Singapore’s Budget 2025 was delivered by Prime Minister and Finance Lawrence Wong on 18 February 2025. He announced a slew of measures to alleviate the cost of living concerns among Singaporeans.

In short, every household will receive $800 worth of CDC vouchers and every Singaporean age 21 and above will receive $600 worth of SG60 vouchers. Notably, the government will top up the Future Energy Fund by $5 billion for investments in clean energy infrastructure such as hydrogen or nuclear.

For detailed information on the SG60 Budget, you can view Budget 2025 website here. Here are 3 Singapore stocks that will benefit from the SG60 Budget.

Sheng Siong Group

Sheng Siong Group is one of Singapore’s top retailers with over S$1.37 billion in annual sales revenue (FY2023). As of 2024, Sheng Siong operate in more than 74 locations across Singapore.

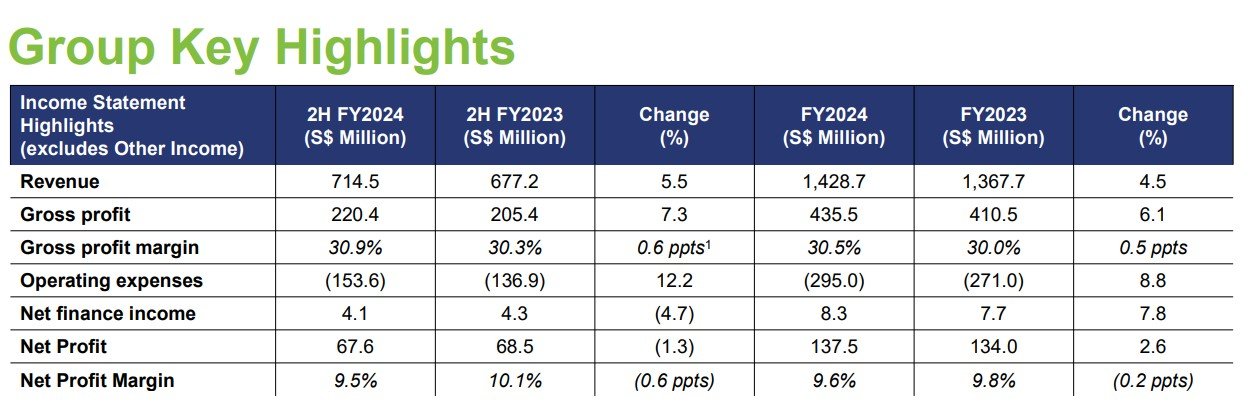

Sheng Siong announced its full year results on 27 Feb 2025.

For the full year ended FY2024, revenue was up 4.5% to S$1.42 billion while net profit was up 2.6% to S$137.5 million. Net profit margin was 9.6%. Balance sheet remains strong with a strong cash and cash equivalents balance of S$353.4 million as of 31 December 2024.

The company declared a final dividend of 3.20 cents per share bringing total dividend of 6.40 cents per share for FY2024.

The company is optimistic on its upward trajectory given the recent government support measures such as the CDC and SG60 vouchers as these vouchers will further enhance consumer purchasing power directly benefiting supermarket sales.

Hence, Sheng Siong is one of the 3 Singapore Stocks that will benefit from the SG60 Budget. You can view the company website here.

DFI Retail Group Holdings

DFI Retail Group is a leading Asian retailer. At 30th June 2024, the Group and its associates and joint ventures operated some 11,000 outlets and employed some 200,000 people. The Group had total annual revenue in 2023 exceeding US$26 billion.

In Singapore, DFI operates several supermarket brands such as Cold Storage, Market Place and Giant.

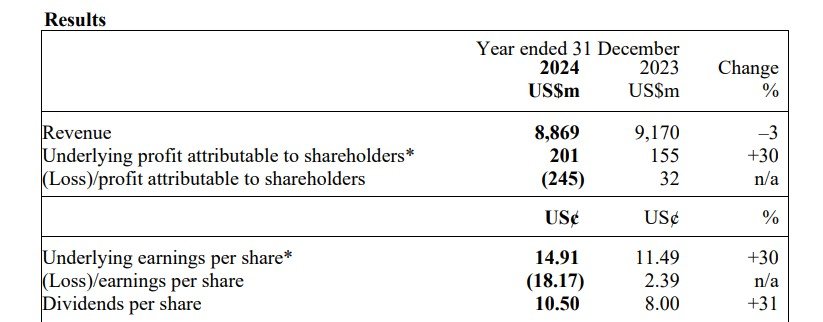

For year ended 31 Dec 2024, DFI reported revenue was down 3% to US$8.8 billion while underlying net profit was up 30% to US$201 million. The company is in net cash position with the sale of Yonghui supermarket in China.

The company full year dividend amounted to US10.5 cents which was 31% increase compared to 2023. As half of the CDC and SG60 vouchers must be spent on participating supermarkets, DFI Retail Group will benefit from this government measures.

Hence, DFI Retail Group is definitely one of the 3 Singapore stocks that will benefit from the SG60 Budget. You can view the company website here.

Sembcorp Industries

Sembcorp Industries is a leading renewables player and an established industrial and urban solutions provider in Asia.

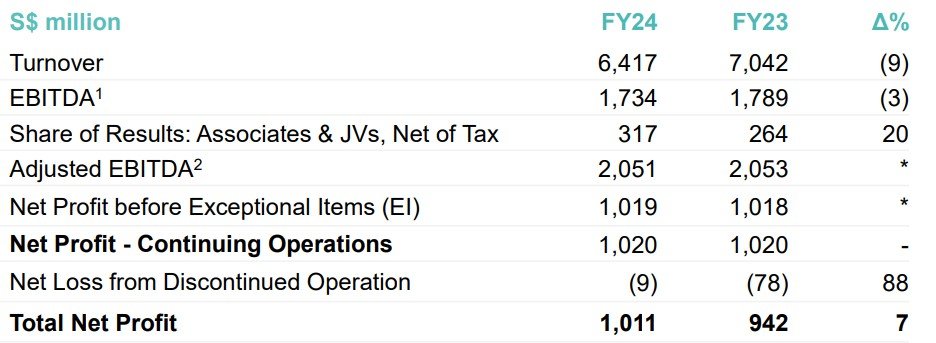

For FY2024, Sembcorp Industries delivered a resilient performance. Group net profit before exceptional items (EI) and discontinued operation was S$1.02 billion, comparable to FY2023, despite a planned major maintenance in the first half of 2024 (1H2024).

Group net profit after EI and discontinued operation was S$1.01 billion, 7% higher than S$942 million in FY2023. Net profit before EI and discontinued operation for 2H2024 was S$487 million, 17% higher than 2H2023 mainly due to higher earnings in the Gas and Related Services and Integrated Urban Solutions segments.

In view of the Group’s strong performance, the company declared a final dividend of 17.0 cents. Together with the interim dividend of 6.0 cents per ordinary share paid in August 2024, total dividend for FY24 will be 23.0 cents per share.

Sembcorp is well-positioned to capture the once-in-a-generation growth opportunities in energy transition, AI transformation and industrial realignment.

In addition, with the recent budget announcement of a S$5 billion top up to the Future Energy Fund for investments in green energy infrastructure and de-carbonization, Sembcorp will benefit from this government initiative. Hence, Sembcorp is one of the 3 Singapore stocks that will benefit from the SG60 Budget.

You can view the company website here.

Disclaimer: Please note that the stocks mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these stocks.