The CPF is a wonderful tool to help you save for your retirement. You can also choose to invest the funds in your CPF Ordinary Account under the CPF Investment Scheme-Ordinary Account (CPFIS-OA).

Here are 3 reliable Singapore stocks you can consider using your CPFIS-OA to add to your watchlist and enhance your retirement sum.

Oversea-Chinese Banking Corporation

Oversea-Chinese Banking Corporation (OCBC) achieved record 1H23 profit. Total income is up 30% to S$6.80 billion while group net profit is up 38% to S$3.59 billion.

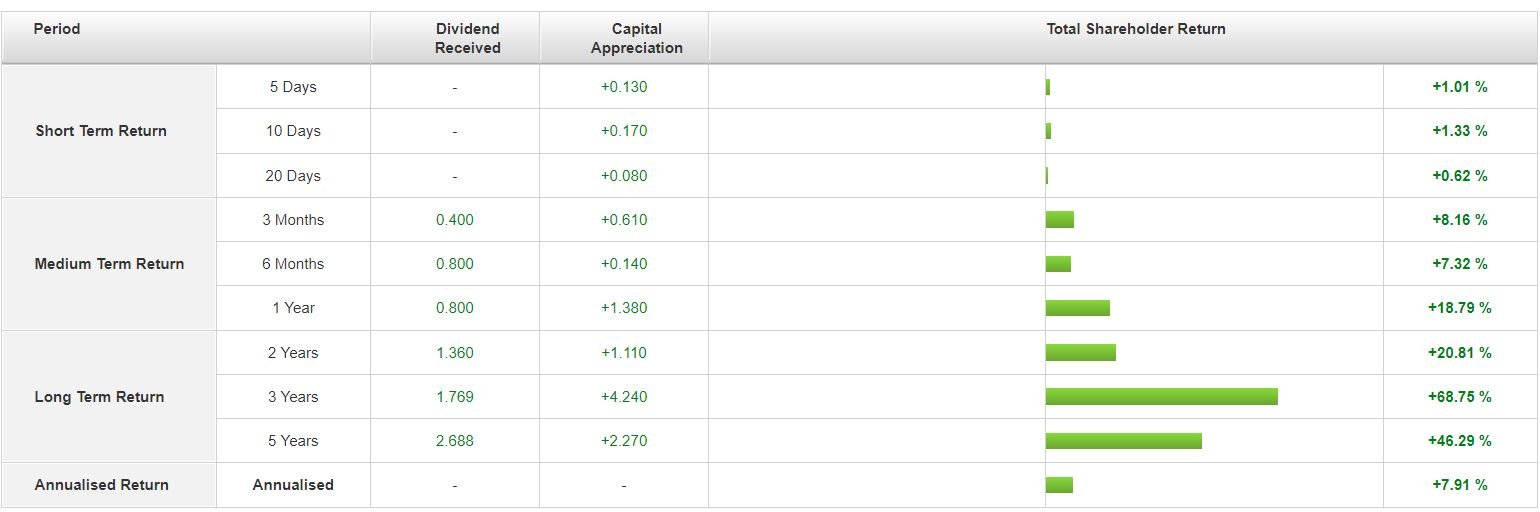

OCBC declared an interim dividend of 40 cents per share for 1H23. Total dividend for 2022 is 68 cents per share giving a dividend yield of 5.23%. In fact, OCBC has an annualised return of 7.91% for shareholders.

OCBC growth prospects include

- Capturing rising Asian wealth with OCBC Singapore and Hong Kong hubs and digital propositions.

- Support increasing ASEAN-Greater China trade and investment flows

- Unlock value from New Economy and high growth industries

- Drive transition to a sustainable low-carbon world

Given its growth prospects and increasing dividend, OCBC might just be suitable to invest using your CPF funds.

You can view the bank website here.

Raffles Medical Group

Raffles Medical Group (RMG) is a leading integrated private healthcare provider in Asia, operating medical facilities in 14 cities in Singapore, China, Japan, Vietnam and Cambodia.

It is the only private medical provider in Singapore that owns and operates a fully integrated healthcare organisation comprising a tertiary hospital, a network of family medicine and dental clinics and a consumer healthcare division.

For 1H 2023, RMG reported revenue decrease by 9.5% to S$370.9 million while net profit increase by 1.0% to S$60.4 million. RMG does not declare interim dividend.

RMG growth outlook will include:

- Continuing its strong partnership with the Ministry of Health, RafflesMedical is an active participant of the Ministry of Health’s recently launched Healthier SG initiative.

- Patients who enrol with any Raffles Medical clinic can enjoy a more seamless experience with both the Group’s in-house clinic management system and e-Medical Records system now fully integrated with the National Electronic Health Record.

- The Group will continue to evolve to offer more specialties and services across its network of clinics and hospitals in the region.

- The Group also offers bespoke and comprehensive integrated healthcare solutions that are customisable to meet the diverse needs of its corporate clients and patients across various geographies.

For FY2022, RMG declared dividend of 3.8 cents, giving a dividend yield of 3% and RMG has an annualised return of 5.54% for investors which is higher than CPF interest rates.

You can view the company website here.

UMS Holdings

UMS is a precision engineering group which specializes in manufacturing high precision front-end semiconductor components and perform complex electromechanical assembly and final testing services.

Included in the core business is the production of modular and integration systems for original semiconductor equipment manufacturers.

UMS reported a 14% decrease in revenue to S$74.3 million while net profit drop 42% to S$12.2 million in its 2Q results ended 30 June 2023 due to soft semiconductor demand and lower margins.

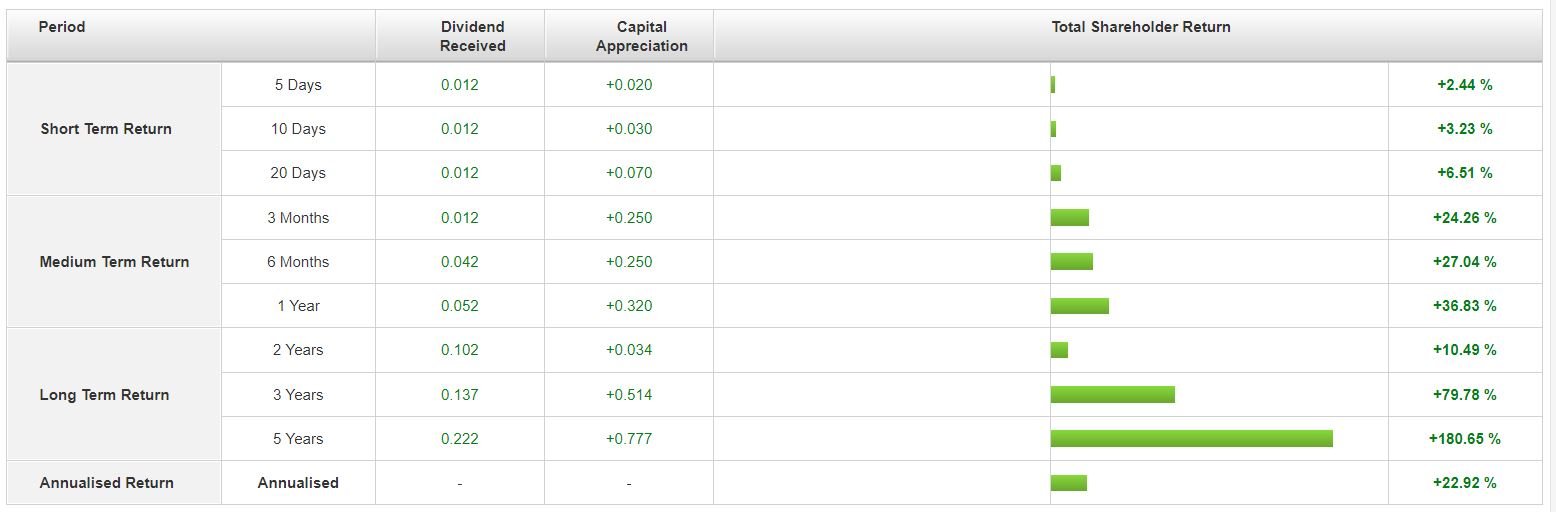

However, the company declared an increase in interim dividend to 1.2 cents compared to 1 cent. The company as an annualised return of 22.92%! This definitely better than higher CPF interest rates.

For its growth prospects, the company expansion plans is on track with its new Penang facilities scheduled for production by September this year.

This will further position the company well to take on new orders from potential new customers which are expanding in South-east Asia.

In addition, the company, which has clocked in much better aerospace sales in the first half of the year, is well-poised to seize new growth opportunities as the global aviation industry takes flight on the wings of robust recovery in air travel demand.

You can view the company website here.

Conclusion

These are the 3 reliable stocks to buy using your CPF Investment Account. However, investors need to be aware that CPF savings is your retirement fund and is practically risk free.

Using CPF to invest in stocks has substantial risks and may incur losses and will deplete your retirement fund

Want to pave your child’s road to being a millionaire? Start today by setting aside money to invest in dividend growth stocks and REITs. Inside, we show you the secrets to investing for your children for a wealthier future. CLICK HERE to sign up now!