China Sunsine Company Profile

China Sunsine is one of the largest producers of rubber accelerators in the world and also the largest producer of insoluble sulphur in China.

It engages in the manufacture and sale of rubber chemical products such as rubber accelerators, anti-oxidant agents, vulcanizing agents, and insoluble sulphur.

The bulk of its products are sold to tyre makers that consume most of the global supply of rubber, driven by growth in the automotive industry. Some of its customers include Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber etc.

Some of the biggest Tyre Makers in the world

In terms of geographical breakdown, 64%of its revenue comes from the People’s Republic of China. The rest of Asia contributes 24% of its revenue.

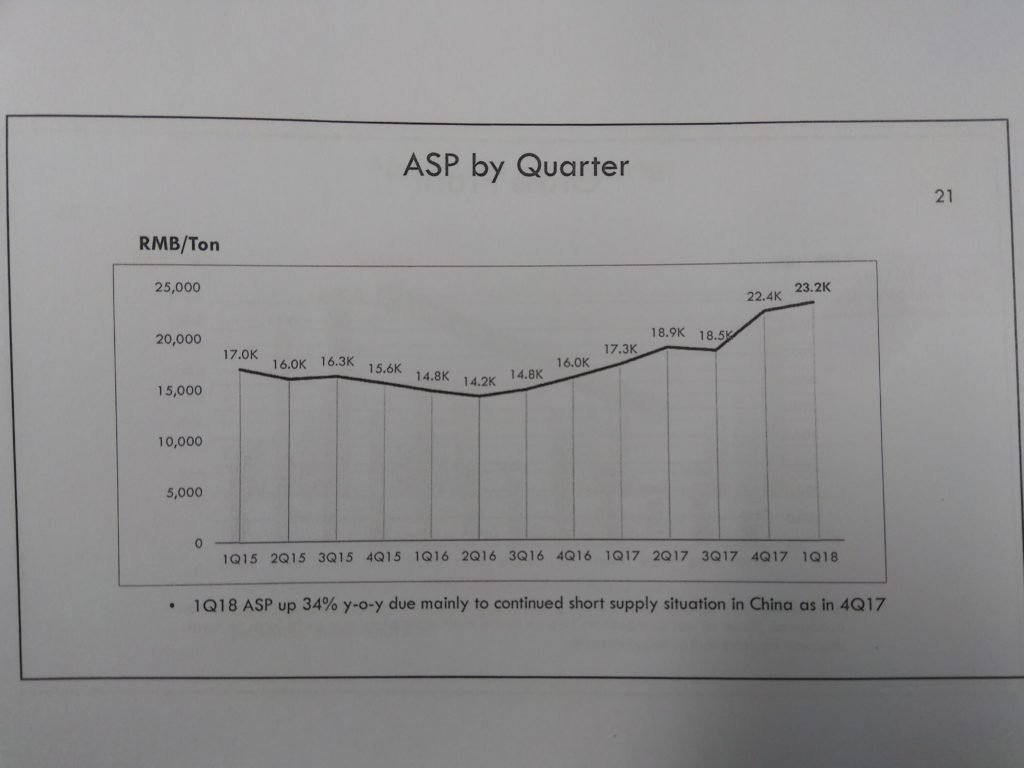

I attended China Sunsine’s annual general meeting to find out more about the soaring Average Selling Price (ASP) and its outlook for the year ahead.

Here are 7 things I learned from the China Sunsine AGM.

1. China Sunsine’s 1Q2018 net profit soars 161% to RMB 149.5 mil.

The spectacular increase is attributed to the rise in ASP from RMB17,300 per ton in 1Q2017 to RMB 23,168 per ton in 1Q2018.

In turn, the increase in ASP was primarily due to the continued short supply situation caused by China’s enforcement of stringent environmental protection laws and frequent environmental inspections in 2017 which affected many other competitors.

2. The Group’s wholly-owned subsidiary, Shandong Sunsine Chemical Co., Ltd, has been granted “High-Tech Enterprise” status.

The High-Tech Enterprise status allows the company to enjoy a concessionary tax rate of 15% as compared to headline tax rate of 25%.

Checking in with the CFO, he mentioned that China Sunsine has many subsidiaries so the overall tax rate will be adjusted, although Shandong Sunsine is its biggest one.

Furthermore, the concessionary tax rate will be issued for 3 years and will go under review again when the time comes.

3. What management plans to do with the Cash Pile?

China Sunsine distributed 3 Singapore cents dividend for the year 2017. Based on China Sunsine’s share price of S$1.50 as at 30 April 2018, its dividend yield is 2.0%.

With a cash hoard of RMB 500 mil sitting in the company, 1 shareholder questioned if more dividends will be given to alleviate the “stigma of a S-chip” since the necessary Capex is already accounted for.

The management team says that it is in the works but they seems to prefer to keep it for

- Working capital

- R&D

- Expansion by acquiring adjacent land and build more production lines

4. A shareholder asked about the risks of FX losses

With all the plants situated in China and their Trade Receivables are in USD but reporting currency in SGD, it is adamant that there will be Forex losses.

The board says that no actions are currently undertaken and management team will monitor the situation. They follow “natural” hedging by quoting their product prices in line with USD rates.

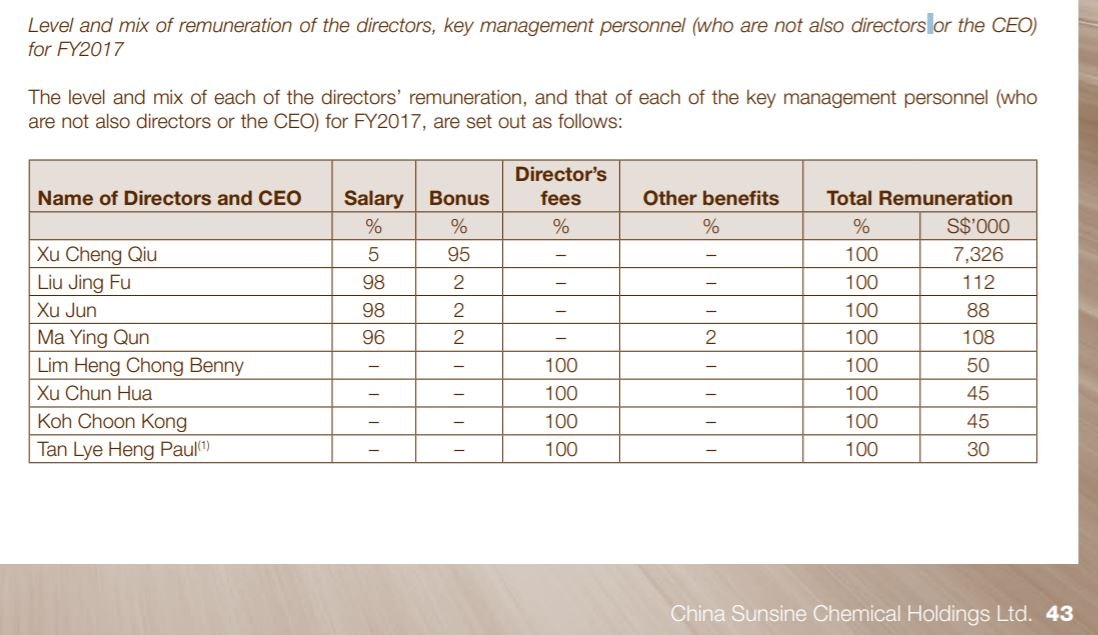

5. Remuneration disparity is a big concern.

Pointing to the “Remuneration” part in the annual report 2017 page 43, several Shareholders have concerns over the huge disparity of Executive Chairman Xu Cheng Qiu’s compensation package against the other directors.

With a 95% bonus & 5% salary structure, he earns S$7.3 mil – a figure more than the CEOs of Billion-Dollar MNCs such as Singtel or KeppelCorp. 1 Shareholder also reiterated that even the CEO of Yanlord, which did even better than China Sunsine, didn’t command that kind of salary.

In a nutshell, shareholders feel that Mr. Xu seems to be the only man running the show and the rest of the board are functioning like employees with a fixed salary (98% salary).

They pressed for changes to this part to tie the overall compensation package in line with company’s performance and also to reveal the formula to Mr Xu’s package.

With that, the board replied with a few pointers (emphasis is mine):

- Yes, Mr. Xu Cheng Qiu is recognized as the main strong leader with the vision and exercise tight, good control over the company.

- As such, the board has the discretion to award him with the bonus scheme.

- Furthermore, Mr. Xu was underpaid during lean times (company not doing well).

- They will discuss the following with Mr. Xu on whether there will be more leeway and if the formula will be disclosed in the reports going forward.

6. As a follow-up, a shareholder inquired about the management’s succession plans.

Given how crucial Mr. Xu is to the company’s operations, a shareholder inquired if there is any succession plans in place. In addition, he hopes that there is clear disclosure of the “Xu” family to see how they are related.

Board reply to this is:

- No worries at the moment as Mr. Xu is healthy and going to the workplace 7 days a week.

- Succession is on the cards. CFO Tong Yiping compares it to be like Singapore’s political landscape where the young generations are being brought in and the supreme leader (Mr. Xu) will guide them.

- Disclosure is being taken into consideration.

7. Will Average Selling Price (ASP) reset very quickly?

Sourced from 1Q2018 Results Briefing from AGM

This question is on everybody’s agenda, including mine.

A shareholder pointed out that Mr. Xu Cheng Qiu kept mentioning about how prices will normalize in the financial reports. What do the company plan to do about it?

CFO Tong Yiping replied that they expect the prices to come down because the 1Q2018 gross margins of 34.9% is unsustainable. Once their competitors (Tianjin Kemai and Yanggu Huatai) start ramping up capacity, prices will dip in sync.

They plan to cope with the price drop through the increase in sales volume. The consolidation in China also serves as a boon to them as smaller players are obsoleted/suspended from stringent environmental regulations.

If you like the stock analysis above, you would be even more interested in our subscription where we unearth hidden gems for our premium members only.

Over 80+ people have joined and given us a raving 4.4+ out of 5 rating! Find out more here!