NAME: Food Empire Holdings Limited

TICKER: SGX: F03

MARKET CAP: SGD 317.5 Million (As of 29 Sep 2017)

MARKET PRICE / SHARE: SGD 0.595 (As of 29 Sep 2017)

SECTOR: Consumer Products

INDUSTRY: Instant Beverage & Food Ingredient

COMPANY PROFILE (Excerpt from Company’s Website):

SGX Mainboard-listed Food Empire Holdings (Food Empire) is a global branding and manufacturing company in the food and beverage sector.

The Group has 24 offices (representative and liaison) worldwide. The Group operates nine manufacturing facilities in India, Malaysia, Myanmar, Russia, Ukraine and Vietnam.

Food Empire’s products include:

- A wide variety of beverages like coffee mixes and cappuccinos, chocolate drinks &flavoured fruit teas.

- Instant breakfast cereal

- Potato crisps

- Assorted frozen convenience foods.

Without further ado, let’s jump into the analysis of Food Empire Holdings (FEH).

1) Business Model & Economic Moat

As a food manufacturer, the one thing that is of utmost importance is its branding.

MacCoffee – the Group’s flagship label – has been consistently rated as the leading 3-in1 instant coffee brand in the Group’s core market of Russia, Ukraine and Kazakhstan.

In fact, Food Empire holds a dominant 50% market share in the Russian instant coffee mix segment, and the country is the Group’s largest market, accounting for nearly 50% of total revenues in 2016.

The Group employs sophisticated brand building activities, localized to match the flavor of the local markets.

Check out this funny video for MacCoffee here. You can see more of such advertisements here too.

On top of being the market leader in Russia, Food Empire also successfully penetrated into Vietnam, becoming the country’s top five coffee players after making losses for many years.

Today, Vietnam accounts for the bulk of Food Empire’s Indochina sales, contributing about 17% to group revenues.

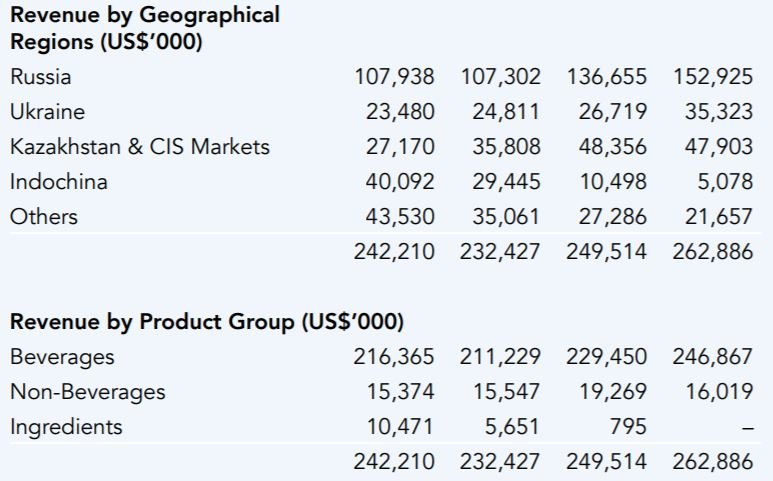

That said, we pulled out the revenue mix from the FY2016 annual report and realised something.

The Russia’s market has been seeing declining revenues even if you don’t factor in the oil crisis. Same goes for the Ukraine and Kazakhstan Markets.

On the other hand, we like how the company’s revenue mix has been focused largely on ‘Beverages’ and ‘Ingredients’ (B2B sales).

It means that FEH has stayed true to its core of selling the stuff they have been good at all this time.

2) Growth Story

A solid growth story is hard to come by. Fortunately for Food Empire, the growth drivers are easy to be determined:

- Opening of instant coffee manufacturing facility in India

- Purchase stake in South Korea’s Caffe Bene

- Rebound in FEH’s core markets

Earlier this year, it opened a state-of-the-art instant coffee manufacturing facility in Andhra Pradesh, India, which makes 10 different types and qualities of spray-dried instant and granulated coffee. The instant coffee plant will aid FEH to accomplish 3 important things:

- Expand its current coffee product offering

- Greater control over the supply and production of raw materials.

- Move up the value chain and expands its coffee product offering

In addition, the Group has also acquired a minority stake in South Korea’s Caffe Bene.

It has a network of more than 600 domestic franchise outlets, and another 100 in Malaysia, Taiwan, Mongolia, Saudi Arabia and the US. You can read more about it here.

In case you are not aware, Caffe Bene has been loss-making for the past few years due to its rapid expansion of stores and high-profile advertising.

Thus, FEH is probably looking at turning around Caffe Bene using 2 approaches:

- Tapping on FEH’s various experiences and network connectivity into the global markets.

- Supplying Caffe Bene with its products (which may mean much higher profits for FEH and lower costs for Caffe Bene).

Last but not least, the worst seems to be over for FEH’s core markets – Russia, Ukraine and Kazakhstan.

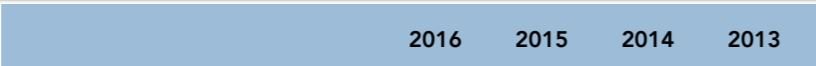

After reporting losses for FY2014 and flat earnings for FY2015, FEH registered a phenomenal jump in earnings come FY2016. We are going to delve deeper into the figures and the revenue mix on our next point.

3) Financials’ Assessment

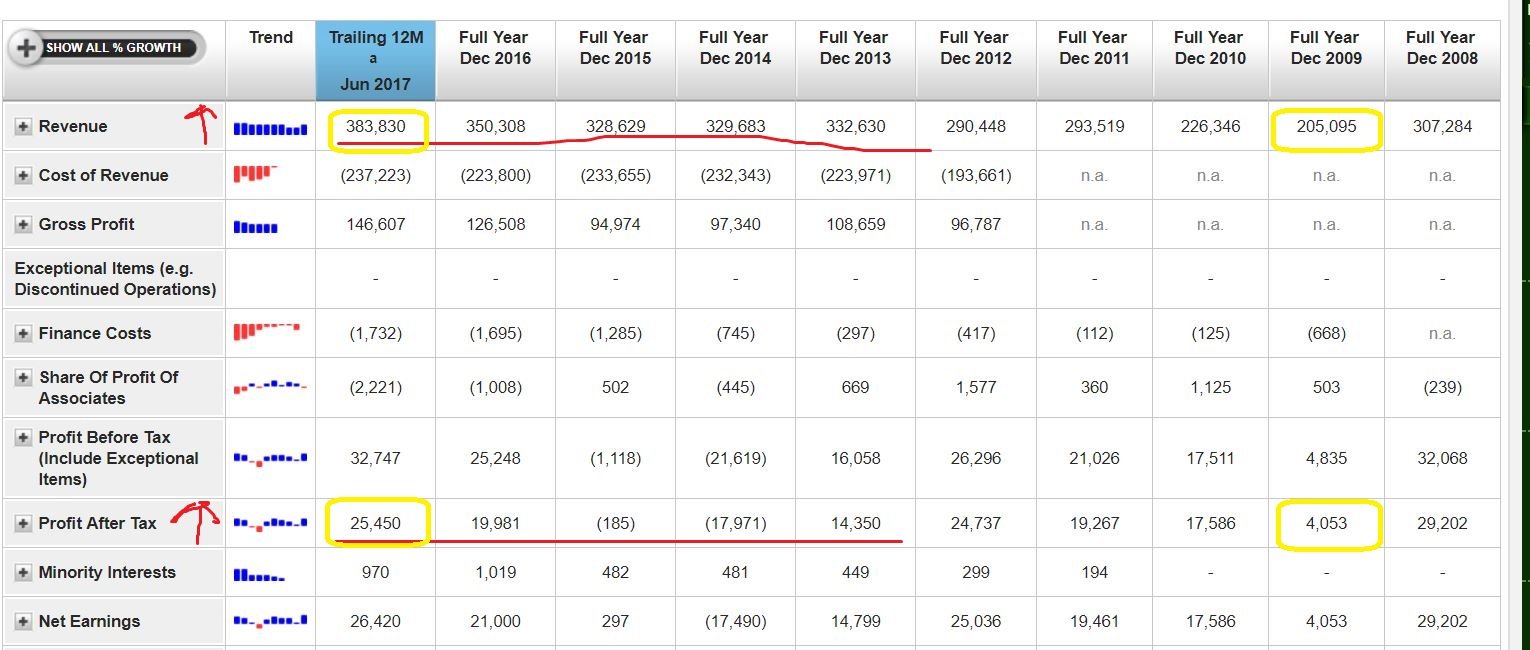

You probably would have given the company a miss if you look at the last 5 years of the company’s sales and earnings.

The earnings have been on a drag due to the oil crisis which resulted in Russia’s rouble devaluation (drop of 50% against USD!). Do check out my article on Motley Fool Singapore (Fool.sg) here too.

Looking at the graph above, the company seems to be back from where it left off in FY2008 where it recorded a high of S$29.2 mil profits.

That said, if you would just exclude this bumper year (just before the financial crisis), I would say that FEH has been making steady progress over the past years – 625% increase in profits over 9 years.

On the other hand, what matters most is the present and the future.

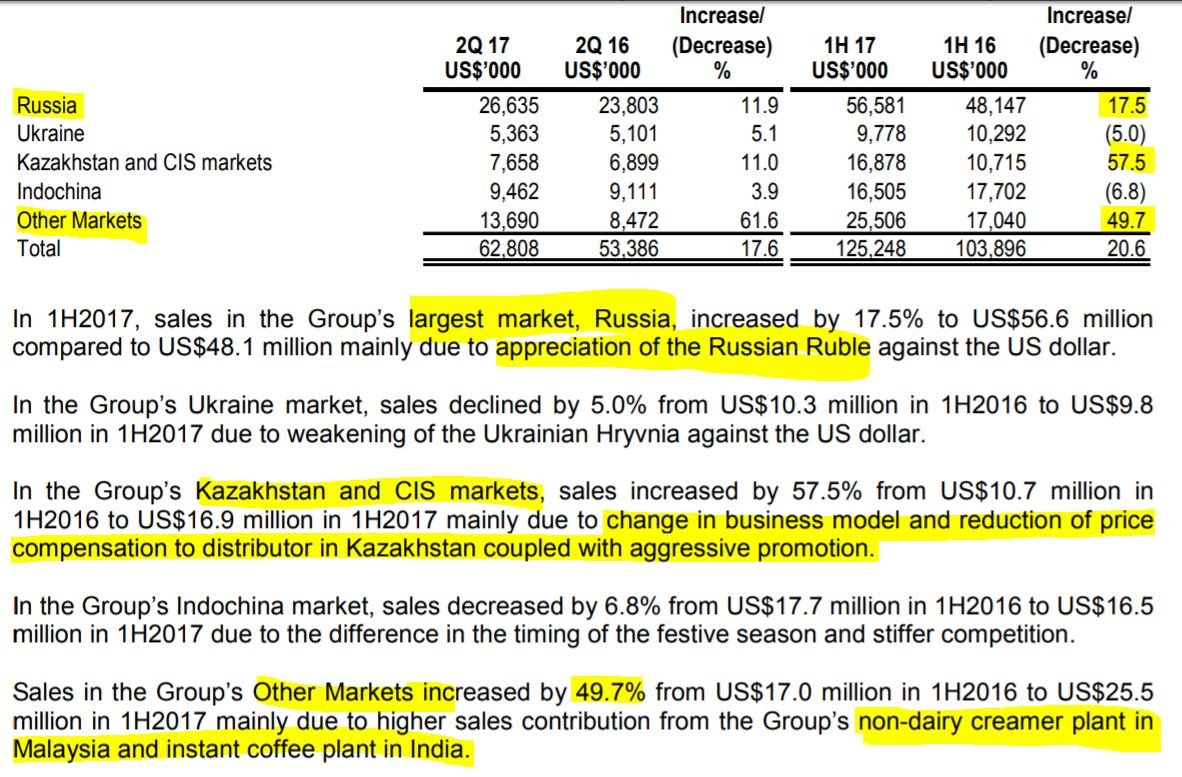

As per its latest 1HFY2017 results, Russia and the Kazakhstan & CIS markets have been on a rebound. On the flip side, Indochina has seen a slight 6.8% decrease due to intense competition which leads us to wonder if it can continue to deliver strong growth rates in that location.

A bright spot can be spotted in the “Other Markets”, a jump in 49.7% sales which stems from FEH’s downstream manufacturing plants. There is reason to believe that this segment can be the next big thing for FEH if done correctly.

With that, let us zoom into its Balance Sheet and Cash Flow taken from the 1HFY2017 report too.

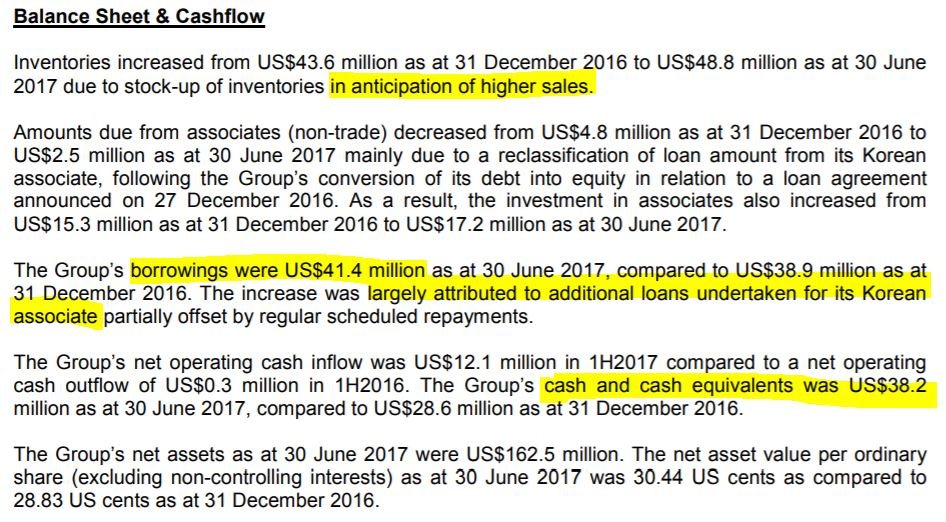

We like how FEH is stocking up inventories in anticipation of higher sales. That just goes to show that the management team is confident about its own prospects!

To further add on to the highlighted above, FEH’s borrowings stand at US$41.4 mil, which represents only about 0.25x total debt to equity. On top of that, FEH churns out free cash flow of S$28 mil trailing 12mths Jun 2017.

4) Key Management Team

The one key thing Warren Buffett looks for in a company is a management team that he trusts. He once said, “In looking for people to hire, you look for 3 qualities: integrity, intelligence and energy. And if they don’t have the first, the other two will kill you”.

Thus, here we drill into FEH’s management team and check out if they are shareholder-friendly and have their interests aligned with yours.

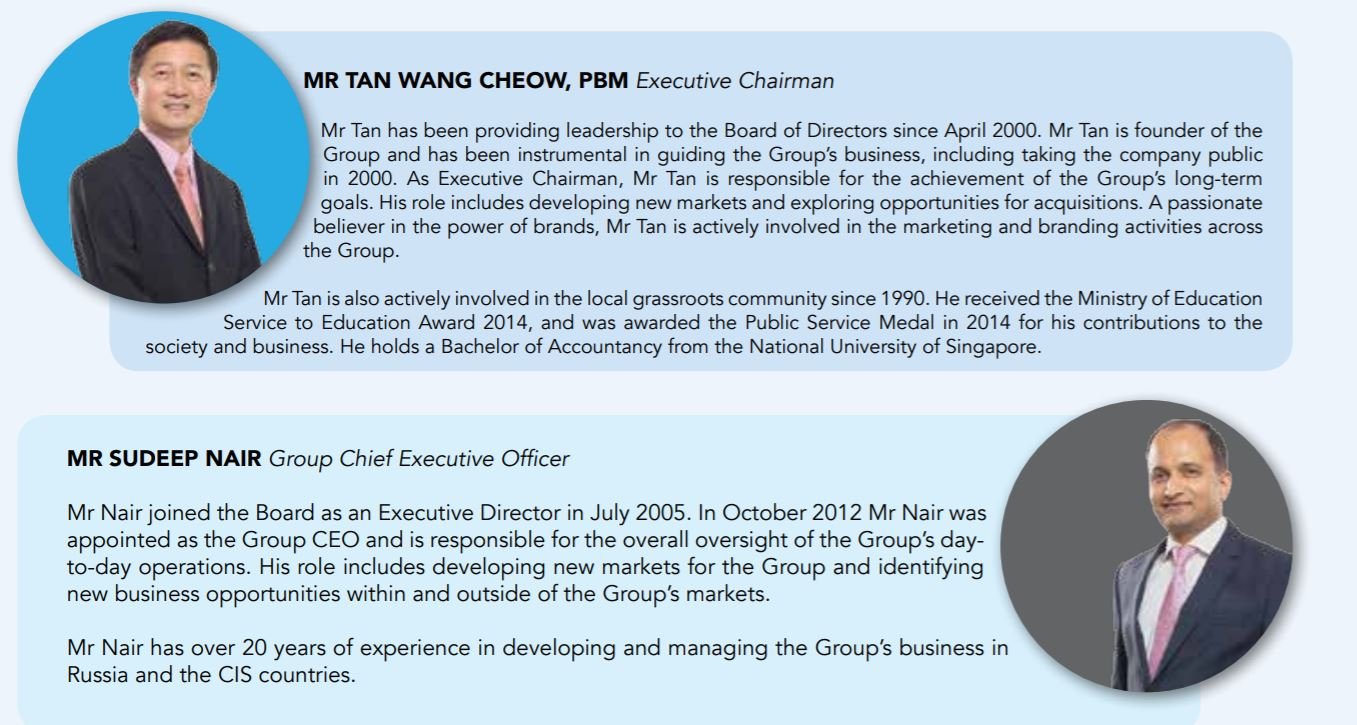

First up, let’s look at the Executive Chairman and CEO profiles:

They have been in the company for over 20 years and have clear boundaries. Executive Chairman Mr Tan is focused more on the big global picture and more involved in the branding activities.

CEO Mr Sudeep Nair manages the day-to-day operations and is more active in the Russia and CIS countries.

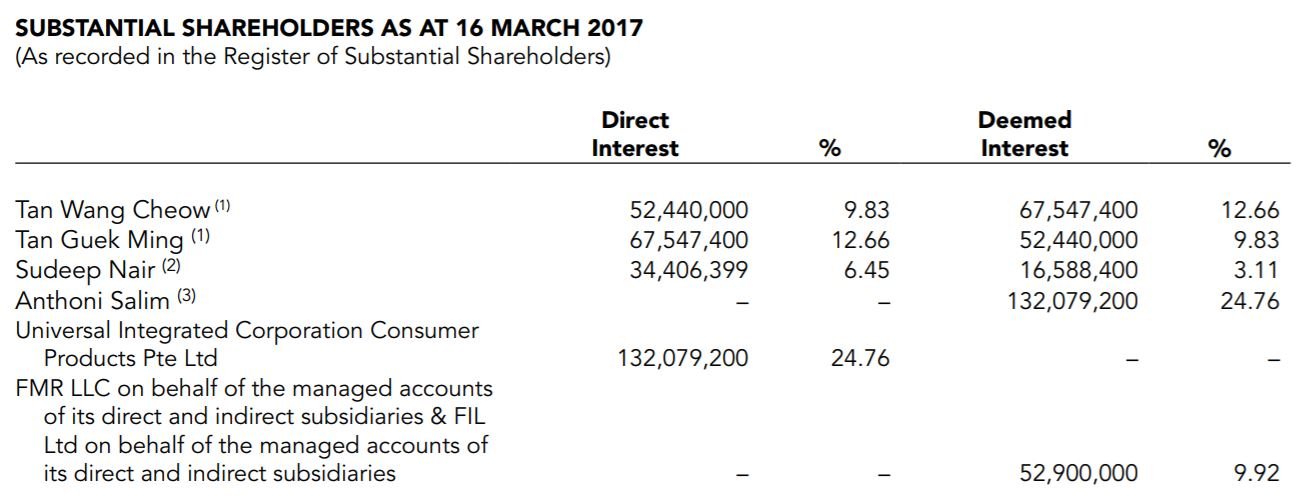

Yes, they also have their skin in the game with both of them owning at least 6% of the company each. Mr Tan’s wife owns an even greater interest of 12.66% as at 16th March 2017.

CEO Sudeep Nair has also displayed huge confidence in the company’s turnaround by raking up 7.6 mil shares of the company during Mar – May 2017. His highest purchase price is $0.67 which provides a ‘floor’ to the share price.

More importantly is how the management team responded to the collapse of the Russian rouble.

Instead of brushing away the incident as a one-off, Mr Tan looked at it as a transformative learning experience.

This is what he said in an interview with SGX:

“It taught us the importance of diversifying geographically, and over the past few years, we’ve been venturing outside the Eastern European bloc into Asia, as well as pursuing vertical market integration“.

True to his words, FEH is making inroads into Indochina and also acquiring Caffé Bene for more upstream sales in the future.

5) Risks Revealed

No investment is without risks and the same goes for FEH. We look at the whole picture and zoom into some of the risks worth noting:

- Lackluster growth in Indochina, esp. Vietnam

- Susceptible to consumers’ switching of products due to relatively cheaper items & similar product offerings to that of competitors

- Unable to turnaround the loss-making Caffé Bene acquisition

- High exposure to fluctuations in currencies

We feel that it could augur well for FEH if they continue to expand their B2B operations through their Malaysia and India plants. This way, they can dramatically reduce the risks mentioned in the points above.

Conclusion: Our Take on Food Empire Holdings

Overall, we feel that FEH’s competitive advantage will constantly be under siege from new competitors and those with the ‘big guns’.

As such, FEH has to either spend a lot on marketing and advertising to maintain that edge or risk being cast aside when the consumers find another better alternative.

The management team deserves a good shout-out here as they have been navigating the company through several tough periods and continued to strive for innovation.

The company is currently in good financial shape and is a classic turnaround story with impending growth catalysts.

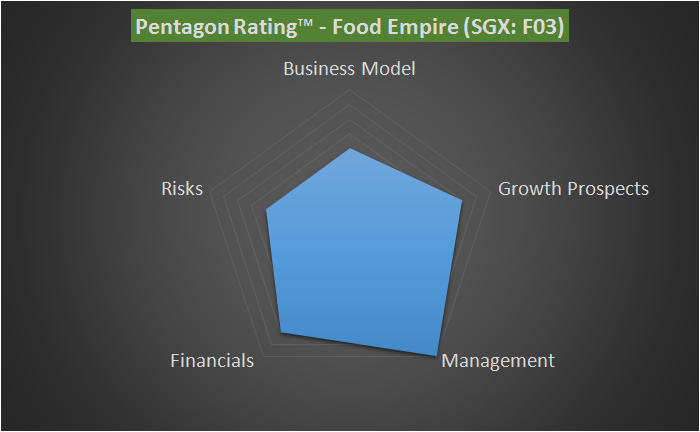

We have tabulated these 5 pointers into what we call: Pentagon Rating™ (see below).

We hope that you have a better understanding of the stock. On the other hand, you don’t have to just take my word for it too. You can also check out more Reading below:

- How Food Empire came about: http://ebm.cheetahmail.com/c/tag/hBZVbClB86$MfB9dNQwAAEhAkC3/doc.html

- Food Empire’s latest FY2016 annual report:

http://foodempire.listedcompany.com/misc/ar2016.pdf - NextInsight’s analysis on Food Empire:

https://www.nextinsight.net/story-archive-mainmenu-60/939-2017/11599-food-empire-from-computers-to-coffee - RHB’s analyst report

http://rhb.ap.bdvision.ipreo.com/NSightWeb_v2.00/Files/GetFile.aspx?FileVersionID=64242&ieHack=.636385293349442075

Do you like the stock above? Good!

We’ve released another 3 HOT growth stock picks which could skyrocket >100% by the next year. History has shown that getting in early on a good idea can often pay big bucks – so don’t miss out on this moment.

Simply click here to receive your copy of our brand-new FREE report, “3 stocks poised for explosive growth”.

Do Like us on Facebook too as we share the latest investing articles and stock ideas for you!