Many investors would have known about DBS Group Investors would have make decent gains as the share price has been rising for the past few years.

In fact, investors would have gain a total return of 131.93% excluding dividends received if he purchased the share 5 years ago!

Many investors would already know about the fundamentals of DBS Group and hence in this article, I will analyze DBS Group using a purely from a Bazi perspective.

I get it, DBS Group was founded in 1968 and hence, technically, we should use 1968 to analyze DBS Group.

However, DBS Group has went through a lot of changes including a merger with POSBank in 1998. Hence, we shall use 9 March 1999 as stated in SGX website to analyze DBS Group from a Bazi perspective.

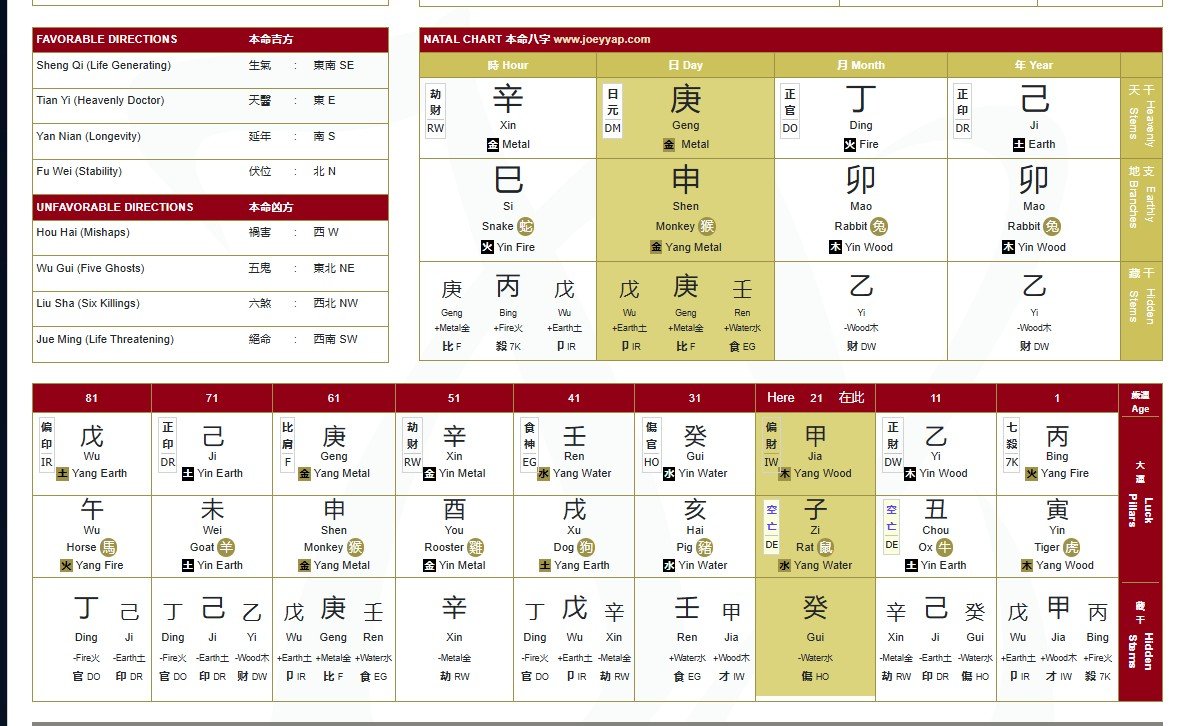

Direct Officer (DO) in the Bazi Chart

As you can see from the Bazi chart of DBS Group, there is a DO star on top of the month pillar. DO for a person represents your career, your leadership, systems and processes.

As DBS Group is a bank and not a person, it will mean being a leader. Hence, you can see that indeed DBS has been a leading bank in Singapore and even South East Asia.

Direct Wealth in Chart

DBS Group has not one but 2 wealth elements in the chart. Wealth element for a person indicate the person ability to generate wealth and even more so if a person has output elements.

Hence, for DBS Group, that will mean increase in its share price resulting in increase in market cap.

Indeed, since 2009, DBS Group share price has increased by 277% excluding dividends and bonus issue.

Current Luck Pillar of DBS Group

DBS Group is currently in its Indirect Wealth (IW) and Hurting Officer (HO) luck pillar. IW for an individual also means wealth potential as well the potential for investment and doing business.

Hurting Officer for a person represents a person ability to create wealth and the ability to innovate and to think out of the box.

Indeed, ever since DBS Group enter its current luck pillar in 2020, its share price has increased by 132% alone!

During this period DBS group has also been at the forefront in doing business and very innovative in creating new products.

For example, DBS Digital Exchange was launched in Dec 2020 just when DBS Group entered its new luck pillar!

However, in its current luck pillar, the Rat has an uncivilized punishment with the Rabbit.

Uncivilized punishment usually means caught in a horrific bad situation. True enough, since 2020 when DBS Group entered its luck pillar in 2020, the DBS Digital App was down a quite a number of times till MAS has to impose significant restrictions on DBS in November 2023, including a six-month pause on non-essential IT changes and a prohibition on new business ventures.

Going forward as the luck pillar will only end in 2029, you should expect more significant disruptions in the DBS banking app 🙂

Forecast for 2026 for DBS Group

From 4 Feb 2026 onwards, we will enter the yang fire horse year. For DBS Group, it will be its 7 Killings year.

Hence, we can expect DBS Group going to have a challenging year next year. The new CEO certainly going to have its work cut out for her 🙂

The year horse also has a destruction relationship with the Rabbit and also the wealth element of DBS.

Hence, we can expect that DBS Group share price will not perform as well as this year and in fact could suffer a fall in share price. You can access the bank website here.

For more Bazi analysis on the companies you have bought or want to have a destiny consult with me, apply a trading account with me and get to receive FREE Bazi analysis on companies as well as destiny consult. You can connect with me via telegram here

Disclaimer: Please note this article is written for educational purpose. The the stock mentioned in this article is not a financial recommendation to buy or sell and investors need to do their own research and due diligence before investing in DBS Group