Established in 2002, Audience Analytics is a well-established business enabler with a regional presence in 15 countries across Asia, with the main market being Malaysia (about 30% of revenue).

Audience Analytics empowers its database of over 500,000 business owners and decision makers with offerings that range from awards such as the SME 100, HR Best Companies to Work for In Asia to organizing events like Mega Career Fair as well as online and offline media as shown below:

Scalable, Asset Light Business Model

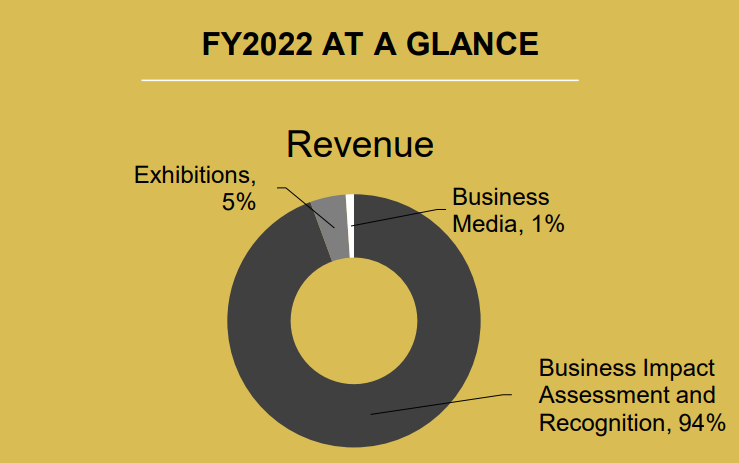

Audience Analytics has 3 main business segments, with the Business Impact Assessment and Recognition (awards) segment constituting 94% of total revenue in 2022. Meanwhile, Exhibitions and Business Media contributes 5% and 1% of revenue respectively.

The Group’s 3 business segments synergize well with each other within the targeted specialization verticals from media to business recognition awards and exhibitions.

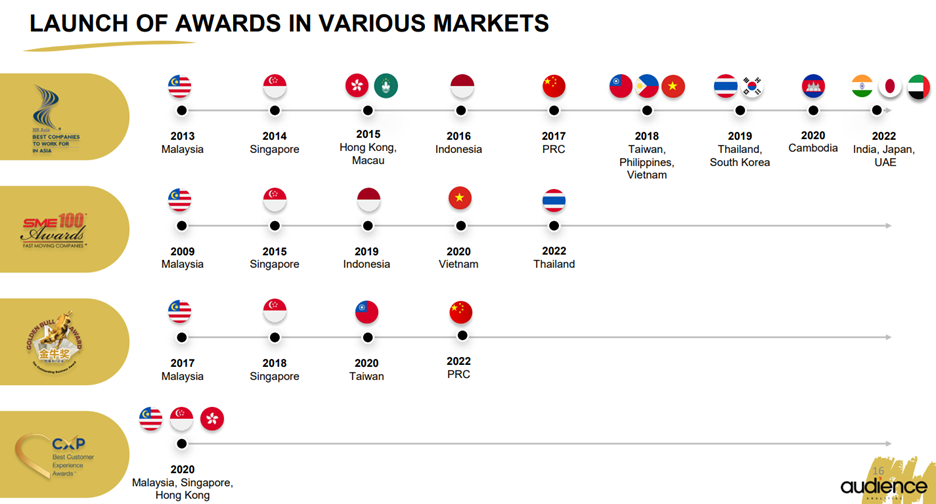

With this well-integrated business model, the Group is able to replicate this scalable model successfully across different countries.

The picture below highlights how Audience Analytics can take 1 award i.e. SME100 Awards and launch it in Malaysia first, then in Singapore and across other S.E.A. countries later on.

Three-Pronged Growth Strategy

Based on its corporate presentation, Audience Analytics’s growth strategy can be divided into 3 core approaches.

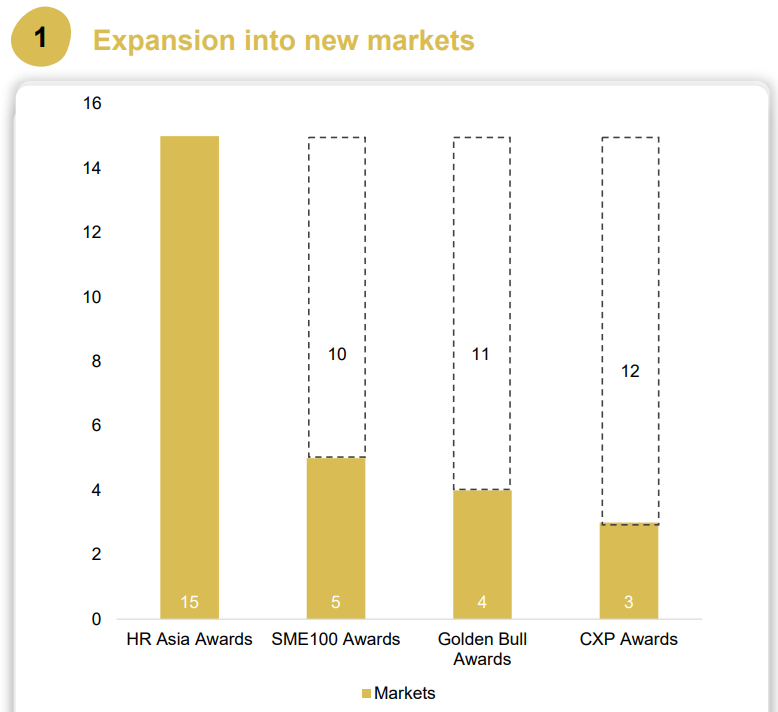

The first straightforward approach is to expand into new markets. Its award – HR Best Companies to Work For in Asia – is already in 15 countries and has been Audience Analytics’s most successful one to date.

Audience Analytics aims to expand its other awards’ coverage to the countries and repeat the success of the HR award.

Currently, the SME100, Golden Bull, and CXP awards only cover 3 to 5 countries. Hence, there is reason to believe that Audience Analytics might focus its efforts on the other countries like Hong Kong, Indonesia and Taiwan going forward.

The second strategy involves cross-selling opportunities across different industries. For instance, Audience Analytics’ aim is to introduce companies participating in the CXP awards (best customer service) to other awards such as HR Asia, SME100 and vice versa.

Finally, Audience Analytics is still focusing on its bread-and-butter markets by penetrating deeper into its existing markets. It aims to increase the number of participants in its award programs, where its average number of participants per award has doubled from 100 in 2018 to 205 in 2022.

Rapid Growth in Financial Performance

Audience Analytics’ has delivered consistent growth in the top and bottom-line over the past few years excluding the outlier year 2020 due to the Covid-19 outbreak.

In its latest 1H 2023 results, revenue almost doubled to S$3.6 million from S$1.9 million in 1H 2022. What’s even crazier is that profits grew by almost 10 times to S$589,000 from S$63,000 over the same period. This growth has been driven mainly by the awards segment, where many businesses ramped up their brand recognition activities and spending as business activities improved after the pandemic.

Historically, Audience Analytics has also registered an impressive compounded annual growth rate (CAGR) of 18.4% for its revenue from 2018 to 2022. Meanwhile, profits after tax grew at a CAGR of 28.2% over the same period.

On top of that, the company is generating healthy free cash flows with little capital expenditure to boot. In 2022, its free cash flow has surged 87.6% to S$7.0 million compared to the previous year.

Events are Bouncing Back

According to this report, the global Exhibition Organizing market, estimated at US$19.7 billion in 2022, is projected to reach a revised size of US$60.7 Billion by 2030, growing at a CAGR of 15.1% over the analysis period of 2022-2030.

In Singapore, the government’s ongoing efforts to promote Singapore as a global MICE destination through initiatives like the Business Events Programme also bodes well for Audience Analytics.

As economies rebound post-pandemic, companies are gearing up for more advertising, marketing and branding activities to further support their growth following a projected increase in global trade.

For instance, 65% of Southeast Asian businesses are now actively showing support for sustainability efforts.

Audience Analytics can help clients bring this message across through its BMI x Visa Sustainability Awards (part of the SME100 Awards), which recognizes brands that have made noticeable efforts in the incorporation of sustainability (ESG) into their businesses.

Attractive Dividends and Valuations

With higher profits come higher dividends. Based on its FY2022 dividends per share of 1.8 Singapore cents, Audience Analytics is currently trading at a 5.5% dividend yield.

Audience Analytics has a policy of recommending and distributing dividends based on the company’s full-year performance. In the years 2021 and 2022, it has consistently distributed dividends to its shareholders and has paid out about 50% of its earnings – demonstrating its remarkable dividend track record for investors.

In addition, the company is currently trading at a P/E ratio of 8.9x, which is much lower compared to other media marketing companies like Asia Media Group Berhad and Focus Media at 21.7x and 19.6x respectively.

Lim & Tan Securities also has a BUY recommendation on Audience Analytics with a target price of S$0.425, implying a 31% potential upside.

Conclusion

Harnessing over 20 years of experience, Audience Analytics has made its mark with its business impact assessments and awards. These business awards have high entry barriers due to the time it takes to build a reputation and the network.

Lastly, Audience Analytics can expect to continue its robust financial growth in the future, underpinned by its clients’ increased focus on their branding and marketing activities.