Known as the “Oracle of Omaha,” Warren Buffett is one of the most successful investors of all time. He started investing at the age 11 (while i am still figuring out how to play my 1st computer game!) and first filed taxes at age 13.

Today, Buffett runs Berkshire Hathaway together with Charlie Munger and it owns more than 60 companies, including insurer Geico, battery maker Duracell and restaurant chain Dairy Queen. Amassing a wealth of more than US$60 billion, he’s promised to give away over 99% of his fortune and donated $3.4 billion in year 2018 itself.

There is much to say about Warren Buffett because of his diverse life experience and profound investment knowledge. In this article, we will cover 12 investing nuggets of wisdom from Warren Buffett.

1.”It’s better to hang out with people better than you. Pick out associates whose behavior is better than yours and you will drift in that direction .”

Have you ever heard of the phrase – “You are the average of the 5 closest friends”?

Yes, the concept is true. If you have the ambition of either making it big in your life like growing your business or investing successfully, don’t mix too much with people who pull you down.

Instead, hang out with people ahead of you. They show you the way and make you strive to keep your bar higher.

2. “Never depend on a single income, let your investments create the second source of income“

A quick look at the richest people in the world shows that most of them invests in something… Be it Properties, stocks or in their own businesses. Thus, if you are employed, it makes sense to generate a 2nd source of income aka. let money work for you.

3. “Don’t save what is left after spending but spend what is left after saving”.

When you set up a savings goal, you are more likely to hit the target. By saving only whatever that is left, you are setting up yourself to lose the battle since you will probably save much lesser as we all have unlimited wants.

4. “Risk comes from not knowing what you are doing. Don’t test the depth of water with both feet.”

An investor should always do his or her homework before taking calculated risks i.e. risk what you can afford to lose. Jumping into the water without any swimming experience is more risky than driving a sports car with 10 years experience of doing so.

5. “Never ask a barber if you need a haircut.”

Warren Buffett’s quote above pertains to the stock-brokers. If you ask them whether you need to buy/sell a stock, they would gladly ask you to do it because they earn from trading activity, not in-activity. As such, be it business or real-life, always take into consideration the motives of another person.

6. “Chains of habits are too light to be felt until they are too heavy to be broken.”

Famously shared to students in his friendly classroom-style lectures, Buffett understands how habits can end up harming a business leader. He warns against getting too comfortable and suggests, instead, that those in charge remain open to change.

7. “It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.”

In essence, it takes a long time to build an empire and its vital to have long term plans instead of focusing on the short term.

8. “You don’t have to swing at every pitch. The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot.”

Chanced upon a few stocks that are out of your radar? Then ignore them!

Warren Buffett has stayed away from the dot-com bubble simply because he don’t understand these companies and scooped up bargains from the aftermath when the bubble burst.

9. “If you buy things you do not need, soon you will have to sell things you need.”

This quote is more towards the “savings” part Warren Buffett think people should adopt. Many people are guilty of accumulating things they don’t need and getting rid of such behavior will enable you to work towards your retirement.

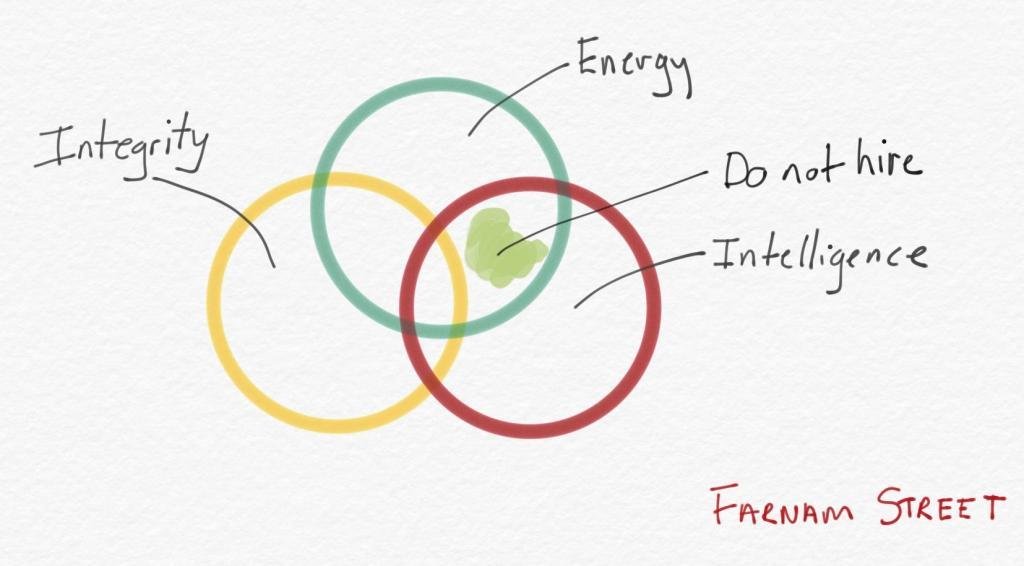

10. “You’re looking for three things, generally, in a person – Intelligence, Energy, and Integrity. And if they don’t have the last one, don’t even bother with the first two.”

Whenever Warren Bufffett goes to give a lesson to students, he would do a simple game with them. He asks each student to pick a classmate. Not just any classmate, but the classmate you would choose if you could have 10% of their earnings for the rest of their life. Which classmate would you pick and why?

“Are you going to pick the one with the highest IQ?” asks Buffett. “Are you going to pick the guy who can throw a football the farthest? The one with the highest grades? What qualities will cause you to pick them?”

Then he asks the students to take out a sheet of paper and list the positive attributes on the left and the negative ones on the right.

Turns out, the most useful qualities have nothing to do with IQ, grades, or family connections. People pick based on generosity, kindness, and integrity.

11. “There seems to be some perverse human characteristic that likes to make easy things difficult.”

In general, the finance industry thrives on making things difficult for the retail investors so that they are always one step ahead of them.

Thus, by making things easy – sometimes like buying an index fund or adopting value investing – you can sidestep all the fluff and concentrate on what’s important – making money.

12. “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price”

Warren Buffett mentioned the above quote in his 1989 Berskhire Hathaway Letter.

A “wonderful business” is able to consistently produce high returns on equity with little debt, and is able to grow that equity over time.

A fantastic example is Buffett’s investment in Coca Cola – a little more than $1B in 1987, and to this day, the dividends alone earn him more than half of that yearly.

While you’re at it, do you want to learn how to invest and compound your wealth steadily with your own system? You’re in luck because we have developed an Unique Investing System just for you via a simple 10-Step Checklist.

Simply click to DIY your one-and-only Investing System today!