How to generate 15+% Returns by investing in Hidden Gem Stocks

*Hidden Gems are undervalued stocks trading under the radar.

Investing doesn't just have to be the plain old boring Blue Chip Stocks and REITs.

Yes, there are many Value Stocks which can offer you multibagger returns >100%...

if you know how to find them where nobody else is looking.

Excited at the potential returns? Sign up by clicking on the button below!

Before we move on, please take just 10 seconds

to answer the below questions...

If you have answered "Yes" to any 1 of the questions above, you ought to read on...

It Took Me 10 Years of "Trial-and-Error"...

If you are looking for a soulmate who have made countless of investing mistakes, you are in luck - I am one of them.

Check out my investing journey below (Be warned - its a long one but i hope you can learn something from it)...

Starting Out

My initial exposure to stocks came from my Dad at the age of 15. Back in those days, people still browse through the share prices through Teletext on TV!

Intrigued, I remembered asking my Dad about the Green and Red things that keep blinking on the screen. He simply said, "Green means You make money; Red means You lose money".

I was literally hooked that time, envisioning how rich i can become simply by mastering the skills of investing properly (yeah, so naive that i am laughing at my old self now).

Anyway, with that in mind, I opened my 1st Brokerage account when I am 18 years old. However, I had totally no clue on what i was doing for the initial few years. Although I piled up on knowledge from hitting the library and online resources, the real deal is totally different when you put your hard-earned money inside.

Needless to say, I made tons of investing mistakes which i will share with you 3 of my 'memorable' ones below...

Mistake #1 Investing Blindly

Although i was reading up on investing/trading, i figured out that putting my money in the market is the quickest way to learn. However, as soon as I did that, the urge to micro-manage my savings came over me and I started watching the ups and downs every day.

Enthralled by the Top 20 Volume/Gainers screen (hands up if you still do the same now!), i look to trade stocks which can jump 10-20% in a day. As you would have expected, i landed more misses than hits.

Every little piece of news made me question my decision. In addition, I was literally buying and selling on a whim, because so-and-so on the media mentioned that this stock is a must-buy for quick gains.

Mistake #2 Lack of Investment Strategy

Similarly, I don't have a faint idea on what i want in the beginning; not to mention any strategy or investment plan.

Not having a plan is detrimental in many ways; 2 of which go like this:

(i) You don't know your Risk Appetite e.g. should you be pulling the trigger on loss-making Uber because it has a huge network effect for ride-sharing?

(ii) What should you do when stocks plunge 50%? Average down, Hold or Sell?

Truth be told, investment legends out there have developed their own investment strategies. One classic example is Warren Buffett where he achieved more than 50% returns a year using Deep Value Investing!

Check the video below for what he will do if he had a small sum of money and mind you... his small sum is a few million dollars :O

Mistake #3 Following the Crowd

During the 2009 US Sub prime crisis, practically every stock had soared to all-time highs.

Everyone was lamenting about how much they made from buying and selling stocks; and analysts were all valuing on how they can be worth much higher based on future growth prospects.

Needless to say, I bought at the top; just like most retail investors do in every bubble.

When the bubble popped, I experienced first-hand on how terrifying the stock markets can be if you don't know what you are doing. In short, i was left 'naked' according to Warren Buffett's quote:

"Only when the tide goes out do you discover who has been swimming naked"

50% OFF expires in:

You missed out!

My Turning Point

Devastated by the lack of progress even after 'investing' for a few years, I was at the end of my wits and contemplating if I should just give it up. Luckily, I got a lucky break when Motley Fool (Fool.sg) decided to set up shop in Singapore.

After a quick interview, I was roped in perhaps due to my basic investment knowledge and went on to write over hundreds of articles to date.

My writing also required me to study those investment legends in depth and thats where I really accelerated my investing wisdom by many notches. In fact, it was how I discovered about the merits of Factor Based Investing...

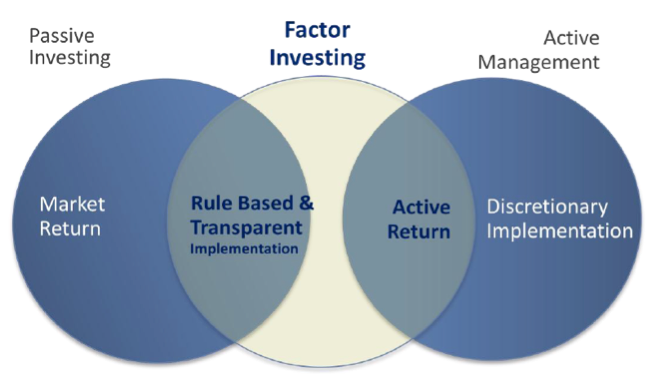

Factor Based Investing

While Value Investing is a popular investment strategy, not many people know about Factor Based Investing:

Factor Investing is an investment approach that involves targeting specific drivers of return across asset classes. Investing in factors can help improve portfolio outcomes, reduce volatility and enhance diversification.

Simply put, Factor Investing brings out the best in both worlds from Active Investing and Passive Investing.

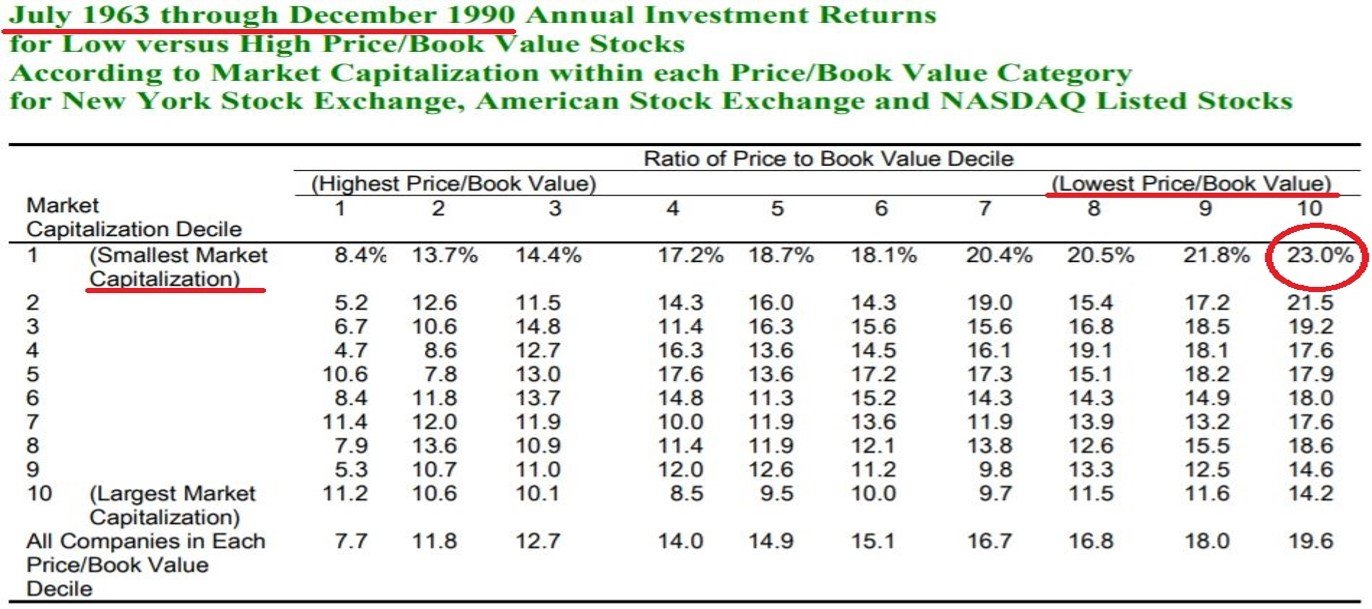

While there are a total of 7 factors, small capitalization and value are 2 factors that stand out and has a proven mettle as shown below:

Simply selecting the lowest P/B and smallest market capitalization would garner a eye-popping 23.0% annualized returns between the period 1963 to 1990.

The above boils down to selecting the right 'Factors' when one is investing (its Value and Size in this case). In fact, according to an article by CFA Institute, those 2 factors play a big role in generating Berkshire Hathaway's out-performance from the U.S. Indices over many decades.

When asked how he could achieve 50% a year with small sums, Warren Buffett said,

“You have to turn over a lot of rocks to find those little anomalies. You have to find the companies that are off the map - way off the map.”

And that is why we came up with this HiddenGemsAlpha Membership to uncover hidden gems and ride them for handsome returns, way before other people have taken notice...

Want to Sieve out Hidden Gems?

Scroll Below to Get Started...

Introducing...

Hidden Gems Alpha 2.0

~ Our Flagship Investing Membership Poised to Hand You Market-Beating Returns ~

12 Issues of Actionable Case Studies

Save time and effort with our well-researched case studies delivered to your Inbox.

Now you can sit back, relax while we do all the legwork for you.

Regular Email Updates

Sembcorp Marine multiple Rights Issue? Sunseap having IPO soon?

We monitor various corp. developments & update you via the community.

In-depth Qualitative Analysis

Companies trading at low multiples are potential Value Traps.

We circumvent this by drilling into their growth catalysts, ownership & management team!

Proven Investing Strategies

Take comfort knowing that this is a strategy practiced by many investing gurus.

It is also proven to beat almost any other approach in the market for a long time!

Exclusive Access to Our Stock Watchlist

The most tedious thing for investors is to keep tab of all the ongoing developments.

We have a Watchlist to monitor our favourite stocks and summarized thesis in them!

Treasure Vault [Special Reports + Bonuses]

What's a membership without all the FREE reports and bonuses?

When you join us, you will get access to our secret treasure vault.

Here's how some of our Stocks have performed...

1) AEM Holdings - Provide Testing for Semiconductor Chips

2) iFast Corp. - Wealth Management Fintech Firm

3) ISDN - Industrial Automation Manufacturer

4) Bosideng - PRC's largest jacket maker

5) Zen-Game - PRC's mobile game developer

Want to discover more stocks like the above?

Click on the button below:

3 Free Bonus Gifts Up for Grabs!

In addition, we want to reward you for taking charge of your financial well-being.

If you take the step to join HiddenGemsAlpha 2.0 today, you get these Exclusive FREE Bonuses below...

1. Private Commumity Group

Now you can network with like-minded investors and hear what everyone has to share. This brings about the exchange of ideas and better investment decisions!

+

+

3. Treasure Vault

Inside, you can find over 10+ special reports such as "Forbes interview with Warren Buffett", "Motley Fool 10 Stocks for 2021" & more!

We're continually adding more reports which one of each is already worth $100! The value just keeps growing here!

30-Day No Questions Asked

Money Back Guarantee

If, for any reason, you don't like this amazing membership, you can get a full refund anytime within 30 days after your purchase.

If you have any issues, just get in touch with our friendly support team and they'll either help you out until you get the results you need or give you a swift refund.

Get Instant Access to the Membership!

If you're ready to take your investing prowess to the next level, simply choose your payment option below to get started...

Value-For-Money

Hidden gems

For Value Investors

$39

$29/month

Billed Annually at $348

Secure Payment. Renews Yearly.

P.S. On average, investing workshops out there usually charge you an arm or a leg ($1,000 to $4,000+) for a few days workshop.

Here, we keep it affordable for you so that you can invest these savings for better returns instead.

See What People Are Saying...

Case Studies Presented In A Clear And Concise Manner

"I have the privilege to preview James's Deep Value Stocks Website before the launch and I have full of praise for this website.

He presented his deep value case studies in a very concise and easy to understand manner which makes it easy to read. Thumbs up and strongly recommended!"

Augustine Lim (Retiree)

Good Contrarian Stocks Which Can't Be Found Outside

“As an investor I am constantly searching for solid investment opportunities. This membership offers me good contrarian case studies which can't be found in the outside market.

No doubt that it takes James a lot of time and effort to provide this high quality service. Kudos and Keep up the good work!”

Xiao Yu (Relationship Officer)

Reliable Investment Educator Who Delivers More Than Expected

“Simple, reliable and consistent - that’s what I look for in an investment educator. Since our first meetup, James has taken the time to meet and explain every detail and question I have had.

James have come up with some interesting stock ideas and delivered more than I have expected. I look forward to many more good years.”

Puay Heng (Entrepreneur)

Frequently Asked Questions

Here are answers to some common questions:

Q1. What do i get from the membership?

Q2. What happens after I sign up?

Q3. How long do I have access to the membership?

Q4. What markets do you cover to find the undervalued stocks?

Q5. Is HiddenGemsAlpha 2.0 membership right for me?

Q6. What actually is Factor Investing again?

Q7. How can I get a refund?

Q8. Didn't find the answer you're looking for?

Here are 3 reasons why Contrarian Investing is so Friggin' Awesome...

- 1RESEARCH-BACKED PROCESS THAT OUTPERFORMS THE MARKETS

Many research studies from the likes of The Tweedy, Browne Company & Causeway Analytics have shown that investing through "Small Cap + Value" factors is proven to provide market-beating returns in the long run. - 2RIDE ALONG-SIDE FAMOUS INVESTING GURUS

Many renowned Gurus like Benjamin Graham, John Templeton and Seth Klarman has utilized this exact same strategy across different generations. We have no need to reinvent the wheel and can ride along this Time-Tested strategy for outsized returns. - 3MASSIVE RISK-RETURN TRADEOFF

Warren Buffett made his 1st pot of gold inveting in much smaller companies in his early days. In fact, he is confident to earn 50% returns a year when his 'investable companies' are much more due to his smaller capital back then.

All It Takes Is One Good Idea

An Annual Membership will cost you less than a cup of coffee per day, yet your return on investment could be life changing...

I'm absolutely confident you will easily recoup your membership fee in value.

Imagine this - you get one good idea and invested $5,000 in it. A 200% gain on your $5,000 capital would make you $10,000 (we have the track record of the 200+% return stocks)!

What if you also look through the stock watch-list and snap up a few other stocks which go on to make double-digit gains in the coming year?

.... Or if the community sharing in the FB group affirms your conviction to sell off a lousy stock just before it drops 50%?

You would literally earn/save tens of thousands of dollars, all because you made the decision to join us today.

The potential is limitless, and the decision is easy.

HiddenGemsAlpha 2.0 will change your life if you fully commit, and it will cost you the lesser amount of money you probably spend on restaurants each month.

So, wait no longer and click the button below to get started with HiddenGemsAlpha 2.0:

© 2022 SmallCapAsia.com. All rights Reserved