AOXIN Q&M Dental Group (SGX:1D4) is the latest IPO to join the SGX Catalist with proposed listing of 57m new shares at $0.20 each entirely via private placement.

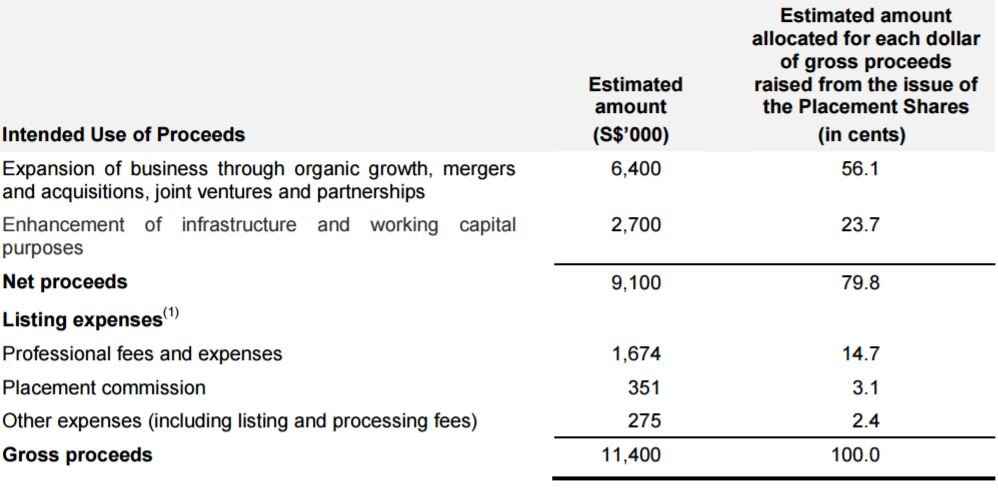

It is seeking to raise net proceeds of about S$9.1 million and will commence trading on 26 April 2017 (today!).

You can check out the offering document here.

1. Aoxin’s Company Profile

As you can see from the name, Aoxin is spun off from its parent – Q&M Dental Group to tap on the rising demand from China. Here’s what I obtained from the offer doc (in my own words):

Aoxin is one of the leading providers of private dental services and dental equipment and supplies in the Liaoning Province, Northern PRC.

As at the Latest Practicable Date, Aoxin have 240 dental professionals, comprising 113 dentists and 127 dental surgery assistants.

They operate and/or manage 11 dental centres, comprising 4 dental hospitals and 7 polyclinics.

The centres are located in 4 different cities in Liaoning Province, Northern PRC, namely, Shenyang, Huludao, Panjin and Gaizhou.

Additionally, Aoxin also owns a dental equipment and supplies distribution network which covers the Liaoning, Heilongjiang and Jilin Provinces in the Northern PRC.

In short, Aoxin’s core business can be categorised into 2 business segments:

- Providing private dental services & management of dental centres for and on behalf of other owners

- Distribution of dental equipment and supplies.

2. IPO Details

Following the placement, Aoxin will have a market cap of S$71.2 million.

Q&M (SGX:QC7) will retain a 45.9% stake while its executive director and chief executive Shao Yongxin will hold a 30.08% stake.

As you can see, the bulk of funds raised – S$6.4 million (70.3%) of net proceeds would go into expansion of its business.

The remaining amount of S$2.7 million (29.7) is set aside for “enhancement of infrastructure and working capital purposes”.

3. Financials

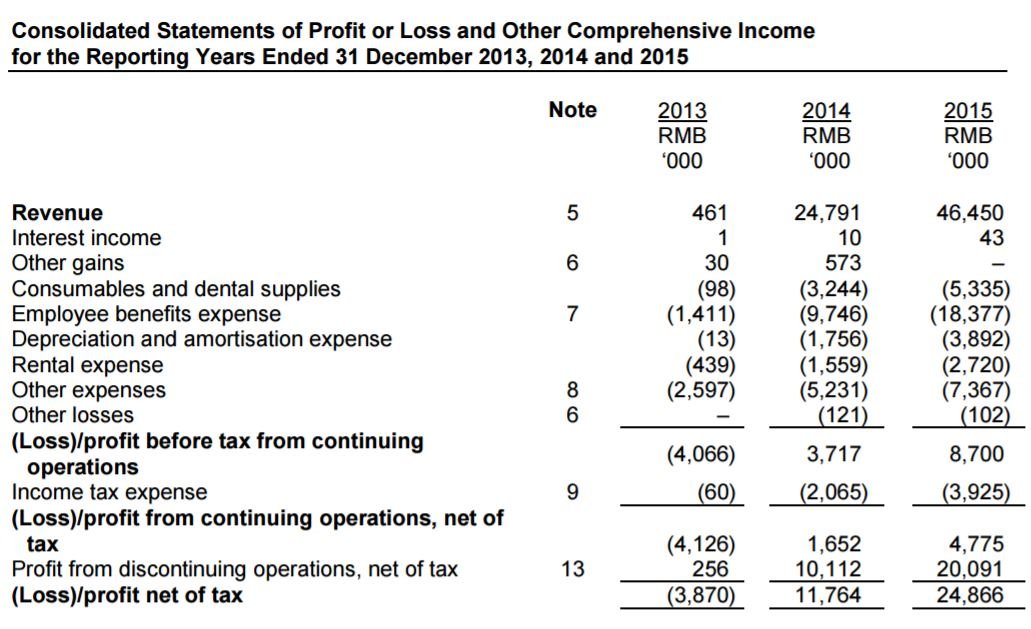

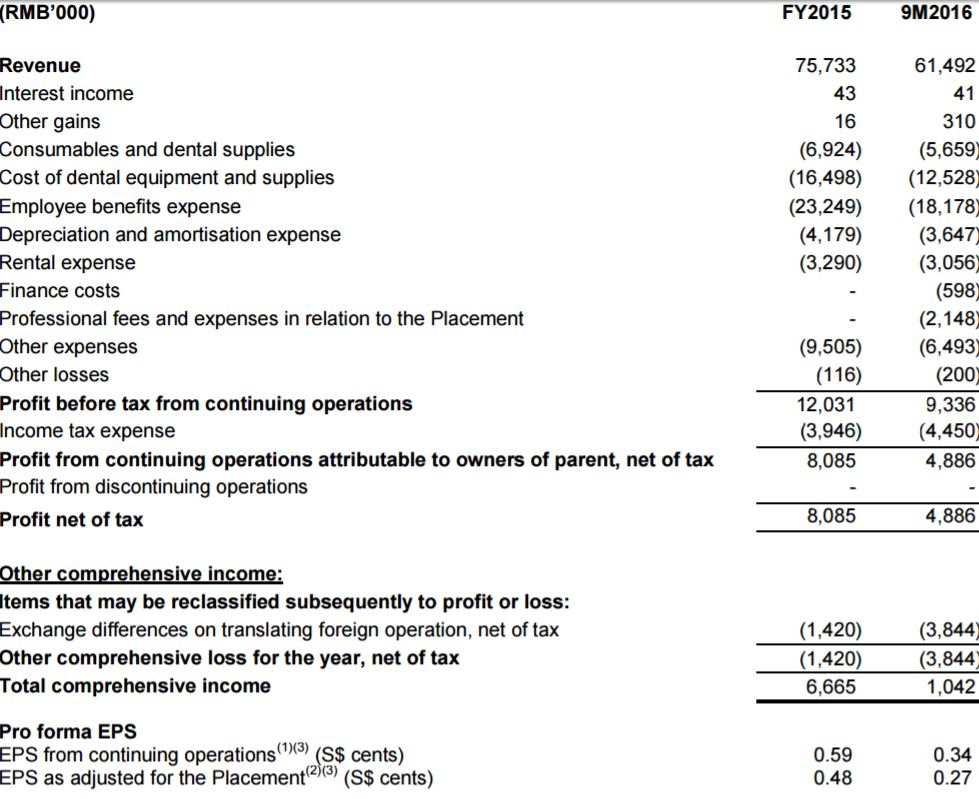

The company has seen explosive growth over the 3-year period from FY2013-2015.

Revenue skyrocketed from Rmb0.5m to Rmb46.5m, underpinned by strong M&A activity, as well as increased patient visitorship.

It also turned around from a Rmb4.1m loss in FY13 to a Rmb4.8m profit in FY15.

In the latest 9M16 results, core net profit jumped to Rmb4.9m (+148%) on an 85% surge in revenue to Rmb61.5m.

A huge portion of the sales growth can be attributed to 3 big reasons:

- maiden contribution from dental equipment and supplies distributor SY Maotai, purchased in Jan ’16

- Acquisition of five dental centres in Panjin and Gaizhou

- Organic growth from existing dental centres.

4. Growth Prospects

According to independent market research consultancy Technavio, Q & M Dental Group has been established as one of the top 5 vendors in China’s dental services market.

The market is expected to grow at a CAGR of 18% from 2016 to 2020.

Dental care in China is still in its infancy. This is expected to change in the near future, as living standards are rising and awareness of dental health issues has increased.

- Western countries: 500-1000 dentists to 1mil population.

- Singapore: 500 dentists to 1mil population

- China: only 100 dentiss to 1mil population

One thing I like about Aoxin is how it has collaborated with the Jinzhou Medical University to provide training to dental professionals.

While addressing the bottleneck in the supply of dentists, Aoxin’s image or reputation is also enhanced and recognized.

“In Singapore, our dentists are sent to Singapore National Dental Centre for post-graduate training. Aoxin has capabilities that parallel Singapore National Dental Centre in this aspect,” said Q & M Dental Group COO Raymond Ang.

Overall, there is rapidly growing demand for accredited dental centres in China. This is because of the rise in corporate staff entitled for public medical insurance.

E.g. you work for company ABC, and as part of its benefits program, it gives you say $500 to visit Aoxin Q&M annually.

That’s a nice recurring source of income for Aoxin isn’t it!?

5. Conclusion

Despite all the good things you heard, Aoxin is based in China. Thus, it is “subject to strict regulations for our operations and changes in government policies relating to healthcare reforms”.

It’s business may be affected if the dental centres lose their accreditation or if there are any changes to the Chinese public health insurance programmes.

Furthermore, it is listing at a high P/E of 37.7x based on the FY2015 EPS. This valuation is around the same as other healthcare companies like Raffles Medical etc.

But given its strong niche market in dental healthcare, I do think that it has much room to grow in future.

Looking for similar growth stocks? We’ve released our 3 HOT growth stock picks which could skyrocket >100% by the end of 2017. History has shown that getting in early on a good idea can often pay big bucks – so don’t miss out on this moment.

Simply click here to receive your copy of our brand-new FREE report, “3 stocks poised for explosive growth”.

Do Like us on Facebook too as we share the latest investing articles and stock ideas for you!