After a year of hard work, many investors would have received bonuses in their employment. Armed with this amount of money, where should you invest this money?

One group you can look at are REITs which are prized for their reliability and dividends. These REITs can potentially provide investors with a solid mix of capital gains and passive income.

Here are 3 attractive Singapore REITs to buy with your year end bonus.

ESR-Logos REIT

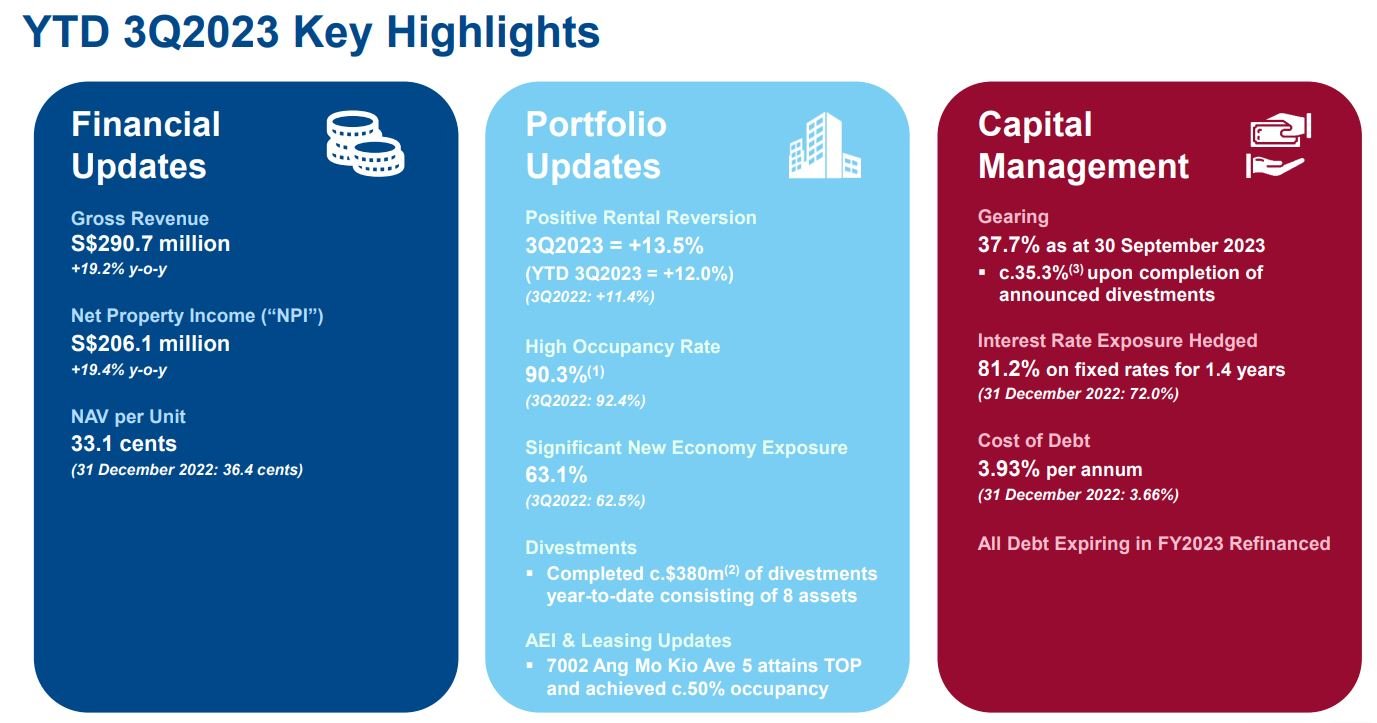

I first mentioned in this article here. In their last business update, net property income increase by 19.4% to S$206.1 million while NAV dropped slightly to 33.1 cents. Rental reversion was a positive double-digit of 13.5% which is remarkable in this economic climate.

Gearing is at 37.7% after a series of divestments of non core assets to reduce their gearing. 81.2% of the debt are on fixed rates while portfolio occupancy is 90.3%.

With a significant reduction in gearing together with a double-digit rental reversion, we could see a potential increase in the DPU and hence the share price.

ESR-Logos REIT is also positioning for its next growth phase with its 4R Strategy which is to rejuvenate asset portfolio, recycle capital, recapitalise for growth and reinforce sponsor commitment. You can view the REIT website here.

Mapletree Logistics Trust

Mapletree Logistics Trust (MLT) just announced its results on 24 Jan 2024.

Net property income is up 1.5% to S$159.5m while DPU is up 1.2% to 2.253 cents. Portfolio occupancy is still respectable at 95.9% with average rental reversion of 3.8%.

Gearing is still relatively healthy at 38.8% with 83% of their debts are on fixed rates. The REIT will continue to focus on accelerating its portfolio rejuvenation strategy through accretive acquisitions, asset enhancements and selective divestments.

It will also optimize its performance so as to maintain its steady distribution to shareholders. You can view the REIT website here.

Mapletree Industrial Trust

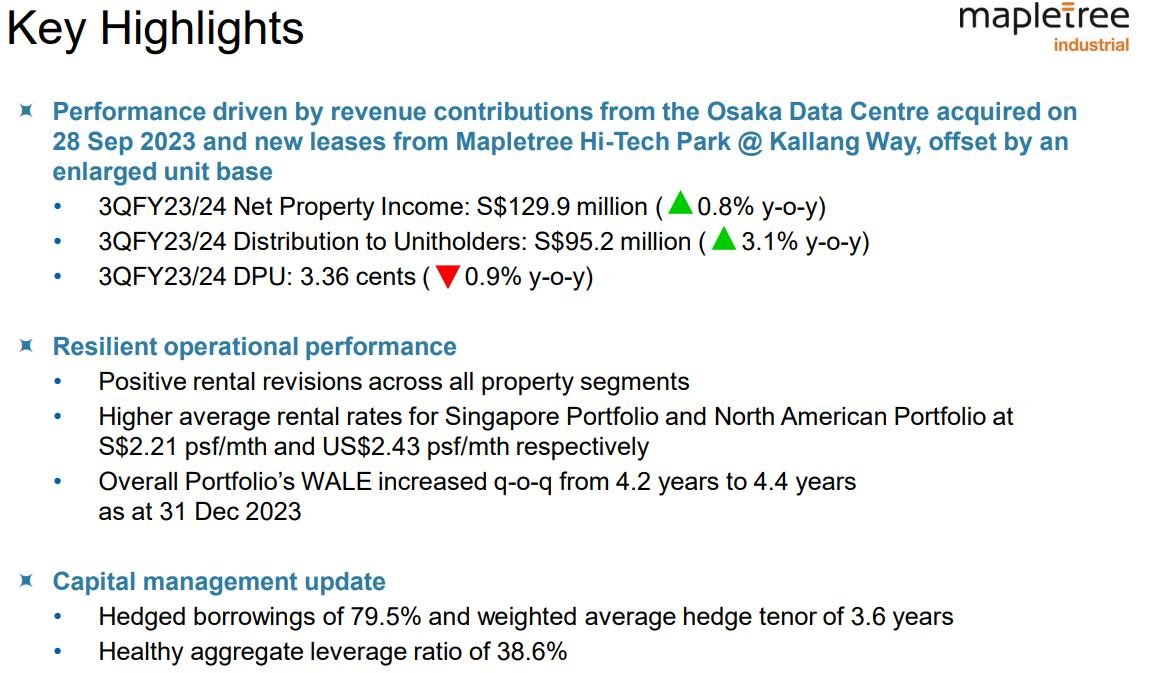

Mapletree Industrial Trust just announced its 3QFY23 results on 25 Jan 2024.

Net property income is up 0.8% to S$129.9M while DPU is down 0.9% to 3.36 cents. The REIT reported positive rental reversion across all property segments with portfolio occupancy of 92.6%. 79.5% of their borrowings are hedged.

The REIT maintained a healthy gearing ratio of 38.6%. The REIT will maintain a stable and resilient portfolio which will be anchored by large and diversified tenant base with low dependence on any single tenant or trade sector.

The REIT will focus on tenant retention to maintain a stable portfolio occupancy so as to maintain stable DPU. You can view the REIT website here.

Conclusion

These are the 3 attractive Singapore REITs you can consider to buy with your year end bonus. Investors need to do their own due diligence before investing in any of these REITs.