Inta Bina Group Berhad is set to be listed on the ACE market on 25 May 2017. At an offer price of RM0.25, 26.8 million shares will be available for the Malaysian public.

Just last week, it was announced that its IPO had been oversubscribed by close to 43 times!!

With such impressive subscription rate, what does this stock have in store for us?

Here are 5 things you need to know about this company.

1. Company Info

Inta Bina is an investment holding company with a wholly-owned subsidiary, IBSB. Through IBSB, they secure and carry out construction contracts. To date, they have completed more than 110 building construction projects mainly in Klang Valley and Johor.

With more than 25 years in the construction industry, they are currently registered as a Grade 7 (G7) contractor. This allows them to tender for construction projects in Malaysia that are of unlimited value.

2. Use of Proceeds

From its IPO, the company aims to raise RM26.76 million. The use of proceeds is as follows:

- 5 million (18.7%) to invest in the Industrialised Building System (IBS) and machinery

- 9 million (33.6%) to repay bank borrowings

- 56 million (35.7%) for general capital requirements

- 2 million (12.0%) for listing expenses

3. Financial Health

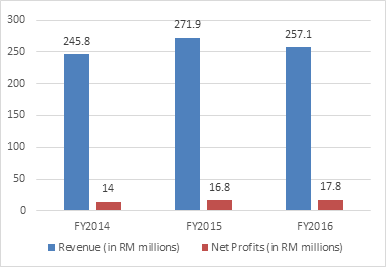

From its prospectus, the company has recorded revenue of RM257 million in FY2016. Compared to the previous year, that is a 5.4% drop in revenue. However, over the past 3 years, its net profits have increased by 27.1%, from RM14.0 million in 2014 to RM17.8 million in 2016.

The figures are graphed below for your easy reference.

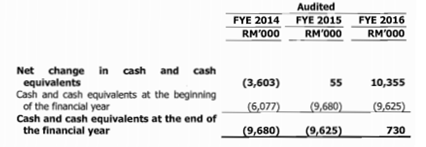

As of FY2016, its total debt stood at RM32.9 million with long-term debt accounting for RM9.4 million. That is a 17.8% decrease from RM40.1 million in FY2015! You can refer to the table below for the figures.

The company has also recorded a net gain of cash and cash equivalents of RM10.4 million in the same year. That whooping gain manages to turn their cash position around after being in the red for previous years. The surge in cashflow can be attributed to a 244% jump in operating cash flow from FY2015.

4. Dividend Policy

The company does not have specific dividend policy in place but has intention to pay dividends in the future. Payments will depend on the company’s financial performance and capital expenditure requirements.

5. Growth Prospects

Over the next 2 years, the company hopes to strengthen their working capital with the net proceeds from IPO. This will allow them to undertake and tender for more projects of higher contract values.

From 2017 to 2021, the IMR report states that the construction industry and real estate market in Malaysia is expected to grow at CAGR of 8.9% and 4.8% respectively. For Inta Bina’s market share, the report estimates it to be 0.5% and 0.9% within these two industries. These figures will translate to an addition of RM34.2 million in revenue for the upcoming year, an expected 13.3% increase from FY2016!

With the enlarged share capital, its earnings per share will stand at 2.38, giving us a P/E ratio of 10.5. This P/E ratio is relatively low, compared to its industry peers. Hence, all these factors can be the reasons why its IPO has drawn so much attention!

Fancy an Ebook that teaches you the hallmarks of multi-bagger stocks and how to find them? Simply click here to receive your copy of a brand-new FREE Ebook titled – “100 BAGGERS” by Christopher W. Mayer today!

Last but not least, do remember to Like us on Facebook too as we share the latest investing articles and stock case studies for you!