On 30 May 2022, YX Precious Metal Bhd (YX) has launched its IPO at 28 sen a share.

You can find YX IPO Prospectus on Bursa Malaysia here – Part 1, Part 2, and Part 3.

Upon its listing, YX’s market capitalisation would be lifted up to RM 104.2 million. The closing date to this IPO subscription is set on 9 June 2022.

Here, we have summarized 8 key things that investors must know before investing.

#1 YX Precious Metal Profile

YX is an investment holding company where its subsidiaries are mainly involved in wholesaling, design, and manufacturing of gold jewelry to 300+ clients which consists of jewelry retailers, wholesalers, and manufacturers mainly in Malaysia and Singapore.

YX specializes in 916-gold jewelry inclusive necklaces, pendants, bracelets, anklets, bangles, rings, charms, and earrings.

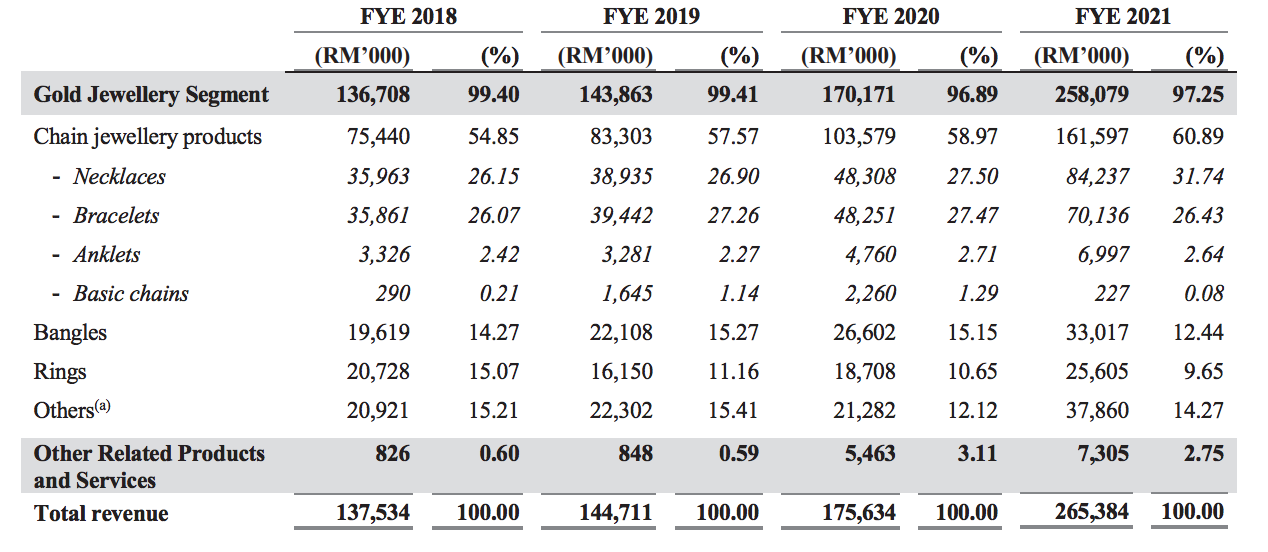

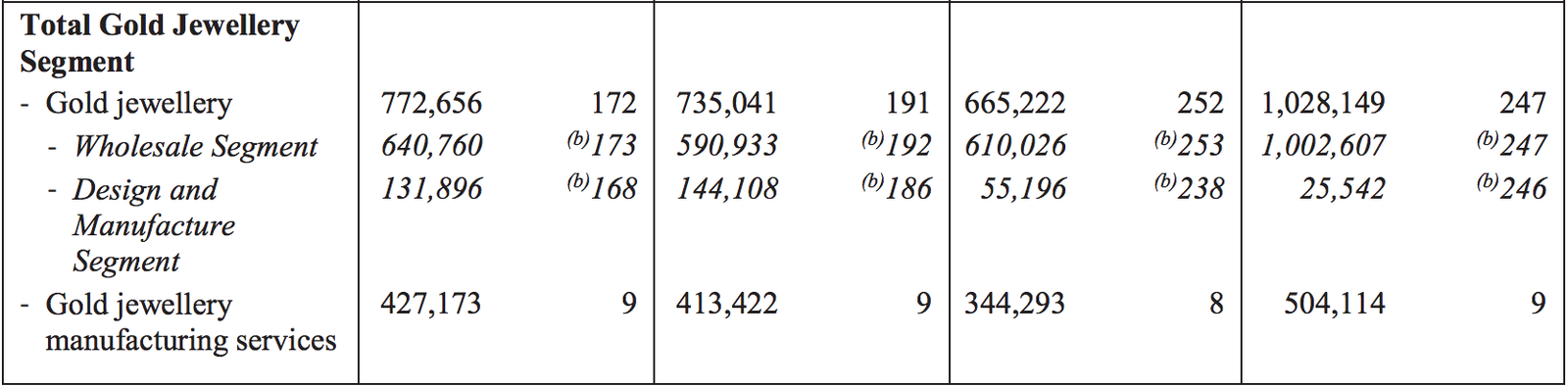

For the last 4 years, YX’s sales volume is summarized as below:

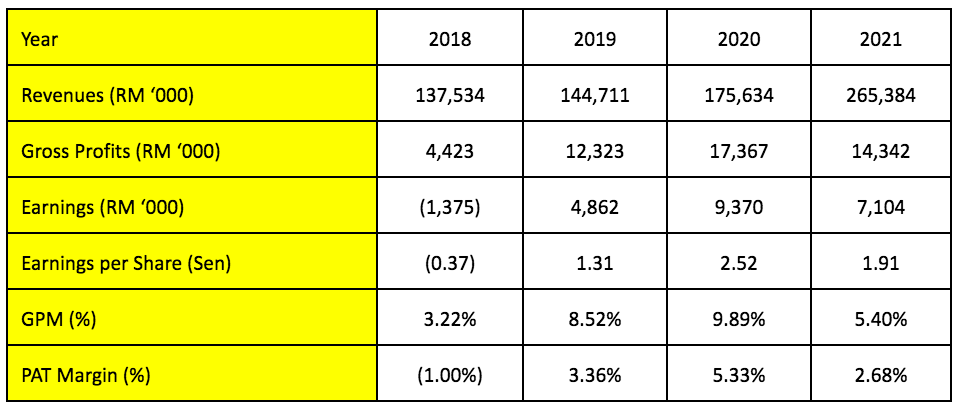

#2 Financial Results

In 2018, YX had incurred losses of RM 1.4 million. This is because YX’s average selling price of gold jewelry in 2018 was lower than its average cost of sales in that year.

Since then, YX had attained three consecutive years of profitability. Its profits in 2019-2021 were in line with YX’s increase in sales volume in that period.

After which, YX had reported RM 4.9 million, RM 9.4 million and RM 7.1 million in earnings from 2019 to 2021.

However, investors should be concerned about its paltry gross profit margin (GPM) and profit after tax (PAT) margin as they were below 10% throughout the period.

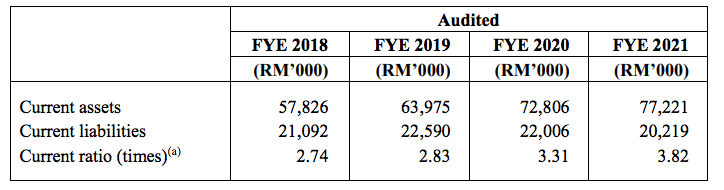

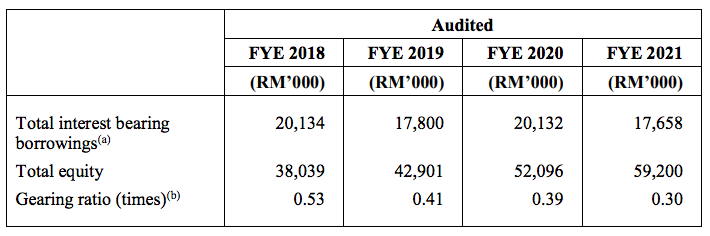

#3 Balance Sheet

YX maintained >1.0 in current ratio in 2018-2021. In the period, YX had lowered its gearing ratio from 53% in 2018 to 30% in 2021.

Source: Page 248 & 249 of YX’s IPO

#4 Utilization of IPO Proceeds

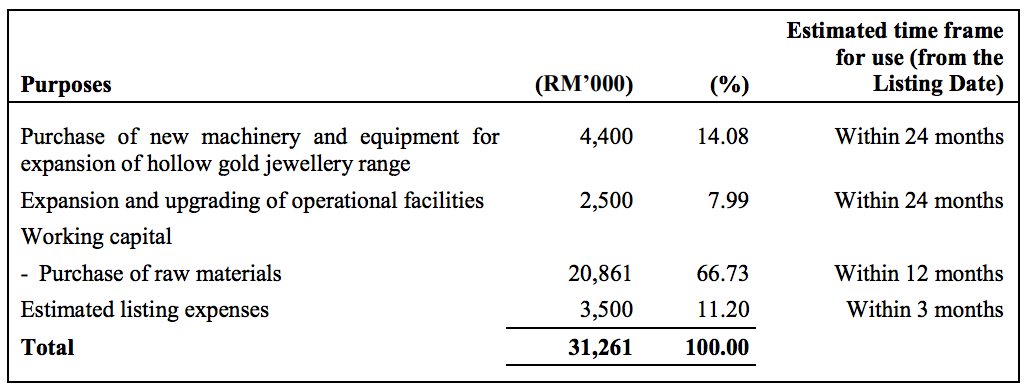

YX intends to raise RM 31.3 million in IPO Proceeds and it plans to use them:

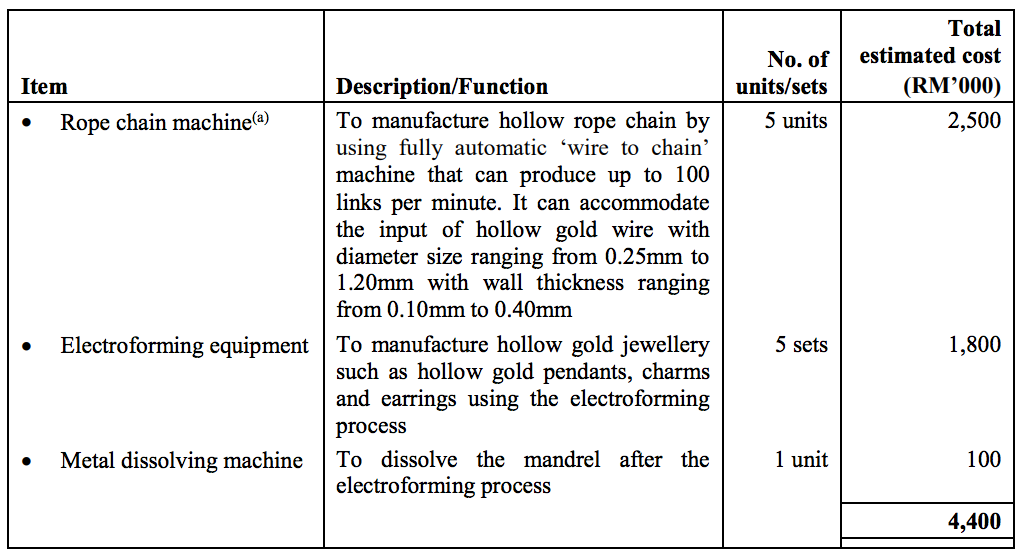

1. Expansion of Hollow Gold Jewelry Range (RM 4.4 million)

XY budgets RM 4.40 million to acquire a total of 5 units of rope chain machines, 5 sets of electroforming equipment and 1 metal dissolving machine.

To place its additional plant & machinery, XY plans to rent an additional factory which has a built-up size of around 1,600 sq. ft. within the vicinity of its current facility.

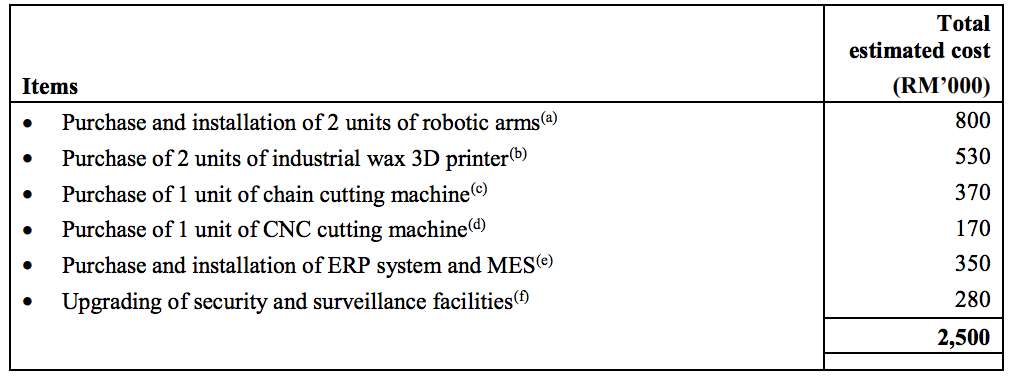

2. Expansion and Upgrading of Operational Facilities (RM 2.5 million)

They include:

3. Working Capital (RM 20.9 million)

This includes RM 16.7 million in purchases of pure gold bars and RM 4.2 million in purchases of scrap gold bars to expand its range of hollow gold jewelry.

4. Estimated Listing Expenses (RM 3.5 million)

In short, 66.7% is used to purchase GOLD at this current price to expand the range of gold jewelry.

Looking at the Gold Price chart, the company is buying it at 10 years high! And with interest rates rising – USD will increase and the inverse is true for gold prices.

This is probably something that will affect the company if the above materializes.

#5 Risks

As mentioned, YX’s financial results are subject to the fluctuation of global gold prices.

In addition, YX is subjected to several key risks such as fire, flood, theft, burglary, loss of goods, and damage to property, plant, and machinery.

At present, YX had insured itself an amount of RM 58.7 million, but it offers no guarantee that its insurance sum assured could cover all risks related to its business operations.

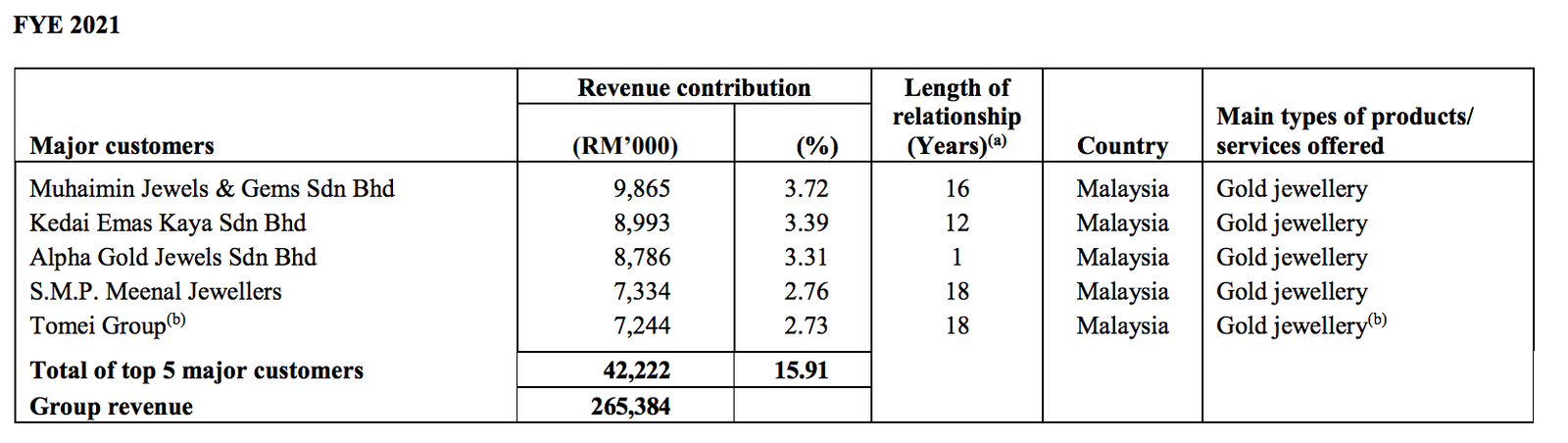

In addition, YX derived RM 42.2 million (or 15.9%) in sales from its top 5 clients, listed as follows:

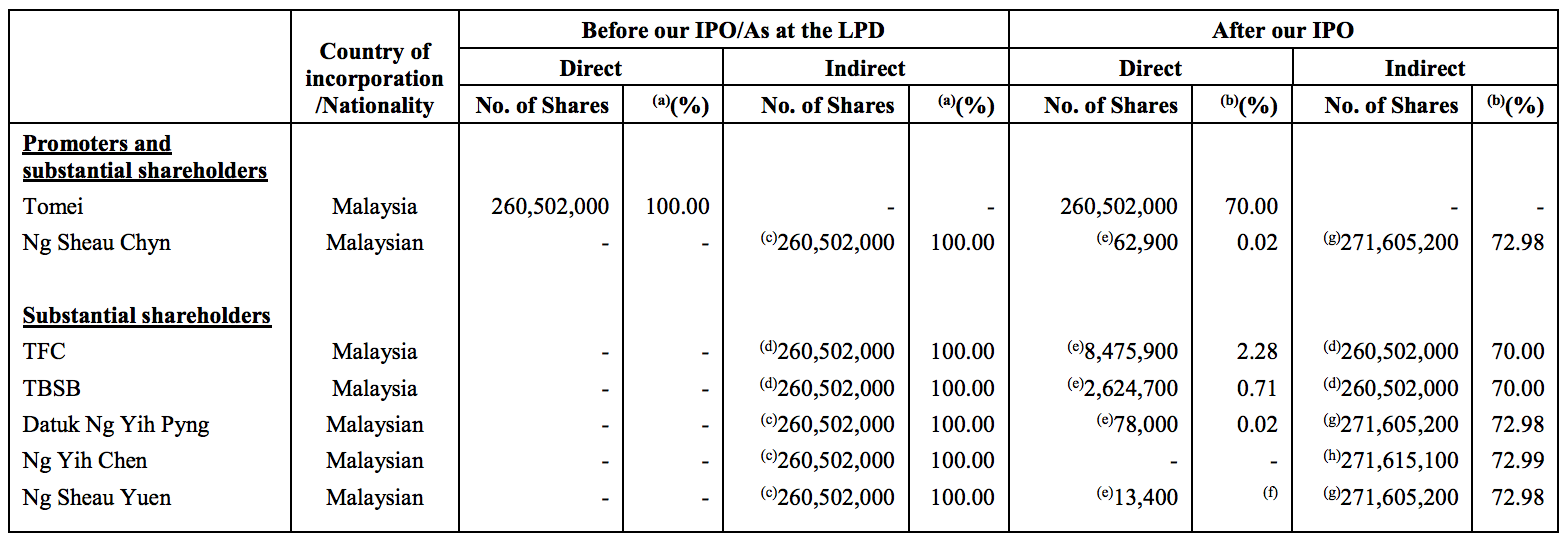

#6 Major Shareholders

Upon its listing, Tomei Consolidated Bhd, a Malaysian-listed jeweler, would hold as much as 70% direct shareholdings of YX.

Ng Sheau Chin shall be appointed in YX to be its Managing Director. Her brother, Datuk Ng Yih Pyng sits on its board as a Non-Executive Director. Datuk Ng Yih Pyng is now the Managing Director of Tomei Consolidated Bhd.

#7 Dividend Policy

YX does not adopt any formal dividend policy at the moment.

#8 Valuation

YX’s IPO shares are offered at 28 sen a share. Based on its 2021 EPS of 1.91 sen, the offer is valued at P/E Ratio of 14.6x.

Based on its pro-forma consolidated net asset per share of 23 sen, the IPO offer is valued at P/B Ratio 1.22x.

Conclusion

YX possesses 30 years of experiences in the gold jewelry business in Malaysia and is managed by Ms. Ng Sheau Chin, who is an experienced jeweler herself.

However, YX’s fortunes are directly correlated and mired in the constant volatility in gold prices. In its balance sheet, gold would remain as its biggest current asset. Thus, rise or fall in gold prices would impact its book value moving forward.

In terms of growth, YX revealed that it would acquire plant & equipment and as well as pure gold bars and scrap gold bars to increase its production capacity.

In this light, as investors, it is important to decide on the prospects of this industry and its valuation metrics.