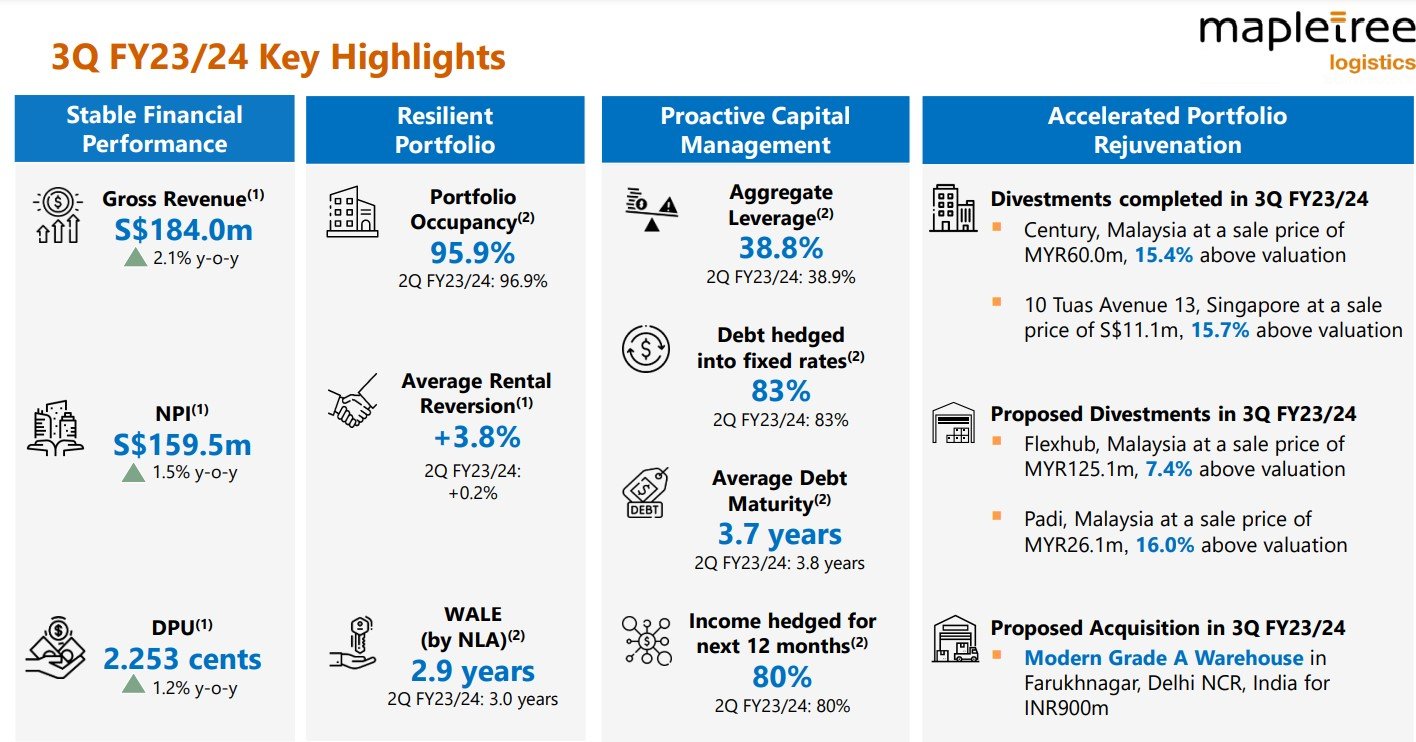

Nonetheless, MLT has a good track record of increasing their DPU and this may present a bargain at current price. In its latest 3Q FY23/24 results, MLT present a decent set of results.

Net property income is up 1.5% to S$159.5M while DPU increase by 1.2% to 2.253 cents. Portfolio occupancy remains high at 95.9% with average positive rental reversion of 3.8%.

Gearing ratio is still manageable at 38.8% with 83% of debts hedged into fixed rates. Given that MLT still sees steady leasing demand across most of MLT’s markets except China and given MLT track record of increasing its DPU, this beaten up REIT could be a bargain.

You can view the REIT website here.

Keppel DC REIT

Keppel DC REIT (KDC) share price has declined by more than 9% year to date far worse than the decline in FTSE index. The decline in share price was mainly due to the uncollected rental and coupon income of ~5.5 months and recoveries at the Guangdong DCs.

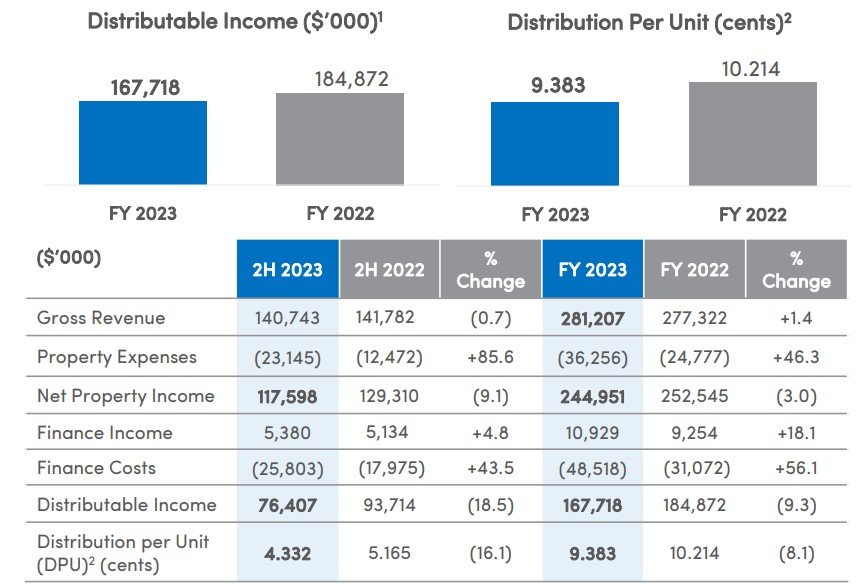

In its full year results ended 31 Dec 2023, KDC second half net property income decline by 9.1% to S$117.5 million while DPU decline by 16.1% to 4.332 cents.

The decline in DPU was mainly due to the non-payment of rent by the China DCs and higher finance costs resulting in the decline in share price. Gearing ratio remains healthy at 37.4% and interest cover is at 4.7 times.

Given the rapid growth of artificial intelligence along with other modern technologies, such as streaming, gaming and autonomous driving. It is expected to underpin continued strong data centre demand.

This will spur innovations in data centre design and technology as operators aim to deliver the capacity to meet the increased power density requirements of high performance computing.

Hence, with the tailwinds expected in demand for data centres, KDC could be one of the beaten up REIT that could be a bargain. You can view the REIT website here.

CapitaLand Ascendas REIT

CapitaLand Ascendas REIT (CLAR) share price has drop more than 8% year to date. It is surprising that the biggest REIT in terms of market cap has underperform the FTSE REIT index.

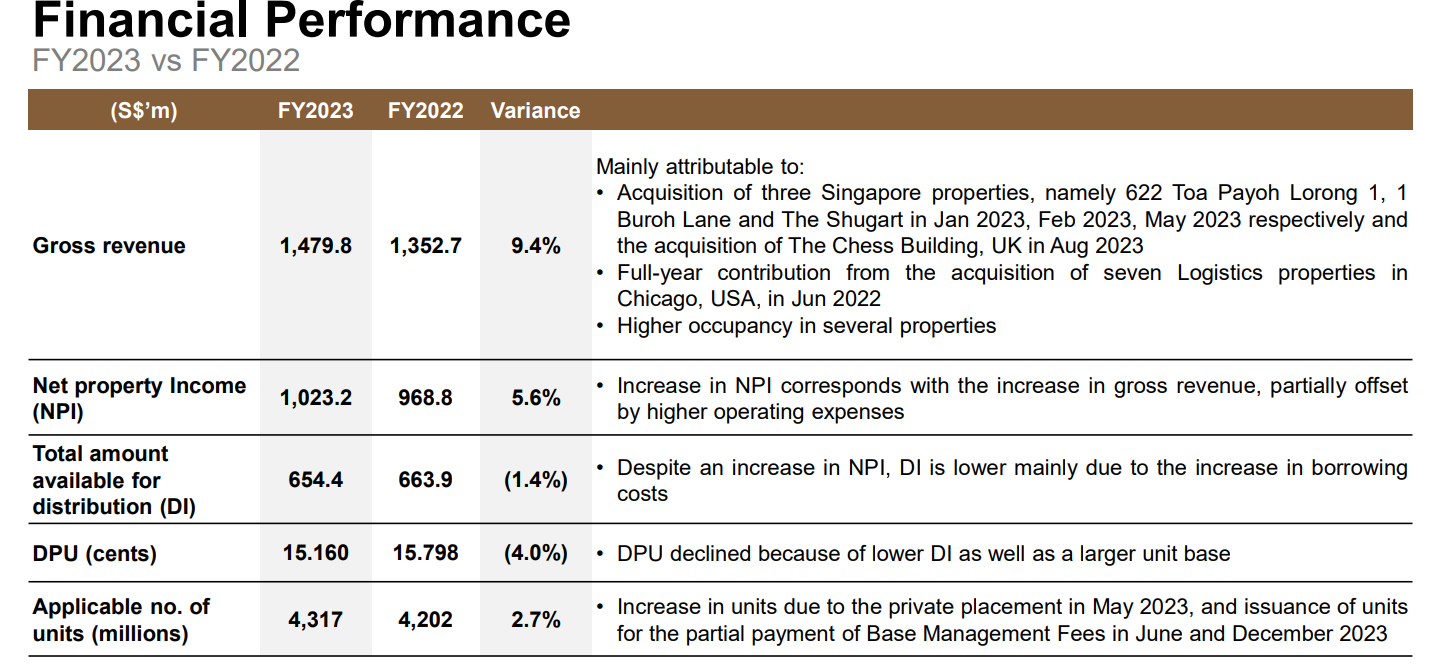

In its FY2023 results, CLAR reported net property income increase by 5.6% to S$1023.2 million while DPU declined by 4% to 15.16 cents due to enlarged unit base. Rental reversion is a positive at 13.4%

Gearing ratio remains healthy at 37.9%. 79.1% of the total debt is on fixed rates. This is especially important if interest rates were to remain elevated for a long time. Interest cover remains healthy at 3.9x with average debt maturity at 3.4 years.

Despite the uncertain outlook for inflation, geopolitical tensions, and risk of faltering growth in China, the REIT will remain nimble and proactively reshape CLAR’s financial and portfolio management in response to changing market and tenant requirements.

Conclusion

These are the 3 beaten REITs that has fallen more than the FTSE REIT index and could present bargains for investors to add these 3 REITs to their watchlist. However, given the uncertain economic outlook, investors need to do their due diligence before investing.

You can view the REIT website here.