Income investors should be feeling let down by REITs this year. After bottoming out in July 2024, it rebounded strongly to near year high due to expectations that inflation has eased and FED will lower interest rates.

Investors who have listened to analysts and bloggers that said it was time to buy REITs is now feeling like a train wreck now. Indeed the FTSE REIT index has dropped from the high in Sep and is now near year lows again.

I did wrote in my article before that inflation will remain sticky and that FED will find it difficult to have big cut in interest rates. True enough the 10yr treasury yield has remain stubbornly above 4%.

Though REITs will continue to have bumpy road ahead, investors who love REITs can invest in them when time is right. In this article, I highlight 3 Singapore REITs boasting dividend yields of 6% and above that you may add to your watchlist.

First Real Estate Investment Trust

Many REIT investors do not like First Real Estate Investment Trust (First REIT). Firstly. it is a small cap REIT. In addition, some investors may have bad experience in the past regarding First REIT and also First REIT does not have a strong sponsor.

However, First REIT share price has been relatively stable for the past 2 years and is down only 1.92% year to date compared to some big cap such as CapitaLand Ascendas REIT which is down 12.75% year to date.

Hence, First REIT share price performance has proven many investors and bloggers they were wrong.

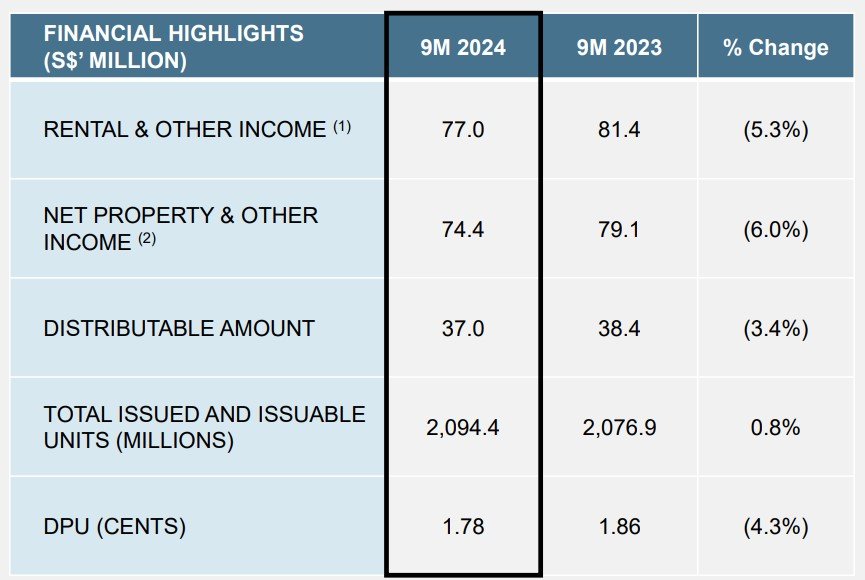

First REIT reported its 9M FY 2024 business update on 30 Oct 2024. Rental & other income is down 5.3% to S$77.0 million while DPU dropped 4.3% to 1.78 cents.

3Q 2024 DPU came in at 0.58 cents. Assuming, DPU remained constant at 0.58 cents, this give an annualized dividend of 2.32 cents which is translate to dividend yield of 8.9%.

Gearing ratio remains below 40% at 39.3% with cost of debt of 5%. Interest cover is at 3.9x with 86% of debts on fixed rates.

First REIT with its stable share price and yield of 8.9% is definitely on of the 3 Singapore REITs boasting dividend yield of 6% and above. You can view the REIT website here.

AIMS APAC REIT

AIMS APAC REIT (AA REIT) is relatively unknown REIT compared to the so called strong sponsor REIT as AA REIT is not backed by a strong sponsor.

However, look at AA REIT share price, it has been relatively stable and is only down 4.55% year to date.

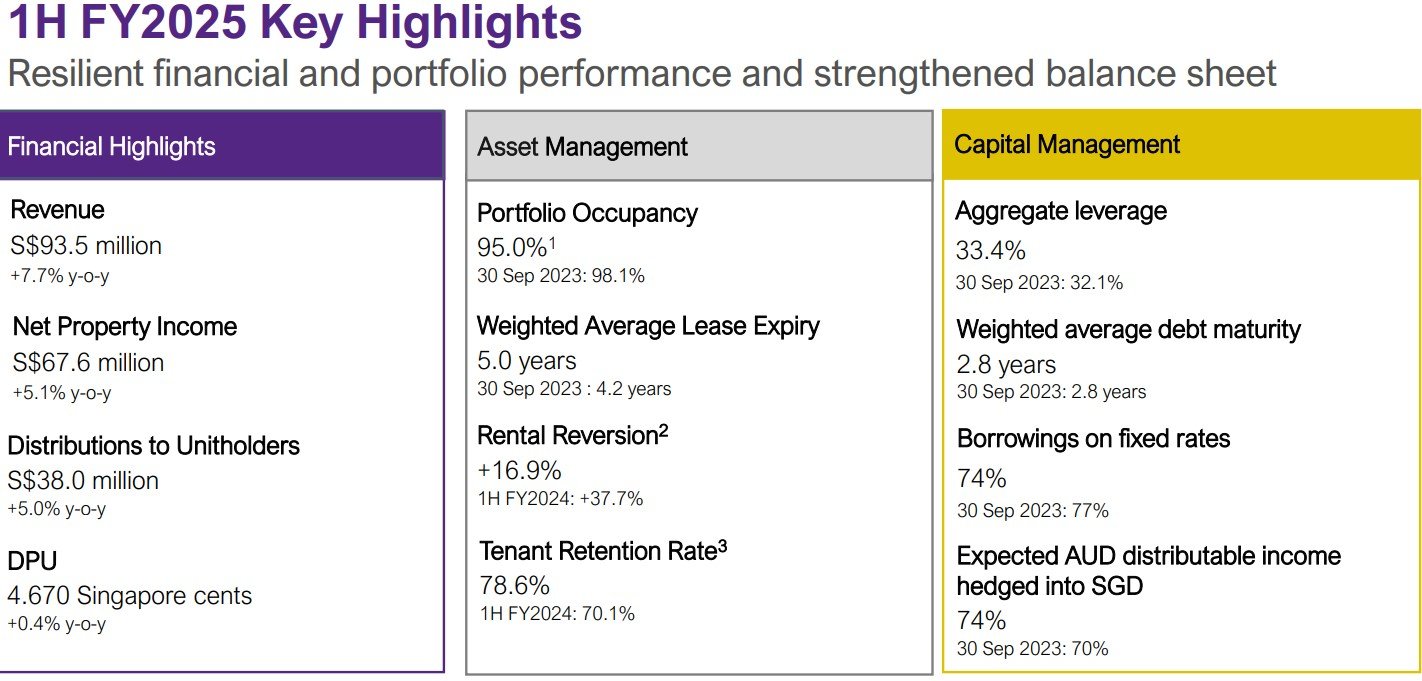

For 1H 2025 ended 30 September 2025, AA REIT reported a set of good results. Revenue is up 7.7% to S$93.5 million while net property income is up 5.0% to S$38.0 million.

DPU is up 0.4% to 4.67 cents for 1H FY 2025 which translate to an annualized dividend yield of 7.4%. Portfolio occupancy remains healthy at 95% with positive rental reversion of 16.9%.

Gearing ratio is still low at 33.4% with 74% of debts on fixed rates. AA REIT with a decent yield of 7.4% and relatively stable share price, can definitely be considered as one of the 3 Singapore REITs boasting dividend yield of 6% and above. You can view the REIT website here.

Mapletree Logistics Trust

Mapletree Logistics Trust (MLT) has been one of the worst performing REIT this year with share price fallen more than 25% year to date. Investors who love to buy REITs and keep long term for dividend is worse off this year as the dividends collected cannot cover the loss in share price.

This is despite that Mapletree Logistics Trust is so called strong sponsor REIT and also a big cap REIT.

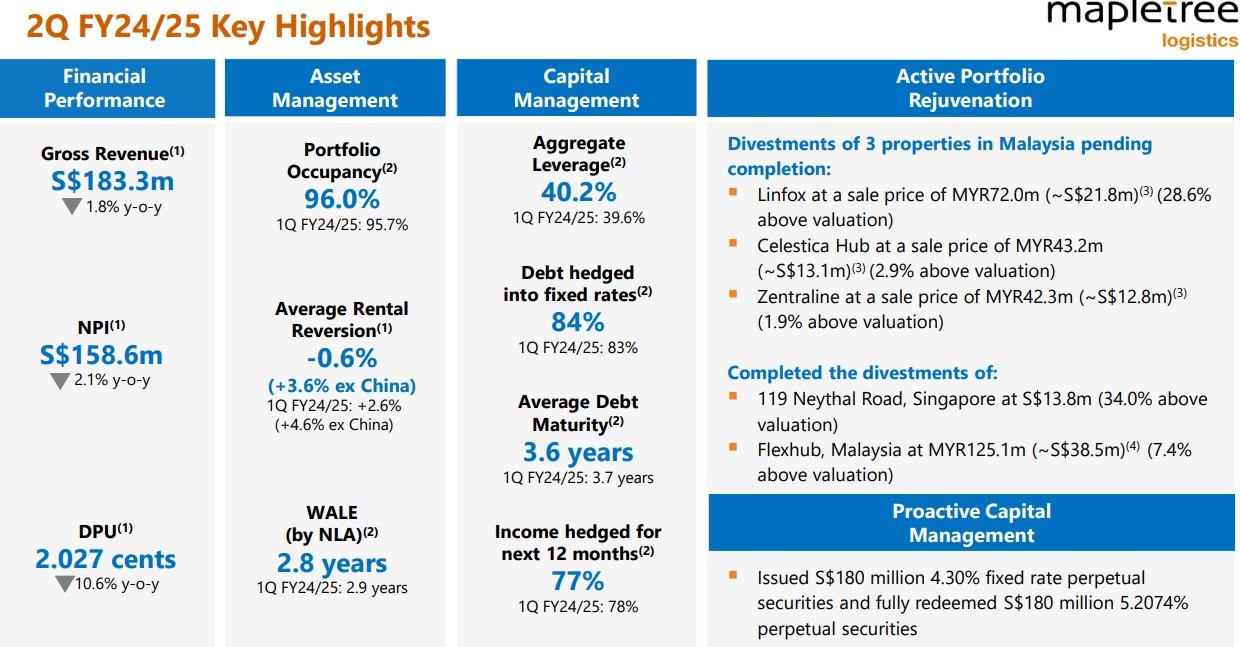

For 2Q FY24/25, MLT reported gross revenue is down 1.8% to S$183.3 million while net property income is down 2.1% to S$158.6 million. DPU dropped a whopping 10.6% to 2.027 cents.

Portfolio occupancy is still healthy at 96.0%. However, average rental reversion is a negative 0.6%. This negative rental reversion is bad for the REIT going forward which means that DPU will remain depressed.

Gearing ratio is relatively high at 40.2% with 84% of debts on fixed rates. With DPU of 2.027 cents for 2Q FY24/25 which translate to a dividend yield of 6.4%, MLT is definitely one of the 3 Singapore REITs boasting dividend yields of 6% and above.

You can view the REIT website here.

In this article, I have list out 3 Singapore REITs boasting dividend yields of 6% and above. However, investors need to note that as long as the 10 yr treasury yield remains at elevated levels, it is not going to be easy to just buy REITs for income as the capital loss may not cover the dividends collected.

Disclaimer: Please note that the REITs mentioned in this article are not a financial recommendation to buy and investors need to do their own research and due diligence before investing in any of these REITs.