On 28 January 2022, Siab Holdings Bhd (Siab) had extended an invitation to buy its IPO shares at 30 sen a share with the release of its IPO Document onto Bursa Malaysia.

Upon listing, it would have RM 146.89 million in market capitalization based on 489.63 million shares. You may download Siab’s IPO Document: Part 1 and Part 2 to study it.

Alternatively, you can spend 5 minutes to read this article where I summarized 8 things to know about Siab before investing:

#1 Business Model

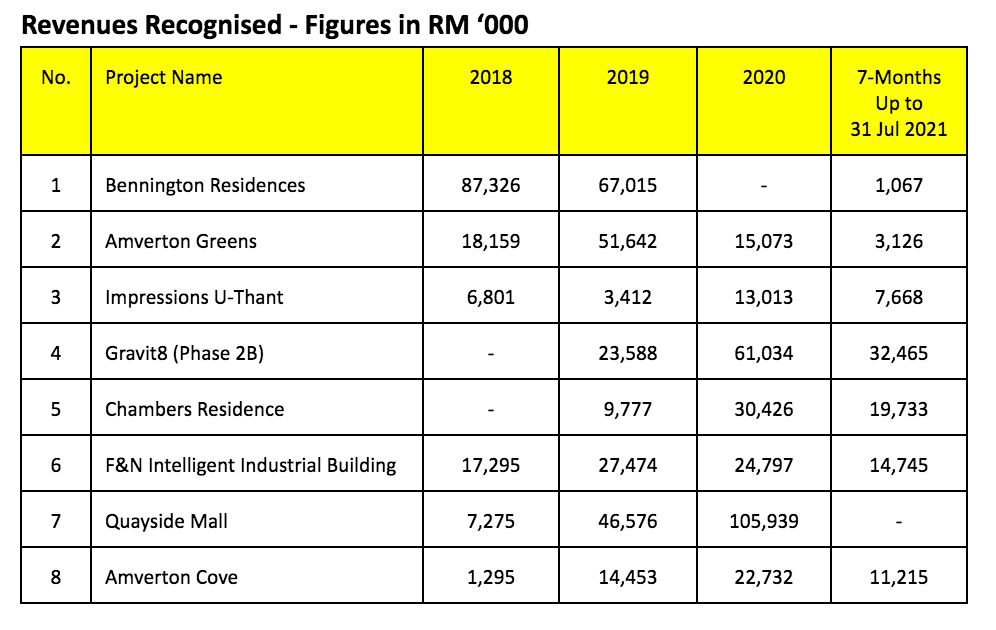

Siab offers design, build and construction services to real estate developers and owners in Malaysia. From 2018 to 31 July 2021, Siab had derived sales & profits from the following major projects:

#2 Profitability

Siab had generated higher sales and adjusted profits in 2019-2020 as a result of its involvement in Gravit8, Chambers Residence, and Quayside Mall projects.

As such, its revenues had grown from RM 145.42 million in 2018 to as much as RM 273.39 million in 2020. Its adjusted earnings had grown from RM 4.08 million in 2018 to RM 11.02 million in 2020.

#3 Cash Flow

For Siab, sales is recognised based on the stage of completion of its projects. As such, it is vital to take note of its cash flow.

From 2018 to 31 July 2021, Siab had generated positive operating cash flows. But, it had spent on CAPEX and bought investment properties.

Hence, it was on negative cash balance in 2018-2019. As for 2020 and the 7-month period till 31 July 2021, Siab’s cash balance had been positive RM 2.22 million and RM 7.79 million respectively.

Apart from operating cash flows in that period, Siab had obtained net loans & borrowings totalling as much as RM 4.06 million in 2021.

#4 Balance Sheet

From 2018 to 31 July 2021, Siab had maintained 1.0+ in current ratio and below 50% in gearing ratio.

#5 Utilization of IPO Proceeds

Siab intends to raise RM 36.72 million in gross proceeds from its IPO listing:

Page 28 of Siab’s IPO Prospectus

1. Purchase of Land and Construction of Storage Facility (RM 6.098 million)

This involves the acquisition of 2 acres of land to build its new storage facility in the Klang Valley. The land cost is RM 8.71 million and the cost of construction is RM 3.49 million.

Siab intends to fund 70% of the land cost via bank borrowings. Siab plans to fund the remaining 30% of the land cost and the construction cost with the RM 6.098 million raised from its IPO listing.

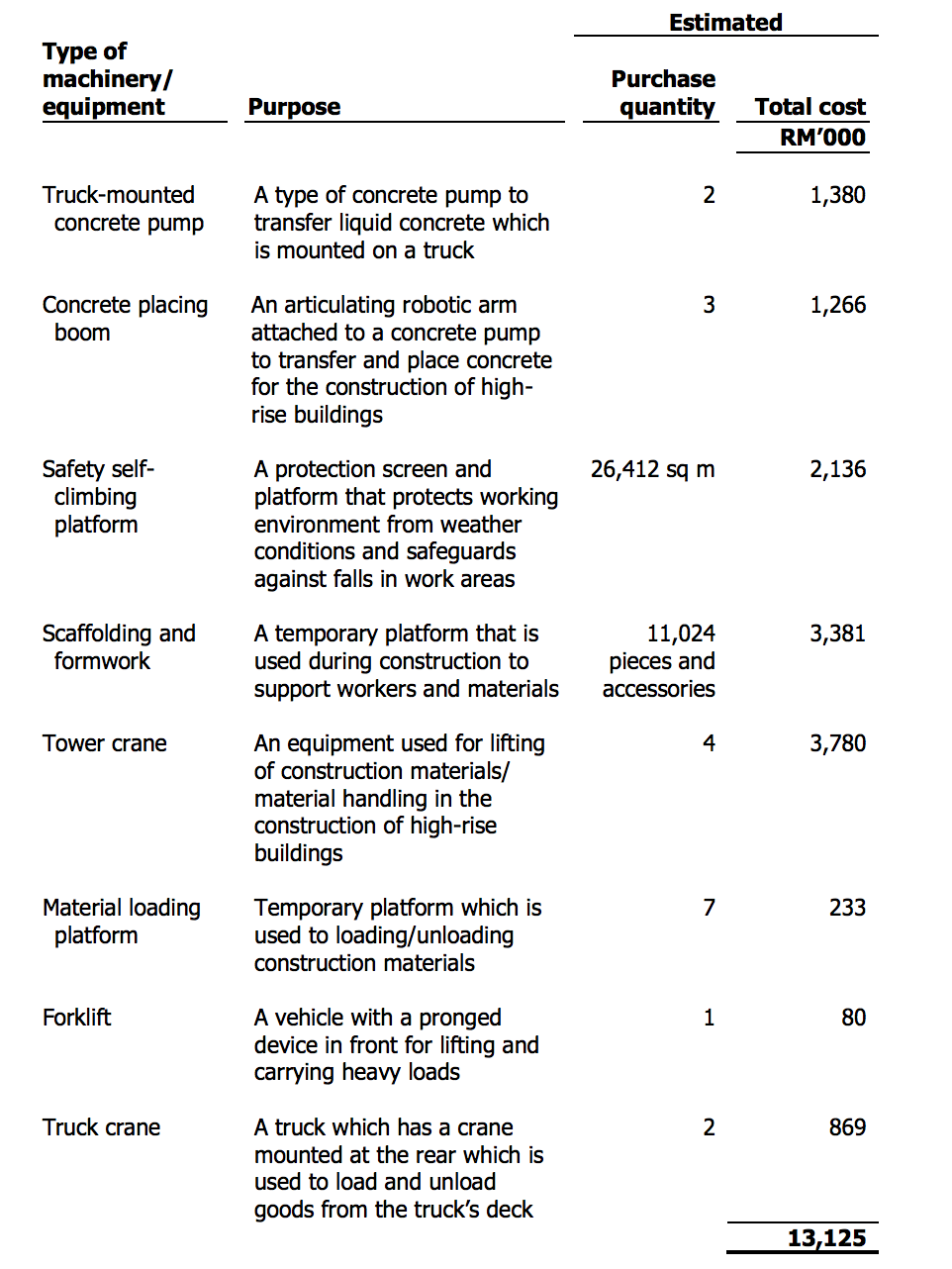

2. Purchase of Machinery and Equipment (RM 13.125 million)

They are intended to expand its building construction activities.

Page 30 of Siab’s IPO Prospectus

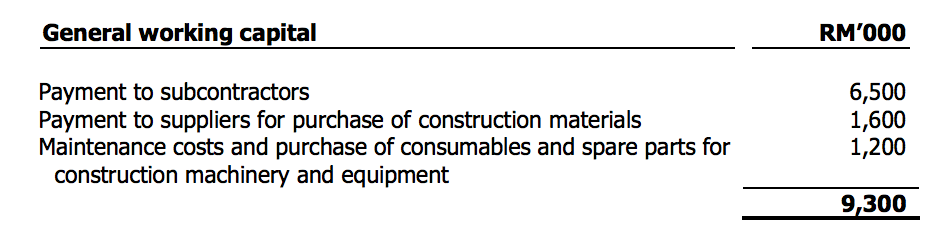

3. Working Capital (RM 9.300 million)

Siab intends to allocate RM 6.5 million for subcontractors and the other RM 2.8 million for construction materials and spare parts for machinery & equipment.

#6 Order Book

On 31 December 2021, Siab has RM 544.98 million in total unbilled order book, where these projects mainly include:

#7 Major Shareholders

Ng Wai Hoe, Lim Mei Hwee and Tan Sok Moi would be substantial shareholders of Siab. Ng is appointed as Siab’s Managing Director while both Lim and Tan are Executive Directors of the company.

#8 Valuation

Based on 30 sen a share, its offer is valued at 13.33x its adjusted EPS. Siab does not adopt any formal dividend policy at this moment.

Conclusion

Siab had delivered higher sales and profits in 2019-2020 due to projects such as Gravit8, Chambers Residence and Quayside Mall.

But, the Gravit8 and Quayside Mall projects had completed and shall not contribute to sales & profits in 2022. This is to be replaced with projects listed in Note #6 and it is important for Siab to continue to secure new projects to sustain revenues and profit growth in the future.

Billionaire Warren Buffett is arguably the most successful investor of all time.

Learn the secrets to Warren Buffett’s investment success by downloading the Free Guide below: